Buying your first car is an exciting experience. However, the car loan portion of the car buying experience can be daunting. If you make a mistake on your car loan, it could cost you money and negate the savings you negotiated on the purchase price. Therefore, we’ve created a list of mistakes to avoid when applying for your car loan as a first-time buyer.

Not Knowing Your Creditworthiness

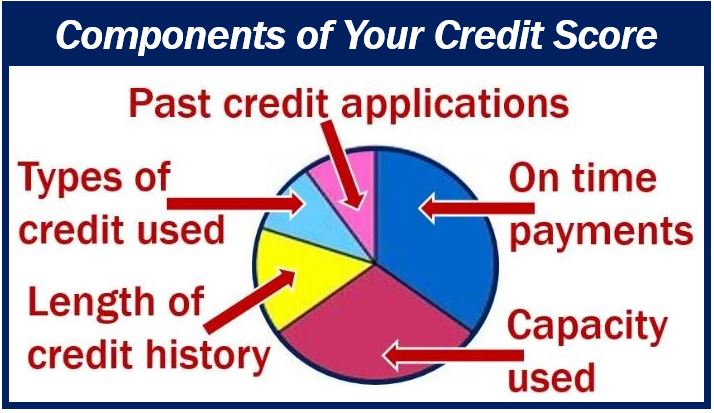

Your creditworthiness determines your interest rate. Your creditworthiness is defined by your credit score, which is based on your credit report with three credit reporting agencies; Equifax, Experian, and TransUnion. If you have a high credit score, you qualify for a better auto loan rate than a low one.

If you can shave just one percentage point of interest off a $15,000 car loan over 60 months, you would be saving hundreds of dollars in interest. Therefore, you must know what your credit score is before filling out a car loan application. Don’t let the dealer determine your creditworthiness. You need to go into the dealership knowing what kind of loan you qualify for. Otherwise, the dealer can pretty much tell you anything.

The best way to check your credit is to obtain preapproved financing. Even if you intend to take advantage of a deeply discounted interest rate offered by the car manufacturer’s lending agency, if you find out how much of a car you can afford and the interest rate you qualify for, you’ll have the upper hand.

Negotiating the Monthly Payment Instead of the Purchase Price

You should never buy a car based on the amount of the monthly payment. While you should know how much you can afford to pay for your vehicle each month, don’t tell this to the salesperson. Telling the salesperson what you can afford each month will negate your ability to bargain for a lower purchase price.

This is because once the salesperson knows how much you can afford to pay each month, they know how much room there is to hide other costs such as add-ons and a higher interest rate. Therefore you should negotiate the price of each cost category separately. In other words, negotiate the purchase price, then interest rate, then the add-ons.

Using Your Car Loan for Add-Ons

Aftermarket add-ons are there to make extra profit for the dealership by increasing interest rates. These add-ons are things like extended warranties, fabric protection, and paint sealant. If you want these things, it’s better to get them from a source other than the dealership, as you’ll likely get them at a lower cost. If you fold the cost of these add-ons into your car loan, you’ll be paying interest on them, which can add hundreds of dollars to the amount you’re paying.

Furthermore, you should look over your contract carefully and question every fee that you don’t understand. Oftentimes dealers will write fees into a contract under an official sounding name. This is a way to take profit on the back end of the deal when your guard is down.

Choosing Incorrectly When Given the Choice Between a Cash Rebate and Low-Interest Rate Loan

If a manufacturer is offering you the choice between a cash rebate and a low-interest loan, you must consider the options carefully before deciding. The option that will net you the most savings varies from offer to offer, so do your research. Moreover, low-interest financing isn’t available to everyone, so even if you choose this option, it doesn’t mean you’ll actually get it. It depends on your credit.

Summary

The four most common mistakes that first-time car buyers make when applying for a car loan are:

- Filling out a loan application and not knowing your credit score.

- Bargaining over your car loan’s monthly payments instead of the purchase price of the car.

- Financing add-ons instead of purchasing them separately.

- Choosing incorrectly between a cash rebate and a low-interest rate loan.

Now that you know what mistakes to avoid, you are well prepared to go into a dealership and get financing for the car of your dreams.

Interesting related article: “What is Autofinancing?“