Starting a new business is a challenge because it does not have a credit history and cannot access financial support from mainstream lenders. Most companies turn to their credit cards when they need immediate financial support to pay vendors, utilities and other business necessities. However, a new business does not have this luxury and could collapse when facing extreme financial challenges.

Do You Need a Credit Card for Your Business?

As highlighted above, every business needs a credit card to help reliable access financing in financial challenges. Besides the quick and reliable funding that is offered by most of the credit card companies, there are other essential benefits that your startup will enjoy by having a credit card. These benefits include:

- No annual credit fees

- Loyalty points and rewards

- Cash travel bonuses

- Hotel discounts

- Air travel benefits

- Cash back on purchases

Your business does not have a credit history does not mean that you cannot get a credit card. Although it will be a challenging experience as most of the companies will be turning your offer down, you can use some innovative ideas to secure a credit card for your business.

Using a Credit Partner

As a new business owner, you can partner with a company with a known credit history to access the benefits of a credit card. This occurs when a business operating for several years applies for a new credit card but lists your company as the authorized user.

This process will enhance the financial security of your organization and take care of personal finances as well. However, you need to work with reputable organizations that can access credit cards with ease for this to work.

Use Secured Business Card

Businesses that do not have a credit history have the option of applying for a secured business card for their financial flexibility. In this case, a business has to deposit some cash on a bank account used to pay for all the money borrowed if the company fails to meet its financial obligations on credit repayment. Secured business cards are known to present very little or no risk to the credit companies, and thus, your business can easily access sufficient funding when in need.

Build a Strong Credit History

As a new business, accessing a Revenued Business Card will always be a challenge. However, to minimize risk and make your business a potential customer, you must build a strong credit history. Your business needs to make sure that all the expenses and financial obligations are paid on time.

Lenders are always interested in evaluating how your business has been paying its expenses, such as utilities, rent, insurance, and workers. With a good credit history, a business’s credit profile will improve, and credit companies will be willing to give a new business credit card.

Liaise With Financial Institutions

Another method of getting a business credit card without a credit history is liaising with financial institutions around your business. You need to choose one banking institution and make sure that all the organization’s financial transactions are handled in that business. Financial organizations appreciate loyalty, and by showing that you’re willing to deal with such entities, you will quickly get a credit card to support your organization’s financial needs.

New business owners need to know that getting a credit card for their organizations will always be challenging. No credit card company is willing to offer credit cards to a business that does not have a credit history. However, this is not the end of the road as business owners have some unique techniques to get a credit card without a credit history.

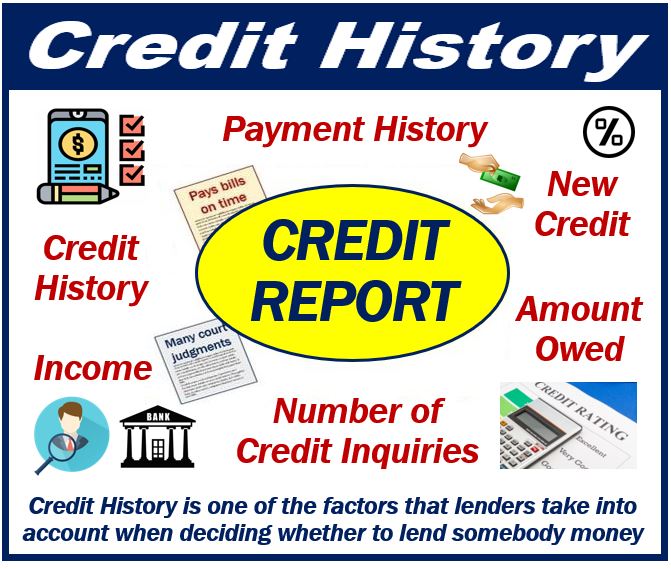

Interesting related article: “What is Credit History?”