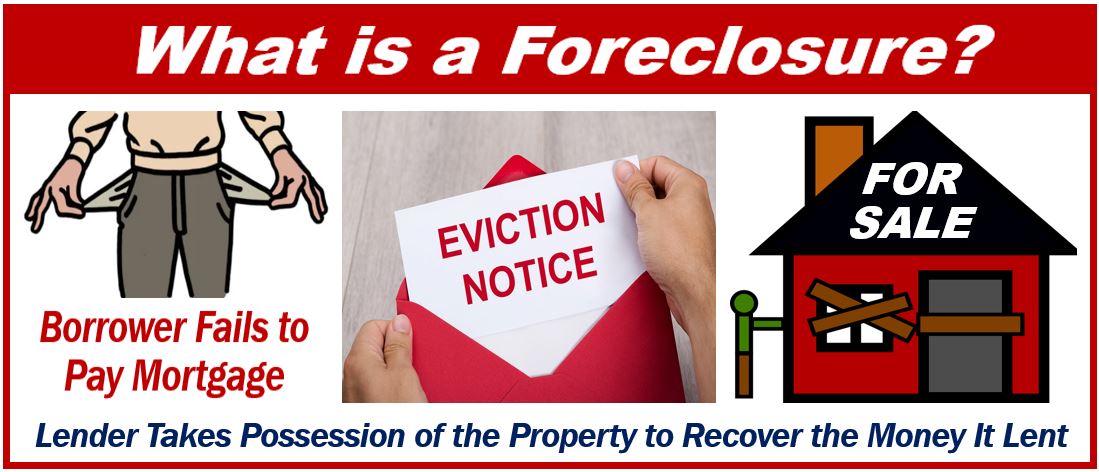

Homeowners are at risk of foreclosure when they encounter financial struggles and are far behind on their mortgage payments. At the time your home is being foreclosed on, the lender is seeking your property as a form of collateral. A majority of lenders prefer to not foreclose and would rather find an alternate solution. However, if you cannot keep up with your mortgage, the foreclosure process will begin. This happens in several phases.

How the Foreclosure Process Starts

A foreclosure is initiated so that the lender can receive the money owed by you. Once a loan has defaulted, the lender can take ownership of your home and sell the property to recover the financial loss.

Your Installments Enter Default

When you miss a payment, the mortgage goes into default and your lender will send a notice that you missed your payment. There is typically a grace period after the payment due date, where a late fee is assessed after the missed payment. A demand letter occurs after two payments are missed.

You Receive a Default Notice

You will get a notice of default if 90 days pass and there is no payment. The notice is often placed on the home. If you are able to make a payment, you go into a reinstatement period.

There is still an opportunity to get out of default on your loan. You can use the help of a foreclosure lawyer to guide you back into good standing.

You Receive a Notice of Trustee Sale

After the loan has not been paid, a notice of trustee sale goes out and is recorded in your local county. It will be announced that the property is for sale at a public auction. You and any other owner’s name will be printed in this notice, and will go into the newspaper. This notice will describe the address, description of the property, and the timing of the sale.

There Is a Trustee’s Sale

After the property has been announced for public auction, it is put up for sale. The bidders who meet the pre-qualifying requirements will bid on the property. The highest bidder wins the sale. The opening bid is based upon the loan amount, any unpaid taxes, and liens. The buyer may allow you to stay or to relocate.

Real Estate Owned Property

If your property isn’t sold after the auction, the lender will try to use a real estate asset manager to sell it. It then becomes a bank-owned property. Some of the liens may be removed off of the property by the lender so it can be resold.

Eviction After the Sale

You can typically stay in the home until it is sold through public auction or as real estate-owned property. The eviction is sent to you so that you can vacate the property. After you have removed all of your personal belongings, the sheriff will visit.

Retrieve Remaining Items

If anything else remains on the property after the eviction deadline, they are removed. These items are placed in storage and can be retrieved. However, there will be a fee to obtain your possessions, so it is better to remove all of them after you receive the eviction notice.

Learn More About Managing Your Foreclosure

If you are struggling with your mortgage you can work with a professional who can help you. Contact a foreclosure attorney for more information.

Interesting related article: “What is a bad debt?“