You’ve finally entered the world of trading stocks. Maybe you’ve even set up a brokerage account and traded a few stocks. It feels good to get a return on your investment.

You’ve finally entered the world of trading stocks. Maybe you’ve even set up a brokerage account and traded a few stocks. It feels good to get a return on your investment.

Lately, though, your stocks aren’t performing as you hoped. You’re starting to understand the term inherent risk.

It makes you wish you could make money on a stock regardless if it goes up or down, but that’s CRAZY TALK… right?

What if it wasn’t?

Believe it or not, traders do this successfully every day! It’s called options trading. Consider this your options trading for beginners course.

What Is Options Trading?

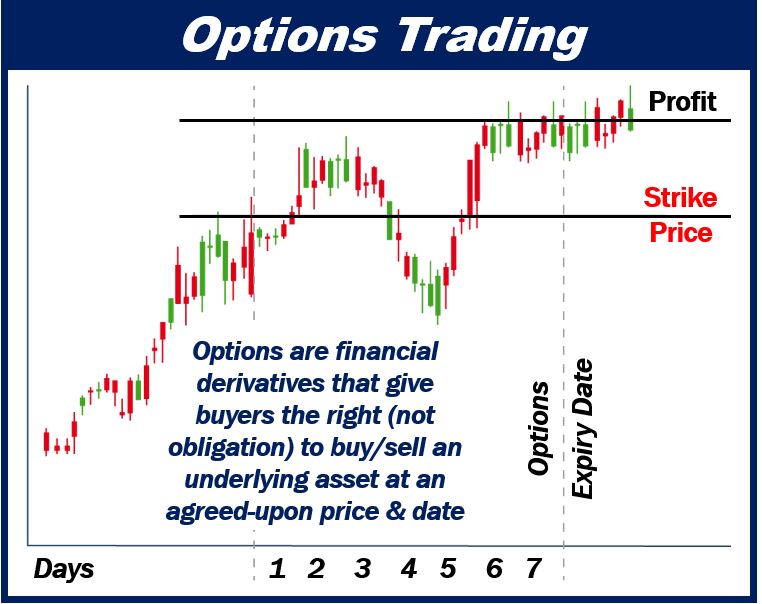

Simply put, an option is a contract. This contract gives the buyer has the right, but not the obligation to buy or sell a stock or other asset. These contracts are purchased at a predetermined price for a predetermined time.

Options trading is like purchasing insurance for an investor.

Options Trading for Beginners

Let’s say John by 100 shares of Nike for $125 per share. He has invested $12,500 in Nike.

However, John feels a little nervous about the volatility of the market. He decides to buy an option as insurance. After all, $12,500 isn’t chump change.

John purchases a put option for $500. In the next 30 days, Nike’s stock falls to $100 per share.

If John were a normal investor, he would have two options:

- He can keep the stock and pray that it goes up.

- He can cut his losses and sell the stock.

BUT John is not your average investor. John knows that it could take a while for Nike’s stock to rebound. Meanwhile, there are other stocks out there that could offer a return-on-investment.

John decides to exercise his right to sell his $500 put option. Even though the price of Nike’s stock dropped by $25 per share, he hasn’t lost any of his initial investment. He only lost his $500 payout for his purchase of the option.

John just saved himself from a $3,125 loss! Now that’s INSURANCE!

Plus, he can take his initial investment and put it into stocks that are currently turning a profit.

Options aren’t just insurance, though. Also, you don’t need to own a stock to buy an option! They can be bought and sold just like stocks, and if done correctly, they can earn you a TON OF MONEY!

How to Start Trading Options

Now you know that trading options can be like buying insurance on a current investment. Let’s discuss how you can use options to turn a profit whether the market goes up or down.

Believe it or not, you can purchase options in companies you support every day, like Google, Amazon, Facebook, Apple, and more. You can even save money buying options than you would if you bought the stock outright.

Types of Options

You can think of trading options like placing an over-under bet. You either bet a stock will be above or below a specific price, and at a particular time. The price you bet a stock will be over or under is called the strike price.

When it comes to options, you have two choices: CALL or PUT.

What Is a Call Option?

If you purchase a call option, you are basically betting that the stock will go above the strike price. In short, you want the stock to go up.

Let’s say you have been following Nike’s stock for a while. You notice that the stock is trading an unusually low price according to trends.

You notice that blogs have been going crazy about a new shoe that’s set to come out by Nike. You purchase a call option because you feel confident that the price of Nike is set to go up in the next month or two.

What Is a Put Option?

If you purchase a put option, you are betting that the stock will go below the strike price. In short, you want the stock to go down.

So you went with you got on Nike, and just like you thought, the price of the stock went up! Your call option has been profitable. Good for you!

Now when you look at Nike’s stock price, it seems to be bloated. You think it’s probably because of the new shoe. At the same time, you start to notice that the buzz on the new shoe has subsided.

You believe that the stock of Nike is set for a fall, so you purchase a put option. With the sneakerheads out of the market on the new shoe, you feel confident the stock price will follow suit.

Just as you suspected, the price comes back down to earth. You sell your put option and collect a profit.

How Are Options Prices Calculated?

Options prices are affected by three factors: time to expiration, stock price, and volatility. These three things determine the price of an option and how much profit you stand to make.

Time to Expiration

All options have a time in which they expire. Remember, you are hedging a bet for a specific price and time. Options may be set out 30 or 60 days.

The longer you hold an option, the more expensive it becomes. For instance, a 30-day option may cost $200, while a 60-day option may cost $400.

Most stocks have expirations that are weekly, monthly, or quarterly.

Stock Price

Options are bought at a certain stock price. The price that an option is bought at is called the strike price. The strike price is the price you would use if you want to exercise your option.

Again, if you purchase a call option, you want the stock to go above the strike price. If you purchase a put option, you want the stock to go below the strike price. Get it?

Volatility

The price of an option also depends on its volatility in the market. The more volatility stock has, the greater the risk. If the risk is greater, the price is higher.

Volatility is an important factor to consider when purchasing options. This factor is the foundation for some investors’ options trading strategy.

Win Whether the Market Goes up or Down

This completes our course of options trading for beginners. We hope it helped! Being an investor isn’t for the faint of heart. It involves risk. How you accept that risk is up to you.

You can do this by buying and holding stocks, working with dollar-cost averaging, and feeling sad every time the market takes a tumble.

On the other hand, you can ride the market up and down and collect wins along the way with options trading. The choice is yours.

For more information on options trading and other investing tips, be sure to check back on our blog regularly.

Video – What is a Trader?

_________________________________________________

Interesting related article: “What is a Trader?“