In today’s ever-changing economy, investors need to have some form of investment strategy or plan in place. With markets constantly changing, investors need an investment strategy that allows them to make the most of opportunities when they arise, but most importantly, to reduce the level of risk you are exposed too. Investing is a great way to build wealth, but keep in mind that this industry is unpredictable, and being unprepared when risks arise may cause all of your investments to go down the drain.

Ideally, you need an investment strategy that allows you to pivot to suit your risk, tolerance or schedule. This strategy should also be cost-efficient, tax-efficient, simple and transparent. Since investing is a long-term endeavor, your investment strategy should be easy to manage, especially when you’re making any changes.

For those who are new to investing, this piece will act as a guide for everything to do with investment strategies. This article will provide information on the importance of an investment strategy and how you can choose one that’s perfect to your investment goals.

What is an investment strategy and what should you consider?

This is one of the most common questions new investors have when they enter the market—if you’re planning to invest soon, it’s vital that you have the answer to this question. Investing is a complicated market and not knowing the basic processes and terminologies can prevent you from earning profits and surviving in the industry.

In short, an investment strategy is what guides investors to secure long-term income capital growth based on several factors including, risk, tolerance, and future capital needs. Investment strategies define the plan for future growth, whether this is rapid growth where an investor focuses on capital appreciation, or they can follow a low-risk strategy which prioritizes wealth protection in the long run.

Before you choose an investment strategy, you must gather some necessary information about your current financial situation and where you would like to be. Such questions include:

- What is the current financial situation?

- How much can you afford to invest – initially and on an ongoing basis?

- What returns are you expecting? What are your goals?

- What is your time frame?

- What level of risk can you be exposed to?

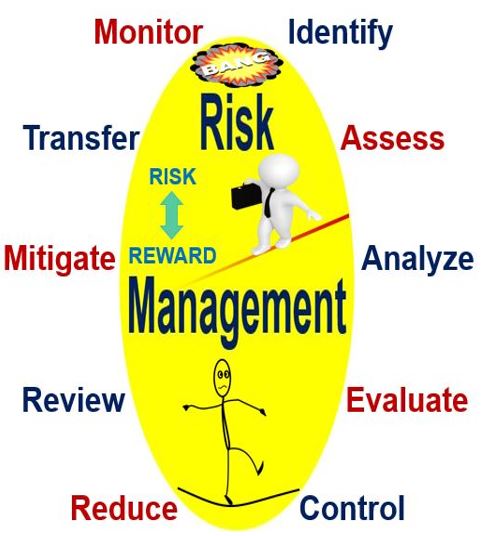

Risk Management

Before we explore how strategies can take shape, you must understand what levels of risk you can expose yourself to. This is an important phase because the information you can get here will allow you to manage your expectations and come up with solutions before problems arise.

The level of risk you can be exposed to is usually determined by a select grouping of factors including, how much you want to invest, what you want to invest in, the speed of returns, your current income. Your financial goals also influence the level and number of risks you’ll likely experience when you start to invest.

Understanding your level of risk is a vital component to consider when investing. Not only will it allow you to work out how you may react to large swings in your investments. It provides a realistic approach to what you can afford long term.

For those who are unsure what risk means for your investment – the greater the risk the chance to receive higher returns, while lower risk will naturally mean your growth or returns will take longer to materialise.

Contrary to popular belief, there are simple yet effective risk management tips every investor can follow regardless of how novice they still are in the industry. Listed below are tips on how you can properly manage risks the moment you start to invest:

- Determine what you can afford to lose;

- Make a plan that includes your goals and how you plan on spending your money to achieve those goals;

- Educate yourself on the different types of risks, and determine when it’s best to take these risks or play it safe; and

- Diversify your portfolio and strive to invest in more than one entity. For example, you can invest in business insurance and then own an exchange-traded fund at the same time. Doing this will provide you a safety net whenever one of your investments don’t work out as planned.

Types of investment strategy

Investment strategies can take shape in a number of ways. The best investment strategy will be different from person to person; it all depends on the needs and wants of the investor. Here are three common investment strategies for you:

Value investing

Often described as a long-term investment strategy, value investing is seen to be relatively low risk as investors seek stocks they believe are currently undervalued, in theory presenting investors with the opportunity to get a stock at a discounted price.This form of investment strategy requires a considerable amount of groundwork in researching the correct stock selection and being willing to see the stock slowly grow to stand any gain.

Growth Investing

Growth Investment strategies solely explore investments that offer strong upside potential when it comes to the future value and earnings of stocks. Growth investing is not as reckless as it sounds, growth investing revolves around the evaluation of a stock’s current health, strength as well its potential to grow in the coming months or years.

A growth investor’s decisions will naturally consider the prospect of the industry they are looking to invest in. Industries like healthcare and the automotive sector are strong industries for growth. To invest in the auto industry find an automotive private equity company. For healthcare there are many different sectors to invest in so you will need to decide which sector is best for you.

If there is evidence of widespread potential and considerable room to grow, an investor may choose to invest. In short, a growth stock should consistently be growing and the company should have a consistent history of strong earnings and the capacity to deliver and grow. Another form of growth investments can take shape in the form of fixed-term investments or bond investments.

Momentum Investing

Momentum investment strategies solely look at the current market trends of stocks. Momentum investors who look to buy stocks experience an uptrend in performance and value. While momentum investing may provide the potential for significant returns, it is one of the riskiest forms of investment strategies that can result in significant losses if predictions are wrong or the stock quickly falls.

One of the more significant elements of momentum investing, which gets pushed to one side is the practice of shorting. An extremely aggressive tactic used by traders, this technique allows an investor to profit from a drop in stock price. It is important to note shorting a stock is an incredibly risky prospect and be financially damaging and compare a value investing vs momentum investing strategy.

Interesting related article: “What is a Portfolio?“