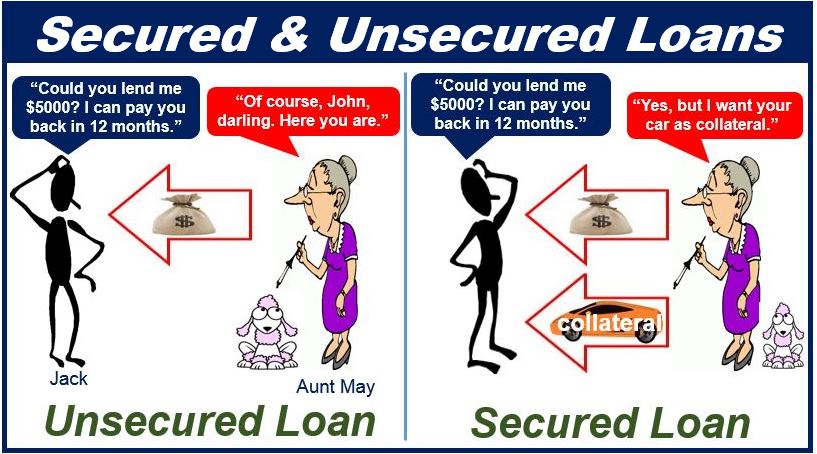

A secured loan is a way for homeowners to borrow money. The loan is then secured against the property, which serves as financial security. There are some advantages for homeowners, but also some disadvantages. If the loan isn’t paid back in time, the house could be repossessed.

What are the advantages of a secured loan?

You don’t need an excellent credit score to receive a homeowner’s loan. Since the value of your home is used to back the loan, its usually not necessary to have a perfect financial record. This makes a secured loan an easy way to borrow money quickly, if needed.

Another advantage is the fact that larger amounts of money can be borrowed, depending on the price of the home. Additionally, you may not have to pay back the loan quickly and can agree on repayments over a longer time period. Even if you are still paying a mortgage on your home, you could still receive a secured loan, in many cases you could borrow up to £50.000.

Many people who decide to take out a secured loan benefit from the lower interest rates that homeowner loans tend to have compared to other loans. Many lenders offer secured loans which makes it easier to find the right solution that works for you.

What are the disadvantages of a secured loan?

Before you decide on a loan, make sure to take some of the disadvantages into consideration.

Secured loans can be very risky, simply because so much is at stake. There is always the possibility of losing collateral. Even if your current situation would allow you to repay it over time, your personal circumstances could change, making it difficult to meet the financial obligations. If payments are late, your credit score could be affected.

Another possible downside of a secured loan is that these types of loans may give you less options than unsecured loans. Usually, homeowners’ loans are used to borrow large amounts of money, starting from £10,000. You have the option to borrow less so always be sure to borrow what you can pay back. Even though secured loans can have low interest rates, the interest you pay can increase if you choose to spread payments and pay back the money you borrowed over a longer period of time.

Always study the terms closely before making a decision and borrow the smallest amount possible. It may still be possible to borrow more later on, once you have repaid it. Loans can be a great way to get past difficult financial situations, but they can also become a burden if repayments can’t be made. Weighing the pros and cons can help make a more informed decision.

Interesting related article: “What is Collateral?“