When most people discuss portfolio diversification, they’re talking about things like stocks, bonds, and real estate. However, these are just the basics. If you really want to switch things up, you should look into rare collectibles.

The Allure of Rare Collectibles as Investments

The Allure of Rare Collectibles as Investments

Luxury collectibles are generally seen as something the ultra-wealthy, “one percent” of the market indulge in, but it goes beyond this. Certain collectibles – rare ones – can actually be utilized as investments. Here’s what makes them so promising:

- Stark diversification. It’s one thing to diversify a stock-heavy portfolio with bonds. But if you truly want to put a percentage of your wealth into a distinct asset class, rare collectibles provide this platform. The rare collectibles market is minimally influenced by larger financial markets and therefore tends to have greater protections in tough times

- Potential for increase in value. Rare collectibles aren’t simply designed to hold value and help your cash beat inflation. In some cases, you can actually see some pretty nice increases in value. In 2018, for example, luxury assets such as fine art and rare wine increased in value by more than 10 percent (at a time when a lot of other asset classes took negative hits).

- Finite resource. They don’t make more dinosaur bones or bottles of 1975 Chateau d’Yquem Bordeaux. Most rare collectibles are rare because of their age and limited availability.

- Passion and interest. In most cases, people invest in rare collectibles because they have an interest in the item. For the car lover, a vintage car purchase does more than diversify his portfolio – it provides excitement. The same could be said of wine lovers, those who appreciate fine art, etc.

Rare collectibles are meant to be leveraged as a complementary investment to a larger portfolio – not as the portfolio itself. While you’ll have to get advice from your financial advisor on the topic, it would generally be unwise for anyone to put more than three to five percent of their portfolio into collectibles. In most cases, it’s a very small piece of a much larger pie.

Luxury Collectibles Worth Investing In

So what kind of rare collectibles are people investing in? While there’s a wide swath of interests, here are some popular categories:

-

Fine Art

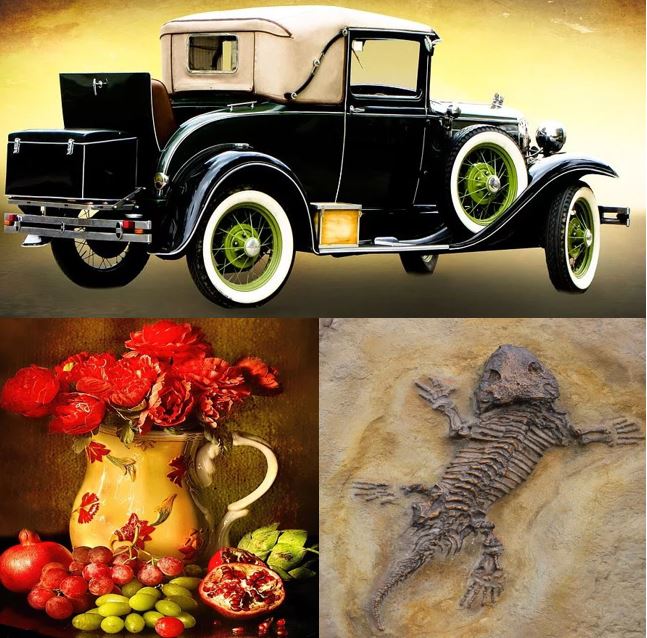

The wonderful thing about investing in fine art is that you’re typically able to enjoy the investment while it appreciates in value. As long as you properly protect it and safeguard against damage and theft, it makes for a great conversation piece in a home or office.

-

Rare Fossils

Fine art might be a couple of hundred years old, but you can also invest in items that are millions of years old. Rare fossils not only have rich historical significance, but they can appreciate in value.

“A large prehistoric cave bear skull that we purchased 16 years ago sold for $2400 (retail) that year, whereas a similar specimen would fetch $12,000 or more today,” Fossil Realm explains. “And it’s not just skulls and skeletons that are garnering attention – Canadian ammonites (gorgeous fossil shells consisting of the gemstone ‘ammolite’) have tripled in value the past 25 years, in part due to rising demand in Asia.”

Other interesting items include mammoth tusks, Megalodon teeth, trilobites, reptile fossils, crinoids, and more.

-

Vintage Cars

Whereas modern cars do nothing but depreciate in value from the moment they’re driven off the lot, vintage cars have a way of increasing in value. In fact, certain brands like Ferrari, Bugatti, Porsche, and Alfa Romeo outpace collectibles like coins and stamps – and even the broad stock index.

As Investopedia explains, “The Top Index was up 13.78% year-to-date through August [2019] and more than 500% over the preceding 10 years thanks to increasing global wealth chasing a limited number of super-collectible cars. The S&P 500 was up only 60% in the same period.”

Obviously upkeep, maintenance, and proper storage play a key role in vintage car collecting, but it can be profitable when done the right way.

How Diversified is Your Portfolio?

You say you believe in the idea of spreading out risk, but how well diversified are you? If you’re just spreading your money across different stocks, bonds, and mutual funds, you still have all of your financial assets in the same house – they’re simply in separate rooms. If the house catches fire, there’s a chance it’ll all burn.

Why not totally change things up by putting a very small percentage of your portfolio into a totally different asset class?

You might not have the time or space for a vintage car, but what about a wine collection? Or maybe you’d like to display a gorgeous Canadian ammonite in your home office? Whatever the case may be, rare collectibles offer an opportunity to diversify in an exciting new way that significantly lowers risk while maximizing enjoyment. Won’t you?

_______________________________________________________

Interesting related article: “What is an Investment?“