Running a business is like juggling in a circus! You not only have to deal with the competitive market but also have to deal with the company’s inner issues. Your employees can get injured, you can face a lawsuit, or get struck by a natural disaster. All these unexpected matters can bring along with it an extra financial burden that can be difficult to manage. That’s where business insurance helps you!

Business insurance is an insurance that safeguards your finances and investment from any financial pitfalls occurring due to unexpected risks and events. You might think that it is just another additional expense and that you will never need it. But you never know how or when things might turn against you, and you have to deal with possible disastrous financial problems.

If you still think that company insurance isn’t what you need, then here are some reasons to change your mind:

Law’s Demand

It is the law for you to cover some aspects of business insurance. Once you set up a company and hire workers, the law demands you provide them protection. For instance, the company should provide the employer’s liability or have compensation insurance for workers.

It is the law for you to cover some aspects of business insurance. Once you set up a company and hire workers, the law demands you provide them protection. For instance, the company should provide the employer’s liability or have compensation insurance for workers.

The company is responsible for the safety and health of its workers. In case of any employee injury, you might have to deal with fines and penalties along with the cancellation of contracts. Business insurance deals with all the financial losses in such cases, and you don’t have to bear any financial burden.

Client Lawsuits

Businesses have to deal with different clients. Some are so good that they feel like family to you. While others can turn into your worst enemies due to a small argument or delay. A client turned to an enemy is one of the worst threats to businesses. They can sue you for millions of dollars in case of a contract breach or any other issue.

Businesses have to deal with different clients. Some are so good that they feel like family to you. While others can turn into your worst enemies due to a small argument or delay. A client turned to an enemy is one of the worst threats to businesses. They can sue you for millions of dollars in case of a contract breach or any other issue.

It can get so bad that you might become bankrupt if you don’t have business insurance to cover the expenses of a lawsuit. It is good to be careful with your clients, but you should still go for business insurance to face any unexpected issue.

Equipment Care

Some businesses must-have equipment to exist. If their equipment should be damaged or gone, it is the end of their business. Like, a photocopier needs a photocopy machine, a chef needs an oven and other culinary tools, and a photographer must have expensive cameras to run their business.

Some businesses must-have equipment to exist. If their equipment should be damaged or gone, it is the end of their business. Like, a photocopier needs a photocopy machine, a chef needs an oven and other culinary tools, and a photographer must have expensive cameras to run their business.

If any of their equipment is damaged, it is over for them, if they don’t have money to repair or buy new equipment. Personal insurance doesn’t cover such expenses, but business insurance compensates for all the business-related equipment damages.

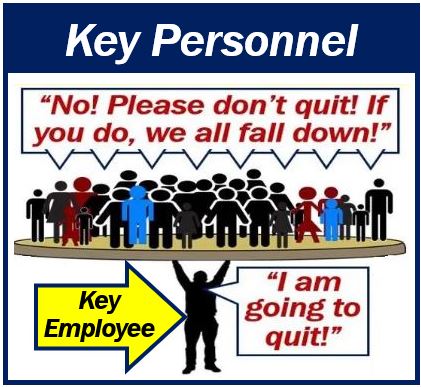

Protects Key Person

Every business has people who are like the backbone of the company, also called key personnel. The one who owns significant skills for creating a quality name for the company, as well as generating profits. It can be your creative director, marketer, or you.

Every business has people who are like the backbone of the company, also called key personnel. The one who owns significant skills for creating a quality name for the company, as well as generating profits. It can be your creative director, marketer, or you.

Any injury, damage, or death of that key person can bring a huge financial loss to the company. Key personnel injury insurance protects you from financial loss in your business in case something happens to your key person, and he/she is not able to work or generate profits for your company.

Peace of Mind

It is very hard for business owners to have peace of mind with the fear of facing unexpected problems. You can handle the market competition by working hard, but what about natural disasters or employee injury? You can’t handle them, but you can minimize the risk of any damage due to disasters, lawsuits, and injury with business insurance – and get peace of mind. And once you have peace of mind, you can think of more creative ideas to boost your business.

It is very hard for business owners to have peace of mind with the fear of facing unexpected problems. You can handle the market competition by working hard, but what about natural disasters or employee injury? You can’t handle them, but you can minimize the risk of any damage due to disasters, lawsuits, and injury with business insurance – and get peace of mind. And once you have peace of mind, you can think of more creative ideas to boost your business.

So, get business insurance and with it, financial protection and peace of mind!