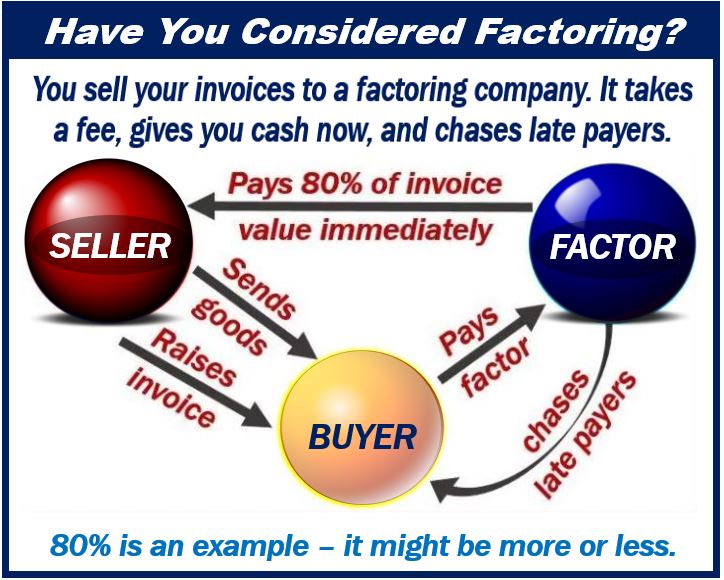

It’s no secret that a lot of small businesses are usually faced with delays or non-payments from their clients. Besides delaying company progress, these overdue accounts tend to push businesses to the very edge of survival.

While factoring saves your business from failing, it can be an expensive option given the hidden charges such as application fees, processing fees, and overdue fees, among others.

For this reason, you need to implement certain strategies in how you conduct your business that will help secure your payments and ensure your clients pay you on time. These strategies will be highly effective if executed before you start your business to ensure the same standards bind every client.

The strategies will help you make sure your clients pay you as a small business owner. They could include having a written contract or order in place before you deliver work, automating your reminders for payment, and setting up strategic business practices and policies to ensure payment.

If you are frustrated and tired of following up with your client, factoring agencies such as ezinvoicefactoring.com is an ideal options. They can boost your cash flow by purchasing your overdue accounts and then give you an advance of a certain percentage of the cash to ensure your business runs smoothly.

Read on as we discuss these factors in detail.

1. Have a Written Contract/Order in Place Before You Deliver Work

A written contract protects your business by keeping off deadbeat clients who may not pay you for services rendered or goods delivered as well as maintaining serious clients.

This contract also gives you a guarantee that your client will eventually pay up whether willingly or through legal enforcement. Without a contract, your client is not legally bound to pay you for your work or goods, and your chances of recovering your payment are not guaranteed.

Your business contract does not have to be a long detailed legal booklet. Rather, you can simplify it by capturing only the fundamental details that detail the scope of the agreement between both parties.

This should include the specific goods or services you will provide to your client, how much your client needs to pay you either on a timely or per-project basis, details of the goods or service delivered, details of the owner, and when delivery should be made.

If you want to be paid promptly, do not leave the client to decide when and how they will pay you. This will give an impression of poor management, giving them the freedom to delay payments or fail to pay.

Instead, include the payment terms in your contract. These include the method of payment, time limit, and discount details where applicable. Also, include the payment methods that you will accept, such as Credit card, eCheck, or PayPal.

These terms should be visible and clear. For instance, rather than saying payable upon receipt, indicate the number of days to a deadline by which you should be paid, or issue a specific due date.

Your contract also needs to protect your business from copyright risks. Include your copyright terms and measures that you will take in case of infringement.

You should also include solutions to risks that may occur in the course of business with your clients, such as the repercussions for late payment and the outcomes on both parties should you decide to terminate the project or business relationship.

Lastly, while your contract states your business terms, it may be unsuitable for some of your clients and may cause them to delay payments. To prevent this, open room for negotiations and make reasonable changes where possible to suit both parties.

For instance, if your client finds your 30-day duration of payment shorter and insists they can only pay you after 90 days, you can negotiate for 60 days instead and include this change in the contract.

2. Automate Your Reminders for Payment

As a business owner, you should be quick to follow up on missed payments. The earlier you do this, the better your chances of receiving payment. To do follow-ups, you need to set up a system that flags late payments.

Phone calls, emails, and one on one reminders can work under different circumstances. At times, an individual might have a busy schedule that they forget to honour the payment. As such, ensure you remain as friendly as possible to recover your payment so you can maintain your client base as you follow up on payment.

To start with, you can make a friendly call to your client, reminding them of the payment. This method is ideal where the payment is about due. It also saves you from doing last-minute follow-ups which can be hectic on your end especially if you have multiple customers paying on the same day.

If your client fails to honour payment after the phone call, you can address your concern via a formal automated email.

However, if you find the email filtering and overload features compromising your follow-up, you may opt for regular mail depending on the debt amount and its effect on your business. Either way, sending emails helps create a copy of the reminder, together with the dates sent

If your client fails to respond or to pay their overdue debts, then it may be time to hand them over to a collection agency for a one-on-one debt settlement. Alternatively, if the debt amount does not affect your business operations significantly, you may write it off as a bad debt.

3. Set Up Business Practices and Policies

Operational policies such as credit policies, frequent invoicing, partial payments, and charging interest go a long way in preventing losses from overdue accounts. These techniques ensure you recover a portion if not all of the amount from the sale of a good or service.

If you want to extend credit to a new client, you should set up a credit check procedure to check how credible the client is. Based on your client’s credit report, you will be able to tell whether they can pay your business or not.

If you are slow in terms of invoicing and fail to inform your customers of their balances immediately, you will make them question their rush to pay your bills. Client invoices should be ready and presented to the client upon delivery of goods or every week. This will create an impression of the timely delivery of services from your end and prompt your customer to adapt to the same.

Alternatively, you can switch to cloud-based invoicing software. This software, unlike ordinary emails, makes billing convenient for you and your client by allowing you to create and send invoices faster. Upon receipt, the client can then make an e-payment, which will reflect on your account within one business day.

If you are worried that your client may not pay you for a highly-priced good or service you have delivered, you can reduce the loss by asking for a retainer upfront or deposit. This technique is non-offensive to a reasonable customer and will protect your business. To effectively take partial payments, you can break the price or charges into three and ask for a third of the whole amount before rendering the service or delivering the goods.

Also, you can ask for the other third when you are halfway through the project and the final third upon completion of the task. Therefore, with a partial payment, even if the client defaults on payment, you will not bear a loss of the whole amount.

Part of your business practice should include interest on overdue payments. While doing this, ensure you include the accrued interest on the next invoice you send to your client. Since interests increase the principal amount, they will discourage your client from late payments.

What Should You Do if the Customer Fails To Pay Even After Employing the Above Measures?

Unfortunately, even after employing due diligence in your business operations to ensure you receive all payments, it is normal to have a few overdue accounts. If after follow-up on email and phone calls and your client fails to honour their debt, you can contact someone else, maybe a guarantor, to find out what could be preventing them from paying you.

While some clients willingly decline to pay, it could be that your client is sick or on vacation and has not been receiving your reminders.

If you find out they are simply ignoring you for no legitimate reason, you can go ahead and notify them that you will take legal action against them or involve a collection agency. It is in such situations that the contract you both signed before indulging in business proves convenient.

Collection agencies will charge a fee or percentage of the total amount a client owes your business. The fee will vary depending on how old the debt is and how much they’re collecting.

Finally, setting proactive policies and procedures cuts down on the overdue accounts your small business has to deal with regularly. Having a written contract, setting reminders, and employing the best business practices and policies will help you get paid so that your small business is not stuck as a result of client debts.

Interesting related article: “What is Factoring?“