Since 2016 South Korea’s central bank has been aiming for a cashless economy. Their first push was towards a coinless society, inviting their citizens to deposit their coins and to use prepaid cards to pay for public transportation. In 2017 they signed retailers such as Seven-Eleven to offer deposits on prepaid cards instead of giving change.

Enter 2020, and for better or worse, South Korea still has coins in circulation. While the Central Bank might not have reached its ambitious goal, cash usage in South Korea is at an all-time low. In 2018 cash accounted for just one-third of all household spending.

But, what makes the Central Bank so sure that they can push for a cashless society? And why are they hopeful that things will change in 2020?

The cost of cash

Cash is a hassle for most users. You can lose it if you are not careful, it can be stolen. And it’s very easy to make a mistake when handling it out.

Cash carries social costs for individuals, especially for unbanked folk. Experts estimated that people who didn’t have a bank account paid up to 4 times more to have access to cash

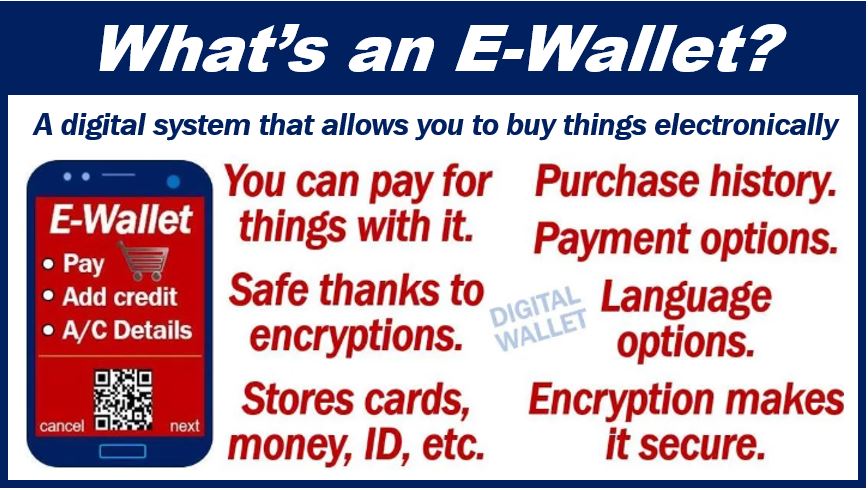

Compare it to how easy it is for a software or app developer to just add a payment option in custom software, storefronts with an e-wallet like Paypal or a bitcoin wallet. Or how Apple’s face recognition payment makes it dangerously easy to buy stuff on their App Store.

Cash is expensive. It’s difficult to print, it costs money to transport it, and it costs even more to have security measures to avoid counterfeits. You need space to keep it and need security so that others won’t steal it.

In 2018, the FBI reported over 3000 bank robberies in the USA. And a survey conducted in 2019 revealed that around 25% of Americans had money stolen at least once.

And let’s not forget that after 2020 we have the possibility that cash is a vector of transmission for viruses and bacteria.

Korea: smartphone capital of the world

Kim Seong Hoon, from the Korea Economic Research Institute, estimates that the Korean economy may grow up 1,2% in a single year when they manage to go fully cashless. Yet, Hoon is the first to admit that is easier said than done.

According to Hoon, the 2 biggest hurdles are the culture change that needs to happen with late adopters such as elder generations and the infrastructure needed to support day-to-day transactions. Simply put, as long as there is the possibility of at least 1% of the population losing all access to the economy, it’s impossible to make the jump.

A solution, at least for South Korea, is the massive popularity of smartphones. The countrywide adoption rate is close to 100%. So, mobile payment seems to be the way to go.

South Korea has been adopting mobile payments since around 2014 with the mobile giant Kakao releasing its payment service Kakao Pay. A year later, Naver would release N pay. And by 2016 both Visa and Mastercard released their owns “app cards”.

By 2018 Kakao was the first one to launch QR based payments, a system where you scan a barcode with your cellphone and the money is immediately transferred from your account to the merchant.

The government followed suit with Zero Pay. Their payment app with special benefits for small merchants to reduce their card-cost processing costs. The Korean government promised a 40 percent reduction in income tax for those who use Zero Pay.

With the proliferation of mobile payment services, it’s no wonder that at least 89% of Koreans use at least one mobile payment service.

The risks of going cash-free

Of course, going cashless has some very important downsides to keep in mind. Every transaction gets recorded. Not just by the government, but by companies who harvest and sell personal data. Losing cash also means losing the anonymity that comes with not having your identity attached to a bill.

On the other hand, government cryptocurrencies like Seoul’s S-coin are problematic. What guarantees that a government won’t choose who gets the coins based on adherence to a political party? Those in power could limit opposing parties’ access to resources such as food or government services. South Korea is a Democracy, but other, less politically free countries could be more restrictive in their use of similar solutions.

And finally, the biggest downside is hacking and cyberattacks. It’s hard to stop robbers in real life. And it is just as difficult to prevent cyberattacks. Upbit, Korea’s biggest cybercurrency exchange, lost the equivalent to $50 million in Ether. Forcing the market to close down for 2 weeks.

Software developers have been testing AI-based tools to create better security systems and prevent attacks. But perfect cybersecurity is nothing but a dream. Especially considering that some of the biggest hacks in cybermarkets have been inside jobs.

Lessons to be learned

So, the quick answers seem to be, no, we are not ready for a cashless world. There is a lot we need to account for. And governments who are aiming for a virtual currency need to start working on both the infrastructure of the networks as well as the culture surrounding money.

It seems that the transition is like a slow boil. A series of small changes over time that finally amounts to a change of the economy by policies and the insertion of newer generations into the economy.

Interesting related article: “What is an E-Wallet?“