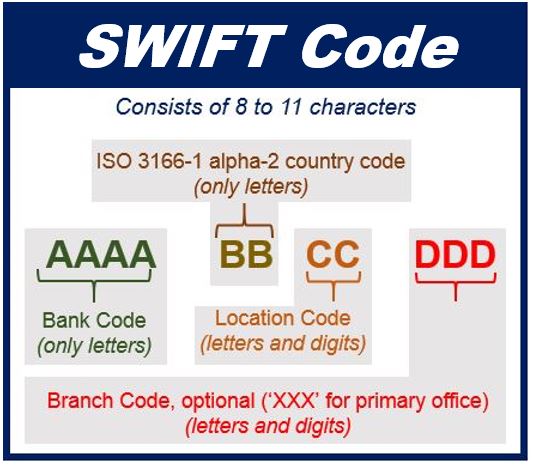

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) enables monetary financial institution worldwide to send and get messages about the financial operations according to all required security measures, utilizing normalized structure and programming. SWIFT unity all members utilizing Business Identifier Codes, which is granted for each institution who is a member of the organization. Business Identifier Codes are otherwise called BIC codes or SWIFT codes.

To have the option to send the data to another member, financial institutions will have to open corresponding accounts with one another. Eternity Law International is professionally engaged in receiving SWIFT for sale.

To become a member of SWIFT network, the financial institution applies and pays membership fee in case of positive result of review. The membership fees are also paid annually. There’s also fee for each conducted transaction the financial institution executes. The charges are distinctive, relying upon the sorts of messages and volumes.

Financial institutions can’t actually send funds to one another; however they can send installment orders to one another. The installment order is a monetary instrument with accordance to which one bank or banking institution has to execute the fund transfer or payment to the other party.

Primary benefits of SWIFT organization:

- SWIFT covers monetary liability for delivery of the message;

- Safety of data while sending utilizing SWIFT organization

- Worldwide financial advising and reference data rules. The use of standardized messages ensures that data exchanged between establishments is unambiguous and machine genial, working with computerization, diminishing costs, and mitigating dangers.

There are various approaches to associate with the SWIFT organization, for example:

- Direct connection

- Indirect connection

Direct network

Direct connection to SWIFT is performed when the financial organization applies to SWIFT and gets its own BIC code. Direct availability enables to be associated with a secured net of SWIFT members and transfer data and installment orders with other financial institutions. For this kind of association, there is needed to utilize certain products created by SWIFT.

Fundamental highlights:

- Working with a direct network – SWIFT

- The information base is focused on the clients’ requirements

- The assurance of dataflow

- Decreases the expense of messages contrasted with utilizing of the indirect connection

Indirect connection

The indirect connection is performed when the banking institution utilizes the BIC code of the other financial institution which is the SWIFT member. The indirect connectivity is additionally named by SWIFT as bureau service. A bureau service gives affiliates with cost-effective solution to send SWIFT messages without need to employ required software internally. A bureau mostly provided by the special organizations authorized by SWIFT. This type of connectivity is also called shared connectivity.

The financial institution can also reach the SWIFT member to utilize their BIC code. It may be performed either with the individual interface of programming that financial institution has and to execute messages it utilizes BIC code of the other SWIFT member, or the financial institution approaches SWIFT member with specific installment order and SWIFT member executes it with their own interface of the software.

So, as a summary, there are different types of the connectivity to SWIFT, each financial institution is able to prefer the one which is the most suitable for it.