For investors, ESG is an important consideration that can significantly impact their portfolio. ESG has been around for a long time, but it has only recently become an important factor for investors. This is because organizations have been increasingly implementing ESG practices in order to improve their investment opportunities.

In this article, we will discuss the importance of ESG for investors and how they can benefit from it, noting 3 key industry opportunities for your investment.

What is ESG?

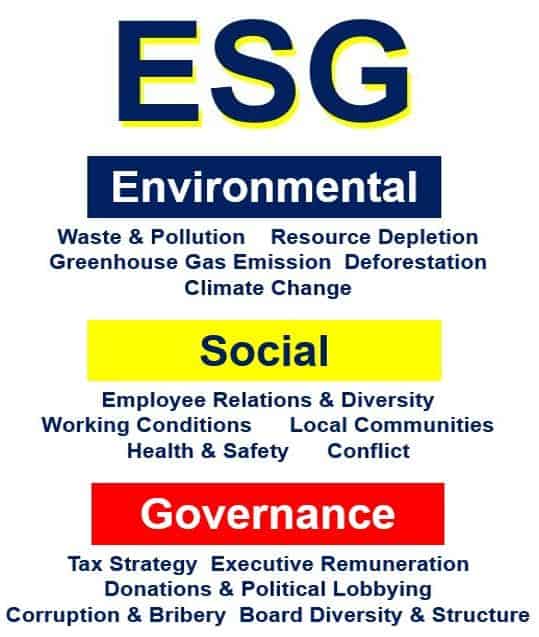

ESG stands for Environmental, Social, and Governance, and it refers to the impact that companies have on the environment, their social responsibility towards stakeholders and employees, as well as their governance practices. ESG factors are increasingly being taken into account by investors when making investment decisions.

How Does ESG Work?

ESG is based on a number of key ESG performance indicators that help investors to assess the ESG practices of companies and make informed investment decisions. These indicators include environmental impact, social responsibility, and governance risks and practices.

For example, in the mining industry, ESG is becoming more and more important as investors are looking for companies that have strong ESG practices in place. This is due to the fact that ESG has a major impact on operational costs, performance, efficiency, community relations and reputation.

There are many different ESG strategies that organizations can implement in order to improve their ESG performance. Some of these strategies include reducing pollution and waste, investing in renewable energy sources such as solar power, and adopting ethical business practices that are fair to employees and stakeholders.

Why is ESG Important in 2022?

The ESG landscape is constantly evolving, and ESG has become more important than ever before. With the rise of technology such as lithium-ion batteries and solar energy, there are many investment opportunities in these sectors for ESG investors. Furthermore, with increasing public awareness around ESG issues, companies are being held accountable for their ESG practices, and ESG is becoming an increasingly important factor in the success of organizations.

So if you are an investor looking to expand your portfolio, ESG should definitely be on your radar. Below we’ve listed some of the top ESG prospects for you so you can get started on your research to see which industry offers the best opportunity for you as an investor.

ESG Investment Areas

Looking for ESG investment opportunities? Look no further than the tech, mining, and renewable energy industries! With ESG becoming increasingly important in these sectors, there are plenty of exciting opportunities out there for ESG investors who want to capitalize on the trend and help drive a more sustainable future.

ESG in the Tech Industry

The tech industry is one of the hottest sectors for ESG investors right now, with many companies investing in renewable energy sources such as solar power and embracing ESG practices to improve their environmental impact, social responsibility, and governance. Some popular ESG investments in the tech industry include green data centers, smart cities, and more.

There are a range of ways to invest in new ESG-orientated tech, including through leading ESG funds, individual stocks, or via ESG indices.

ESG in the Mining Industry

The mining industry is another popular ESG investment choice, with many companies moving towards ESG practices and technologies in order to reduce their environmental impact and improve their ESG performance. Some examples of ESG-focused mining investments include carbon capture technology, green energy sources such as solar power, and smart sensors to monitor air quality.

As ESG becomes increasingly important in the mining industry, there are many investment opportunities for ESG investors looking to capitalize on this trend. You can invest in this by putting your money behind companies that cultivate materials for environmentally friendly resources. For example, manganese offers exciting investment potential according to The Assay, as it is a key resource in lithium-ion batteries and other ESG-conscious technologies.

ESG in Renewable Energy

Yet another ESG investment opportunity is in the renewable energy sector, where companies are investing heavily in solar power and other sustainable technologies to reduce their environmental impact. Some popular ESG investments here include smart grids, wind turbines, and geothermal energy.

As countries such as the United States are shifting to more sustainable energy choices, these ESG-focused investments are expected to grow even further and offer great opportunities for ESG investors.

So if you’re looking to invest in ESG, many exciting options can help you diversify your portfolio while also contributing to a more sustainable future. Whether it’s tech, mining, or renewable energies, ESG is the future of investment and one that you definitely shouldn’t miss out on!

Interesting Related Article: “Best Inflation Investments For 2022 And Beyond“