You might be amazed by the number of businesses that currently suffer from chargeback fraud across the globe. It happens with companies of both solid reputation and those that have just appeared on the market. Chargeback prevention helps to protect the business and even restore the trust of your clients. Here are helpful recommendations for you.

What Is Chargeback and How Can Fraudsters Use It?

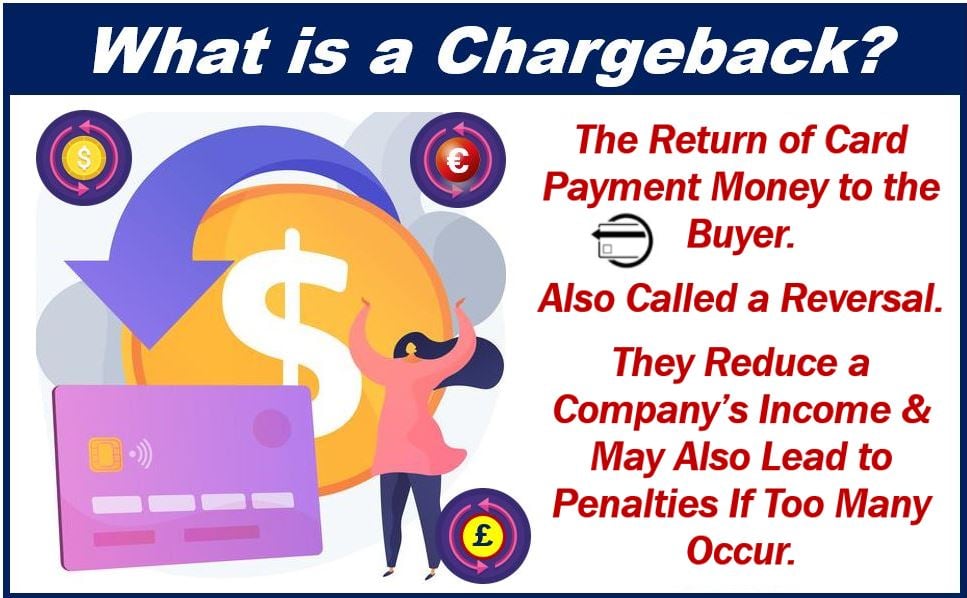

Chargeback is a process started by the unsatisfied client who contacts the bank or credit card issuer to dispute the purchase that was made. The client wants to receive a chargeback for the product that was ordered but did not match the description or expectations. While originally, the chargeback system was created to protect the customers’ rights, many fraudsters use it to receive both money and products and destroy the reputation of the business.

This type of fraud happens only online. The number of such cases has significantly increased during the pandemic. A chargeback may also be used by ordinary customers who want to receive a free-of-charge product plus their money back. On rare occasions, this situation can appear because of the bank’s or seller’s mistake. Sometimes it may happen due to an error in the software.

There are five types of chargeback fraud you have to be aware of:

- The customer assures you that they haven’t received the order while you see that the package has arrived at the address.

- The customer claims they sent the product back to return the goods they hadn’t ordered, but they did order the goods and did not send them back. This way, they get both the product and the money for the chargeback.

- The customer argues that the transaction was not authorized, though it was the opposite.

- The customer assures that the product does not resemble the one you advertise in the store, while it looks the same.

- The customer says that the payment was not canceled as they had asked, while there hadn’t been such a request.

How to Protect Your Business

These steps might help you secure your company from a chargeback. Before we name them, you have to make sure that the complaints that are coming from the clients are not related to the quality of the product or the delivery service:

- The verification method of credit cards must be secure. Even the different names of the company and the brand that is ordered can scare your customers. Make sure that the ordering system is completely developed and well-functioning. You also have to check that the billing address of the customer’s credit card is the same that was filed with the card issuer. You can easily reject the transaction if it does not match.

- Unusual orders. You have to make sure that the billing and shipping addresses are not different, and all the purchases are made in one order. If you suspect something, contact the cardholder, and make sure that the last transaction is valid. You can always record the conversation, just in case.

- Confirm the order. After it is placed, send the confirmation to the customer. Send the information on the delivery.

- Make your payment policy clear. Your clients should be able to reach it in no time.

- Always keep track of shipments. Check the delivery. Don’t trust the carriers you don’t know.

Enabling Advanced Security

Use all the tips listed above; these measures are necessary to perform to protect your customers. If you don’t have much time to spend on upgrading your security, benefit from the ready-to-use solutions that automate the whole process, simplifying it for you.

Interesting related article: “What is a Credit Card?“