With the connectivity of modern systems increasing all the time, the amount of data available to investors is greater than ever.

Much of this is traditional data that investors have always used, but delivered using modern systems such as SaaS platforms and apps that are able to collate metrics like company directors, business sizes, revenue and p/e ratios.

Even government departments (not usually early adopters) are beginning to make more and more data available to the general public.

But a new class of data has emerged that adds depth and richness to business analysis and whilst this has been pivotal to strategic thinking within the businesses themselves, greater access has meant that investors are now starting to see the benefits.

What is Alternative Data?

One thing that business commentators can agree upon is that there is no clear definition of ‘Alternative Data’ but there are some common themes that emerge.

An easy starting point is to suggest that alternative data is anything that hasn’t traditionally been used in that sector before.

From an investment standpoint, that could mean any form of information that may have a bearing on the health and prospects of a business and, by extension, its share price.

Types of alternative data can include;

Customer sentiment – collected from sources like Trustpilot and showing how the business’ core customers are feeling about the company.

If there are problems then they will show up quickly here.

Web traffic – sites with active and vibrant websites that consistently achieve high traffic rates demonstrate that they have ‘got’ the internet age.

Your web start-up might be about to become a unicorn if web traffic goes through the roof.

Credit card sales – showing the types of buyers and their economic subset, average spend data and types of spending

Understanding a company’s customers and what they buy tells you how healthy it is.

Weather data – long term weather forecasts can predict success for companies as diverse as agriculture, shipping and clothing.

Ultra-cold weather means a boost for the energy sector and niche snow-boot manufacturers.

Survey data – both collected primarily by the client but also on behalf of other businesses

The availability of survey software means that it is cheaper and quicker than ever to get up to date information.

Web scraping – bots searching the web for relevant information about investment targets.

You could never hope to find everything about your target on the web, but automated systems can.

Satellite data – how full are retailers’ car parks? Is there enough water in the reservoirs? Are the fields showing a bumper crop this year?

More satellites than ever before with better cameras and analysis capability mean that there’s little you can’t see.

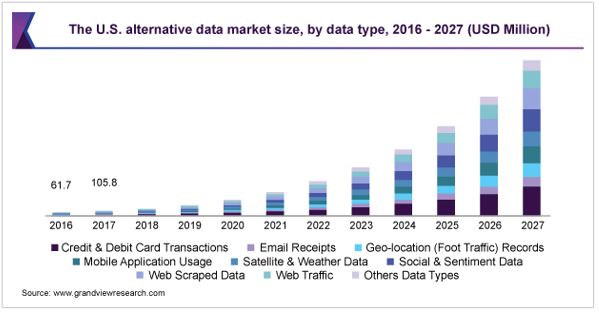

In fact, alternative data is such a hot prospect right now that the sector is expected to grow by a remarkable compound annual growth rate (CAGR) of 40.1% from 2020 to 2027.

It’s a trend that is unlikely to reduce given that the roll-out of the Internet Of Things (IoT) is increasing data availability at an exponential rate.

How can this help investors?

The potential for investors is plain to see.

For long-term investors, the annual company statements and earnings forecasts only go so far. The richness added by infusing traditional information with alternative data means that a complete picture of a company can be formed.

For example, a tech company reports excellent earnings and revenue in its annual statement and trumpets the launch of a new product that will revolutionise the industry.

All good you may think and indeed many investors may pick the stock based on this outlook.

One of the problems here is that annual statements are produced well after the event and can only ever offer a backwards-looking picture.

Looking at the customer sentiment for our imaginary company, including online reviews, customer feedback and credit card refunds shows that the new product, far from being industry-leading, actually turned out to be a buggy, underwhelming and frankly embarrassing debacle.

Now the investment isn’t looking quite so good!

Alternative data doesn’t just show you when things are going well, it also stops investors from making poor decisions.

With investments, speed is of the essence and so having access to up to the minute information means that decision making can be rapid and fully informed.

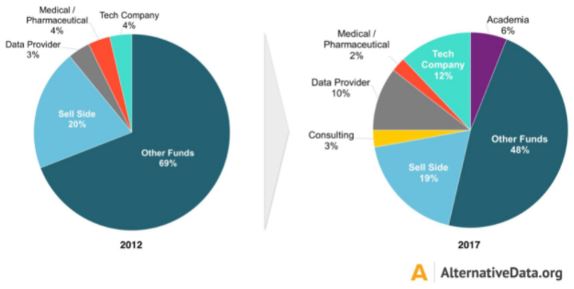

Change in funds using alternative data

For investors, having access to that quality alternative data means that they can identify, evaluate and buy into target businesses in a fraction of the time it was taking ten years ago.

All too often the investment game is one of competition – if you don’t buy that perfect target quickly then your competitor will.

Back in the day, it was assumed that the availability and provision of alternative data would prove to be a great leveller. After all, perfect information means a perfect market but it is actually the availability of the data that has proved to be the problem.

In essence, there is simply too much information out there.

This has meant that the funds and investment professionals that invest heavily in great data sources, excellent analysts and in Artificial Intelligence and Machine Learning have an inbuilt advantage over their less forward-thinking rivals.

The benefit for investors is clear – better information means market-beating profits.

Alternative data – the investor’s secret weapon

With the amount of publicity given to the availability of data, you would think that most investors would have cottoned on to the concept of alternative data but the truth is that is still a bit of a ‘dark art’ to many people.

This means that for investors, both institutional and private who can fully grasp the possibilities that alternative data brings, there is an excellent opportunity to make market-beating profits.

And with more and more data coming on stream it means that the speed, breadth and depth of alternative data are only going to increase.

The question for investors is not if they will start using this valuable resource, but when.

Interesting related article: “What is an Investor?“