Automation is the key to business growth

Businesses are adapting to keep up with the changing demand for better products and services through the automation of different processes. The challenges faced by an organization today are complex, particularly as procurement and the related invoice payments are matching with the scale of the operations.

A few years ago, finance teams did not prioritize AP automation and were even skeptical about the features of digital platforms replacing a crucial function like accounts payable. Another reason for the lack of enthusiasm was that automation was first introduced in processes that were direct growth drivers where consumer experience was a big differentiator.

As a result, till recently the accounts payable function could not match the scale of operations and was a time-consuming laborious process with many errors. However, artificial intelligence, blockchain, and robotic process automation is changing the game for businesses globally. A more dynamic platform with a complex set of capabilities and features that can handle multiples of the current workload is introduced to automate accounts payable processes.

Preview before automating AP

Numerous companies find it cumbersome to assess their situation based on needs and internal process requirements. Most process teams find it hard to identify the inconsistencies and formulate a strong gap analysis that can aid with focussed solutions for existing issues. Understanding what they want and coming up with solutions that fix current process anomalies are ways to start. Nevertheless, the whole process can be debugged with persisting problems if the few parameters are thoroughly checked while finalizing the AP automation tools. Here are a few pointers that can help a business in setting the ground ready before they automate their accounts payable process:

-

Review current process

When the current process is examined, the pain points in the AP function are identified. The possible solutions are often simple steps that may slip the mind of the person manually processing the payments. If the pain points that are a hindrance to the accounts payable process are located, then the AP digital tools can be customized with focussed solutions that address the bottlenecks.

-

Consult the team

Automation tools are important components that contribute to enhancing the digital employee experience. Hence, it is important to involve your teams and ask them for suggestions that need to be incorporated to improve the automation process. When the employees are consulted before moving towards a change, it will have indirect benefits like better employee engagement and quicker adjustment to change in operations. The employee is also trained to accept the presence of robotics as a means to improve their involvement in value-added roles.

-

As for a demo of the platform

There are several AP automation service providers, and selecting the right one that fits the order and matches the bill is plausible only after a physical demonstration of the software. If the software comes with a free trial run that can be canceled within a stipulated timeline, it becomes an easier choice as the teams will have hands-on experience with the latest available services. The decision-making process will improve with the sampling process and the appropriate service will be selected after the initial due diligence reports.

Feature checklist for AP automation

Understanding the need for automation and preparing after consulting the teams are initial steps that will help the next stage in zeroing down the appropriate software or platform that can add value to the accounts payable process. It is advisable to check the following features before the final nod of approval for an automated AP:

-

Easy interfaces

The UI of any application determines the interest of the end user. There are many instances when automation tools have been rejected by the employees as the interface is difficult to navigate and takes too long to respond and load. Ensuring a simple interface that can help in smoothing the automation will be an effective step as it will take less time for employees to learn and adapt to the changes.

Select a platform that offers a neat dashboard, which is not cluttered with too much information. It should also help the employee in locating the essential information and features required as per the accounting principles followed under the regulatory framework.

-

Data storage and security

A business has several invoices that need to be sorted and filed according to the categories to make things more pliable. The information should be accessible to all the authorized members of the team for ease of finishing their tasks. Data can be stored in a central repository and recalled through keyword searches. For instance, if an employee wants to access the invoice details from the archives of a vendor whose name starts with K, then just with the first few letters of the name all the invoices relating to the entity will be displayed. From this list, using the calendar, archived invoices can be pulled out.

-

Automation

Automation of accounts payable will tune the repetitive tasks that are time-consuming if carried out through the manual process. It helps in reducing the timelines, increasing productivity, minimizing the errors like duplication of invoices, and matching the purchase orders and non-purchase orders with the received invoices. AP automation streamlines the process to match invoice approval to improve the overall efficiency of the process workflow.

-

Payment options

A business should have ease of payment options as per the vendor’s requirement. One can find it difficult to convince a vendor to accept a credit card payment for reasons like extra merchant costs in the region where they operate their business from. AP automation must allow users to choose the payment source between different available options.

Conclusion:

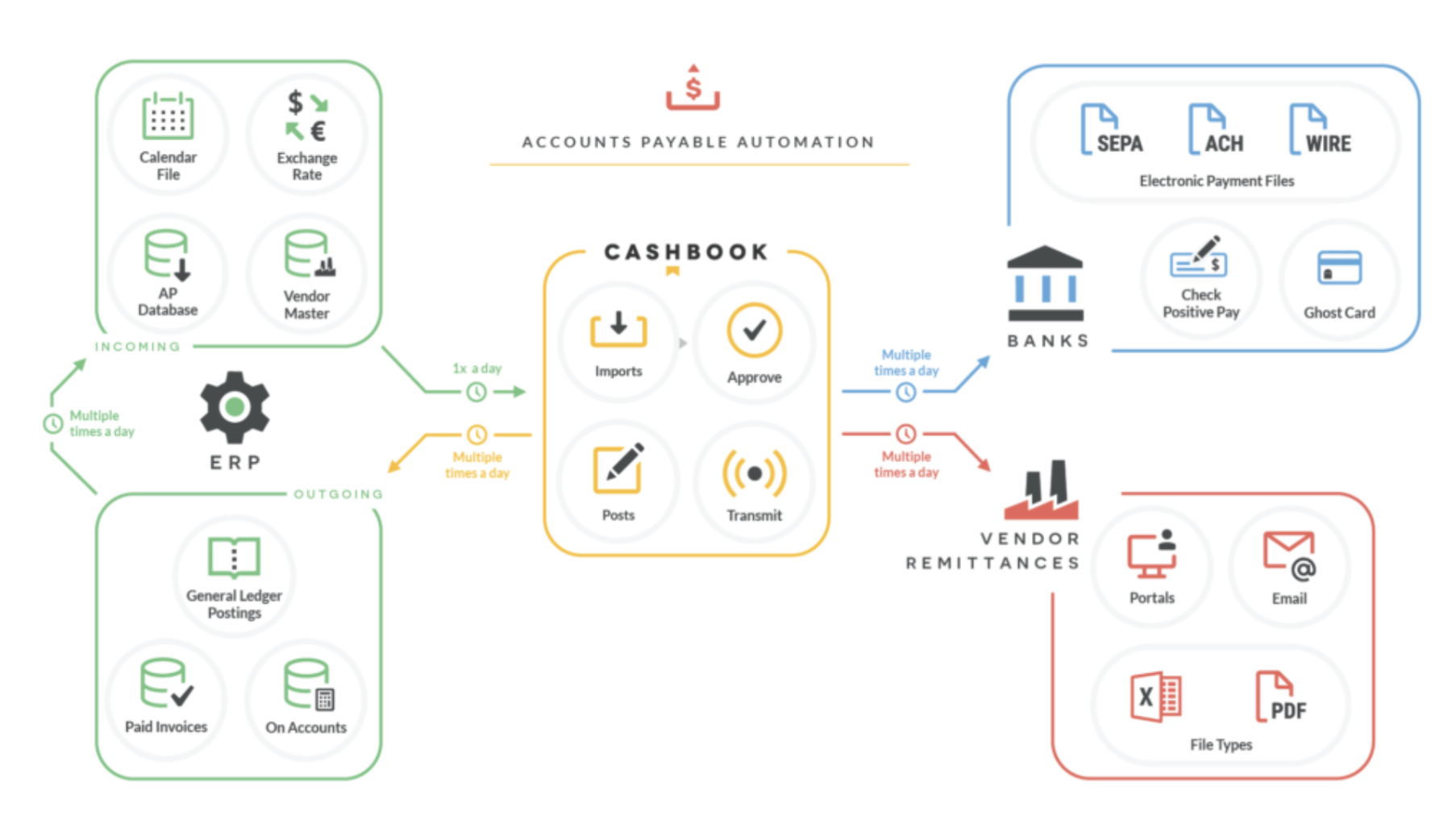

Automated accounts payable can easily integrate with the current enterprise software and do not require any major overhauling. With third-party API and optical character recognition, invoices that are in paper and virtual format are recorded and data is matched with other related files to complete the reconciliation before approving payments. Business growth in current times can be scaled with business process automation where accounts payable figures as a crucial function.