In the European Union, all entities that trade in financial markets must have an LEI code issued by their authorized LEI issuer. With one, they’ll be able to access secondary and regulated markets.

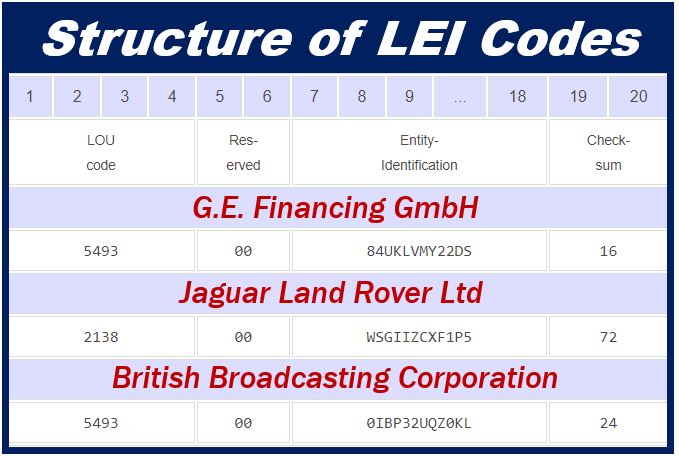

The LEI code is a 20-digit alphanumeric string that uniquely identifies every company and entity involved in the planet’s financial transactions. It tells you who they are, where they are located, and who they do business with. The information is up-to-date and collected from more than 190 countries worldwide.

Many authentic websites provide an LEI finder that serves as a comprehensive list of LEI code holders by country. They have a searchable database of all LEI holders available to them.

Importance of LEI code

Assures the integrity of transactions

It helps to ensure the smooth functioning of the financial markets. It identifies who is involved in the transaction and the legal entity that is the issuer where necessary.

Support regulatory initiatives

It provides additional information which helps with the effective monitoring, analysis, resolution, and enforcement of financial rules by regulators.

Facilitate trade across borders

The LEI provides a unique identifier for every legal entity involved in financial transactions, enabling them to use a single identifier worldwide. It allows trading partners to identify whether or not they are dealing with the same entity regardless of its name or jurisdiction in which it was originally incorporated as well as its location on any given day when carrying out business transactions.

Support good governance

It helps to support good governance. LEI codes facilitate the dissemination accurate, up-to-date information about a company or other entity involved in financial transactions to its stakeholders.

Support efficient and effective monitoring and analysis of the financial system

The LEI is used by the International Organization of Securities Commissions (“IOSCO”) framework for coordination in addressing emerging systemic risks, which address new market developments and build common assessments of systemic market risks at an international level.

LEIs are issued by one of more than 240 firms that have been authorized as legal entity identifier issuers by IOSCO, an international standard setter for securities regulators (members are regulatory bodies for securities markets).

Build and maintain a sustainable infrastructure for global security markets

The LEI helps to build an efficient, effective, and sustainable infrastructure for global securities markets. It facilitates the efficient exchange of information that supports the development of national and international security markets, including cross-border transactions.

Facilitate the development of a world financial market

The LEI is used to identify who is involved in the transaction and the legal entity that is the issuer where necessary. International financial services firms also use LEIs as a uniform identifier to assist in cross-border trade and transaction processing, facilitating trade across borders.

Support compliance initiatives

It supports compliance initiatives by helping to provide accurate and up-to-date information to financial market participants that they can use to meet regulatory requirements quickly and easily.

Conclusion

Using an LEI finder helps you identify every company and entity involved in a country’s financial transactions. It tells you who they are, where they are located, and who they do business with. In summary, the LEI code plays an essential role in regulatory compliance, and its usage plays a vital role in the financial services industry’s growth.

Interesting Related Article: “What Are The Patterns In Financial Trading?“