You have heard about volatility before, especially in the stock market. It could be the fear of high market fluctuations that is stopping you from making your investment. But do you know enough about volatility and why it is essential to every investor? Read on to find out.

As an investor, the performance of your investment is the critical aspect you are focusing on. However, as you assess the potential returns on your investment, it is essential to understand volatility.

What is volatility?

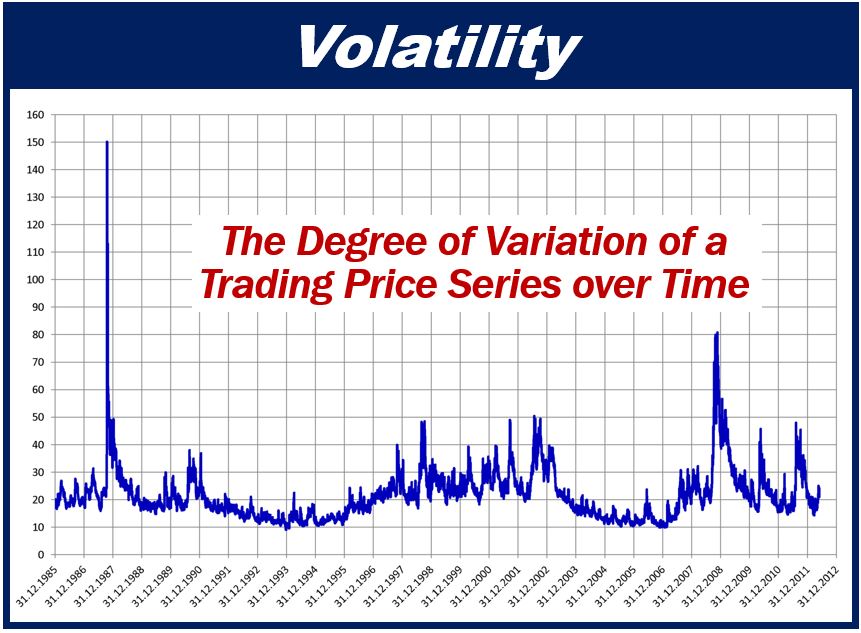

It is a measure of dispersion around the expected average return, which shows how the performance of a security or investment varies over time. Volatility is a standard deviation, and is calculated as a percentage using a statistical formula.

The stock market faces frequent fluctuations. Thus, it is said to be highly volatile. These fluctuations present a high investment risk. In business, the greater the risk, the higher the reward. Therefore, the high volatility in the stock market can be harnessed correctly to generate substantial returns.

Why should volatility matter to an investor?

Every investor aims to get their expected return on investment with minimal risk. A long term investor may find high volatility investments to be riskier compared to a short term investor.

As a trader or investor, you need to determine your investment goals, and have a deep understanding of volatility. Markets are always fluctuating in the short term. Without adequate knowledge, an investor can exit the market, basing their decision on the current fluctuations.

Exiting because of market fluctuations is mostly a wrong call. Most times, if the investor had waited for the variation to pass, the market would have moved in his favor. Therefore, understanding volatility can insulate an investor against loss.

Volatility is also essential because it can help the investor formulate new strategies, or come up with possible reversals. Less fluctuation in the market may force traders to wait for an extended period before making profits.

By checking the market variations, an investor can accurately assess the performance of a security. The fluctuations give information on how risky an investment is. Therefore, day-traders might find a stock with high volatility to be ideal since it offers them an opportunity to make large profits.

How an investor can use market fluctuations to their favor

There are numerous negative aspects whenever market fluctuations come up. Instability causes short-term fear, which can make an investor doubtful about his or her investment strategy. However, as an investor, you need to know that volatility is inevitable, and avoiding it can be risky. Rather than avoiding it, you can make use of the market fluctuations in the following ways;

-

Let it pass

Market fluctuations are inevitable. So, should you notice these variations creeping in, it is wise to maintain your strategy until it passes. These variations are short-term, and they change in time. Waiting for it to pass can prevent you from suffering losses, which you might incur when you decide to get out.

-

Buy more shares

One bright side of the market being volatile is that the shares retail at a lower price. The reduced price can act as an entry point for a new investor. It is an ideal opportunity for a bullish investor who believes the market will perform better later on.

Highly volatile markets

- Stock market- smaller stocks tend to be more volatile compared to more massive listed stocks

- Technological market- the technology sector such as IT and biotechnology are more unstable compared to other industries such as telecommunications

- New companies are more volatile compared to old, or already existing companies

- Gambling industry is volatile too since for example casinos have different games and those that are highly volatile give you better chances of winning more by spending less.

Conclusion

Volatility doesn’t only pretend to have a negative effect. With proper knowledge, as an investor, you can use market fluctuations to your favor. It presents an opportunity to enter a trader and make more. However, you need to be wise and let the short-term volatility pass to avoid suffering huge losses.

_______________________________________________________________

Interesting related article: