Despite interest rates remaining low, the uncertainty surrounding Brexit is likely to put a brake on UK house price growth next year, say Savills.

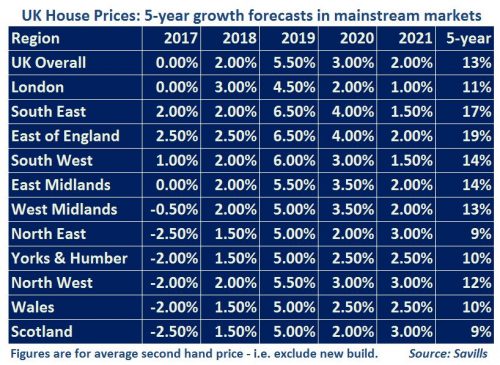

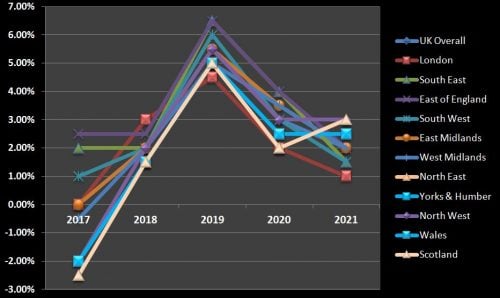

The real estate company forecasts that house prices overall in the UK will remain flat in 2017.

Over the next 5 years, London’s house price growth is forecast to be just 11 percent – 2 percent below that of the UK overall. pixabay – London facade.

Over the next 5 years, London’s house price growth is forecast to be just 11 percent – 2 percent below that of the UK overall. pixabay – London facade.

Then, as more clarity on the deal for leaving the EU develops, they forecast house price growth will increase by 2 percent in 2018, and again by 5.5 percent in 2019, when Brexit negotiations are expected to conclude.

After that, while brighter economic prospects should lift consumer confidence, this is likely to be dampened somewhat by higher interest rates, thus the forecast house price growth comes down again to 3 percent in 2020 and to 2 percent in 2021.

The result, say Savills, is an overall 5-year forecast of 13 percent house price growth for the UK.

Regional differences

The growth patterns will vary in different parts of the UK.

Savills forecast that while all regions are expected to see flatter house price growth as the economy slows, this is likely to be more acute in London, as interest rates start to rise. Over the 5 years, they forecast London’s house price growth to be just 11 percent.

In contrast, the strongest growth is forecast to be in the East of England, where over the 5-year period house prices are expected to grow by 19 percent.

The flattest growth is expected to be in Scotland and the North East, with house prices expected to grow by just 9 percent between now and 2021.

Essentially, while the Brexit vote makes forecasting difficult, it is not likely to have as big an impact as the credit crunch of 2007 – an event which Lucian Cook, head of residential property research at Savills, describes as having had “by far the single biggest impact on the UK housing market in my adult life.”

Rental price will outpace house price growth

Over the next 5 years, the increase in rental prices is likely to outpace house price growth, rising by 19 percent across the UK overall.

Like the sales market, the rental market is also sensitive to uncertainty. But it is tied to different drivers, and on balance, the barriers to home ownership are higher, with the result that, say Savills:

“Renting will remain the tenure of choice for younger households.”

In London, rental prices are forecast to grow by 24.5 percent between now and 2021, say Savills.

However, high housing and office costs in London make regional cities look increasingly attractive.

Savills suggest the prospects for Bristol, Birmingham and Manchester are particularly strong. They forecast rental prices in these cities will grow by 27.5 percent, 17 percent, and 17 percent, respectively, citing one reason as:

“Their knowledge-intensive and high tech economies draw in the most highly skilled (and paid)

employees.”