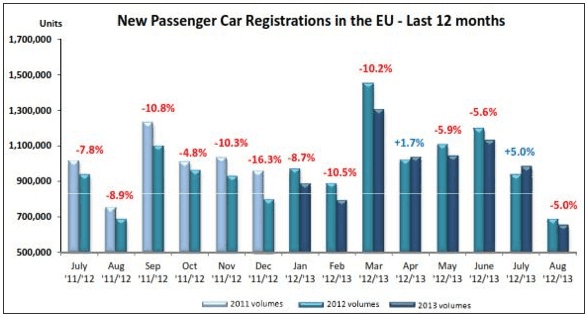

European car sales fell 5% in August 2013, after rising 5% in July, according to a new report by the European Automobile Manufacturer’s Association (ACEA).

The ACEA pointed out that July had on average one more working day across Europe, while August had one less.

During the first eight months of 2013, a total of 7,841,596 new cars were registered in the European Union (EFTA) plus the nations in the European Free Trade Association (EFTA) – 5% less than the same period in 2012.

European car sales percentage change in July 2013

With the exception of Italy, Europe’s five largest markets grew in July.

- France +0.9%

- Germany +2.1%

- Italy -1.6% (shrank)

- Spain +14.9%

- UK +12.7%

European car sales percentage change in August 2013

All major European markets shrank in August, with the exception of the UK.

- France -10.5% (shrank)

- Germany -5.5% (shrank)

- Italy -9.0% (shrank)

- Spain -3.6% (shrank)

- UK +10.9%

A total of 653,872 new cars were registered in the EU plus EFTA in August 2013.

Among the automobile manufacturers, Peugeot of France saw the largest decline, sales fell by 18%. For Volkswagen, Europe’s largest car maker, sales fell by 11%, while BMW saw a 9.9% increase.

European car sales from January to August 2013

The majority of major markets experienced a decline during the first eight months of this year, compared to the same period last year.

- France -9.8% (shrank)

- Germany -6.6% (shrank)

- Italy -9.0% (shrank)

- Spain -3.6% (shrank)

- UK +10.44%

Over the last year, European car sales have fallen every month except for April and July. (Source: ACEA)

Why have car sales grown in the UK?

The BBC quotes Tim Urquhart, from HIS Automotive, who said regarding the UK car market, “Overall confidence is improving, especially among private buyers, as a result of the positive recent economic data. This bolstered confidence has combined with an ongoing very aggressive retail environment where dealers and manufacturers are offering extremely keen deals and incentives packages.”

With low UK interest rates, corporate car buyers have a wider choice today of interesting financial options.

The BBC added that in Europe luxury car makers are performing better than mid-markets brands.