Cashier’s check – definition and meaning

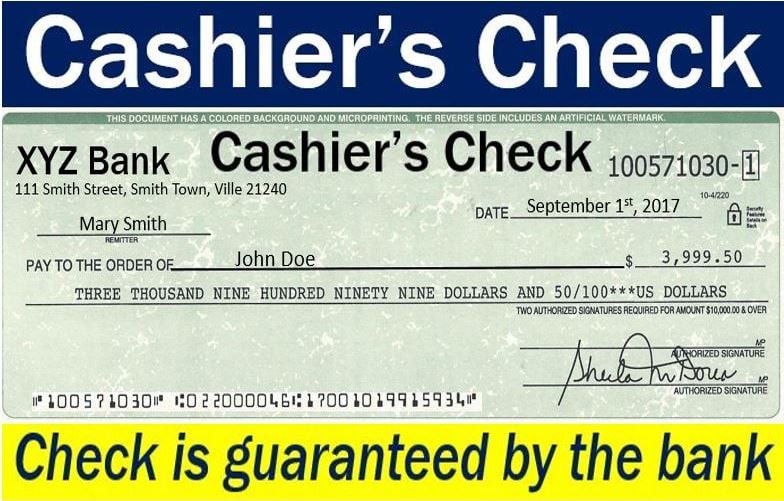

A cashier’s check is a check that a bank guarantees. It has the cashier’s signature and uses the bank’s funds, rather than the purchaser’s funds. We also call it a treasurer’s check or teller’s check.

In the United States, the spelling is ‘check,’ and ‘cheque’ in other native-English speaking nations.

We use a cashier’s check when the receiver of funds requires a total guarantee. For example, in some real estate and brokerage transactions, the receiver may demand a guarantee.

How to get a cashier’s check

Go to your bank and ask for a cashier’s check, stating the amount. The bank will debit that amount from your account. Subsequently, the bank assumes responsibility for making sure the check clears.

This procedure contrasts with a personal check. With a personal check, the money only leaves your account when the recipient presents the check.

A cashier’s check usually clears one day after the recipient deposits it into a bank account. However, most bank managers will allow you to draw money beforehand. They let you do this because they are sure the check will clear.

A cashier’s check is not certified check

A certified check is a personal check. We say ‘certified’ because the bank confirms the signature is the account holder’s. Additionally, the bank confirms that the account has enough money in it for the check to clear.

People trust money orders more than personal checks. However, in the US, people do not recognize them as ‘guaranteed funds.’ In the US, there is a $1,000 limit on money orders (postal money orders).

Most American insurance and brokerage firms will not accept money orders as payment for deposits into brokerage accounts or insurance premiums. They will not accept them because of the regulatory requirements with the Patriot Act and the Bank Secrecy Act.

Bank draft – certified & cashier’s check

A certified check, cashier’s check, and bank draft are all different kinds of bank checks. They are all safer than personal checks. However, they are not the same.

Cashier’s check

The bank signs and guarantees this check. In other words, the funds come from the financial institution and not a personal bank account. It is the most secure of these three options.

Certified Check

This is a personal check which the bank certifies. The customer signs it, and the bank certifies that there are enough funds for the check to clear. The bank also confirms that the signature is genuine.

Bank Draft

A bank draft is very similar to a certified check. However, in this case, the bank sets aside the funds until the receiver uses the document.

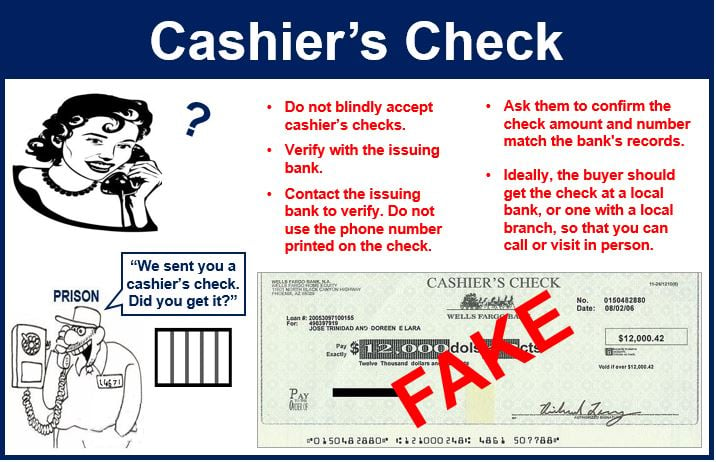

Beware of scams

Counterfeit cashier’s checks are becoming more common in Internet transactions. The seller receives the fake cashier’s check, which the bank does not automatically detect as being counterfeit. In fact, the bank does not realize it is fake until ten days after the receiver has deposited it.

The bank will credit the customer’s account the next day. However, it will subsequently withdraw the funds when it discovers it is bogus.

eBay says you should ask the bank teller to call in the routing numbers on the cashier’s check. According to eBay, asking the bank teller:

“[Calling in the routing numbers] is fast and easy, there is a national registry of bank phone numbers. If you just deposit the check, the bank will not question its validity, and it will take days or weeks to discover it was phony. You will be responsible for all the bank charges incurred, and overdrafts if you started spending it.”

According to the Merriam-Webster Dictionary, a cashier’s check is:

“A check that is written by a bank and signed by a cashier,” or “A check drawn by a bank on its own funds and signed by the cashier.”