What is a Real Estate Investment Trust (REIT)?

A real estate investment trust (REIT) is a company that owns and typically operates a portfolio of real estate properties and mortgages.

REITs allow investors to earn a share of the income that is generated through the ownership of commercial real estate – without the need to actually buy any commercial real estate.

The Nasdaq Business Glossary defines REITs as follows:

“REITs invest in real estate or loans secured by real estate and issue shares in such investments. A REIT is similar to a closed-end mutual fund.”

REITs have been around for more than half a century.

REITs have been around for more than half a century.

A main advantage of investing in a REIT, as opposed to actually buying real estate property, is that a REIT provides much more liquidity and diversity – shares invested in a REIT can quickly and easily be sold.

REITs can own a variety of different types of estate, ranging from commercial real estate to apartment buildings, hospitals, shopping centers, and hotels. There are retail REITs, industrial REITs, residential REITs, healthcare REITs, office REITs, and more.

The structure of a REIT is similar to that of a mutual fund. They can be either public or private companies – often listed on public stock exchanges.

Investors can invest in REITs by purchasing their shares or by investing in a mutual fund that focuses in real estate. One advantage of investing in a REIT is that the majority of them provide dividend reinvestment plans (DRIPs).

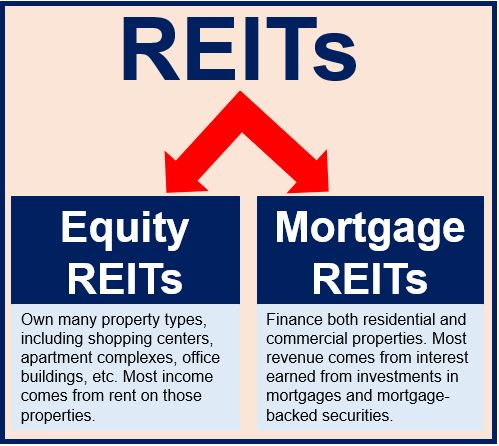

There are three main types of REITs:

Equity REITs: own and operate real estate that generates income for the company.

Mortgage REITs: provide mortgages or loans to real estate owners through the acquisition of mortgage-backed securities. This type of real estate investment trust uses a lot of borrowed capital (leverage) compared to equity REITs – hence it is a riskier investment choice.

Hybrid REITs: these use the investment strategies of both equity REITs and Mortgage REITs.

According to the U.S. Securities and Exchange Commission (SEC), a REIT must:

- Be an entity that would be taxable as a corporation but for its REIT status;

- Be managed by a board of directors or trustees;

- Have fully-transferable shares;

- Have at least 100 shareholders after its first year as a REIT;

- Have a maximum of 50% of its shares held by up to five individuals during the last half of the taxable year;

- Invest 75% of more of total assets in real estate assets and cash;

- Derive 75% or more of its gross income from real estate related sources, including rents from real property and interest on mortgages financing real property;

- Derive 95% or more of its gross income from such real estate sources and dividends or interest from any source; and

- Have no more than 25 percent of its assets consist of non-qualifying securities or stock in taxable REIT subsidiaries.

REITs were first created in the United States in 1960 following the REIT Act title, which was signed by the President Dwight D. Eisenhower. Congress approved the creation of REITs to allow people or institutions to invest in large diversified portfolios of income-producing real estate.

Video – What Real Estate?

This video, from our sister channel on YouTube – Marketing Business Network, explains what a ‘Real Estate’ is using simple and easy-to-understand language and examples.