What is speculation? Definition and meaning

Speculation is an investment approach in which the investor aims to buy or sell stocks, currencies, or other assets solely to make a quick profit. In such cases, the investor is known as a speculator. It is an investment attitude that many people despise. This type of investment generally has a significant risk of loss. The speculator risks losing most or all of his or her initial outlay but expects to make a substantial profit. The speculator’s motive is to take maximum advantage of market fluctuations.

Speculation is typically based on either expectation of a future event or a sense of how the whole investment market might react to such expectations.

Investors involved in speculation are common in markets where security prices fluctuate considerably.

They play a vital role in markets by absorbing surplus risk and injecting much-needed liquidity into the market by trading where other investors dare not. While often viewed with skepticism, they help provide the market with greater liquidity and price discovery, especially in times of economic uncertainty.

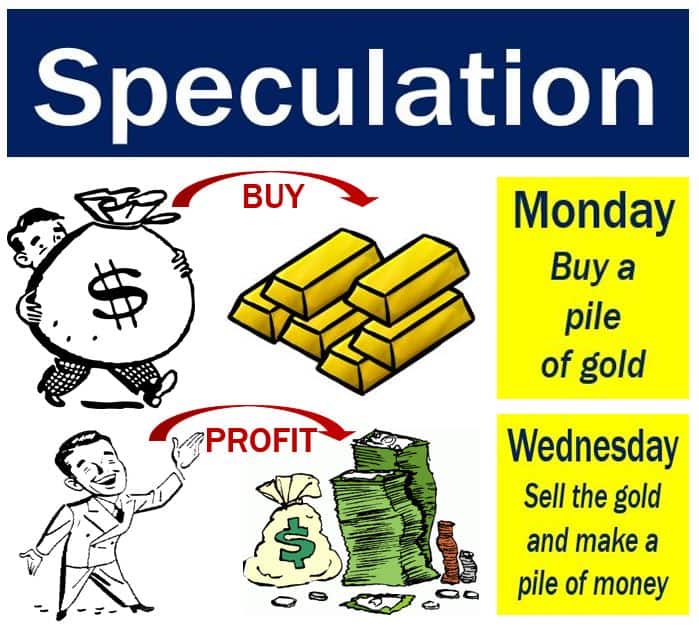

When somebody buys something for a low price and sells it at a higher price, they are speculating. If they do this rapidly, i.e., sell soon after buying, they are flipping.

Speculators and price movements

A speculator pays little attention to the fundamental value of an asset and focuses entirely on price movements.

Speculation is particularly common in markets for real estate, derivatives, collectibles, fine art, and currencies. It is also common in markets for commodity futures, bonds, and stocks.

According to ft.com/lexicon, the Financial Times’ glossary of terms, speculation is:

“A high-risk investment strategy aimed at making quick, substantial gains from the buying or selling of stocks, currencies or other assets. Speculation is often based on expectations of a future event, or a sense of how other investors might react to such expectations.”

“In the stock market, speculation can be limited to the buying or selling of large amounts of penny stocks with the hope that retail investors might follow suit. Trading on the basis of speculation is called speculative trading. Those who speculate are called speculators.”

Speculation vs. investment

Sometimes the difference between speculation and investment is hard to distinguish. How do we know whether somebody is speculating or investing?

It depends on how long they expect to hold onto the asset, the type of asset. It also depends on the amount of leverage.

An investment

If you purchased a property because you wanted to rent it out, for example, that would be an investment.

Speculation

However, what if you bought twenty condominiums with the minimal down-payment, and resold them quickly? What if you did so and made a considerable profit? That would be speculation.

Speculation

Let’s suppose you heard on the news that a major terrorist attack just occurred in a major city. You immediately bought $1 million’s worth of gold.

You then sold it for $1.3 million two days later. People would class your actions as speculative.

Speculation – economic benefits

Nicholas Kaldor (1908-1986), a Hungarian-British Cambridge economist in the post-war period, recognized the price-stabilizing role of speculators.

Kaldor said that those involved in speculation tended to even out price fluctuations due to changes in the demand-supply conditions by possessing ‘better than average foresight’.

Victor Niederhoffer, an American hedge fund manager – speculator – and statistician, described the benefits of speculation in ‘The Speculator Hero‘ as follows:

“Let’s consider some of the principles that explain the causes of shortages and surpluses and the role of speculators.”

“When a harvest is too small to satisfy consumption at its normal rate, speculators come in, hoping to profit from the scarcity by buying. Their purchases raise the price, thereby checking consumption so that the smaller supply will last longer.”

“Producers encouraged by the high price further lessen the shortage by growing or importing to reduce the shortage. On the other side, when the price is higher than the speculators think the facts warrant, they sell. This reduces prices, encouraging consumption and exports and helping to reduce the surplus.”

Adding liquidity

By risking their own capital in the hope of making a profit, speculators add liquidity to the market. Thus, they make it much easier for other investors, such as arbitrageurs and hedgers, to offset risk.

Speculation – economic bubbles

The media and lay people tend to associate speculation with economic bubbles. Economic bubbles occur when the prices of assets exceed their intrinsic value by a considerable margin.

While some economic bubbles may pop partly because of speculative activities, this is often not the case, say economists. They link cash flows and discount rates more closely to collapsing markets.

A major feature of a speculative bubble is rapid market growth, which word-of-mouth feedback loops cause. Initial rises in the prices of assets attract extra buyers who generate additional inflation.

First comes the expansion of the bubble and then a mega collapse. The same word-of-mouth feature causes the collapse. A speculative bubble is essentially a social epidemic.

John Keynes

John Maynard Keynes (1883-1946), a British economist whose ideas and writings fundamentally changed the economic policies of governments, wrote:

“Speculators may do no harm as bubbles on a steady stream of enterprise. But the situation is serious when enterprise becomes the bubble on a whirlpool of speculation.”

Keynes dabbled to a certain extent in speculation when he ran an early precursor of a hedge fund. He was the Bursar of King’s College, Cambridge University, managing two investment funds.

Not only did Keynes invest in the emerging markets, but he also speculated in foreign currencies and commodity futures. His fund averaged 13% per year growth, even during the Great Depression.

Regulatory authorities

Regulatory bodies continue to grapple with the challenges of speculation, striving to find a balance that protects the market integrity without stifling the liquidity and innovation that speculators can bring.

Derivatives of “speculate”

The noun “Speculation” is a derivative of the English root word “Speculate,” which is a verb. It comes from the Latin root “speculatus,” meaning “to observe, look at.” Let’s have a look at some derivatives of “speculate,” their meanings, and how they are used in a sentence:

-

Speculate (Verb)

To form a theory or conjecture about a subject without firm evidence.

Example: “Investors like to speculate on the stock market’s direction.”

-

Speculator (Noun)

A person who forms theories or conjectures about a subject without firm evidence, or who invests in stocks, property, or other ventures in the hope of making a profit.

Example: “The speculator bought shares in the new tech startup, hoping their value would soon skyrocket.”

-

Speculation (Noun)

The forming of a theory or conjecture without firm evidence; investment in stocks, property, etc., in the hope of gain but with the risk of loss.

Example: “There’s a lot of speculation about who the next CEO will be.”

-

Speculativeness (Noun)

The quality of being speculative, or based on conjecture rather than knowledge.

Example: “The speculativeness of his thesis was evident, as it lacked empirical data.”

-

Speculatorship (Noun)

The position or condition of being a speculator.

Example: “His speculatorship in the oil industry was marked by both dramatic losses and gains.”

-

Speculative (Adjective)

Engaged in, expressing, or based on conjecture rather than knowledge.

Example: “His claims were purely speculative and not based on any real proof.”

-

Speculatively (Adverb)

In a way that is based on conjecture rather than knowledge.

Example: “She looked speculatively at the array of desserts, trying to decide which to choose.”

Video – What is Speculation?

This video, from Marketing Business Network, our sister channel on YouTube, explains what ‘Speculation’ is using easy-to-understand language and examples.