The spot price is the price quoted for a purchase that has go ahead now – on the spot. The purchaser has to pay for it now, and the seller has to deliver it immediately. It is the current market price at which something – such as a security, commodity or currency – is purchased or sold for immediate payment and delivery.

A security, currency or commodity’s futures price, as opposed to its spot price, is its expected value at a specific time and place in the future.

The spot price is important because it is the price at which purchasers and sellers agree to value a tradable asset.

However, spot prices become a considerably more important concept when considered in the $3 trillion derivatives market.

The spot price for silver hit a peak of $47.38 per ounce in April 2011. (Image: adapted from jmbullion.com)

The spot price for silver hit a peak of $47.38 per ounce in April 2011. (Image: adapted from jmbullion.com)

Spot prices change all the time – they go up and down, depending on levels of supply and demand. To minimize the risks associated with continuously fluctuating prices, investors have created derivatives, such as futures, options and forwards, which allow purchasers and sellers to ‘fix’ (lock in) the price at which they trade an asset in the future.

According to the Economist’s glossary of terms, spot price is:

“The price quoted for a transaction that is to be made on the spot, that is, paid for now for delivery now. Contrast spot markets with forward contracts and futures markets, where payment and/or delivery will be made at some future date.”

“Also contrast with long-term contracts, in which a price is agreed for repeated transactions over an extended time period and which may not involve immediate payment in full.”

The spot market, also called the physical market or cash market, is a public financial market in which assets are purchased and sold for immediate delivery.

Spot price in a futures contract

Spot prices in the financial markets are most often referenced in relation to the price of a commodity in a futures contract – perhaps for gold, wheat, oil, etc.

Investors calculate a futures contract price by looking at a commodity’s spot price, expected supply and demand changes, the risk-free rate of return for the commodity’s holder, and its storage and transportation costs in relation to the contract’s maturity date.

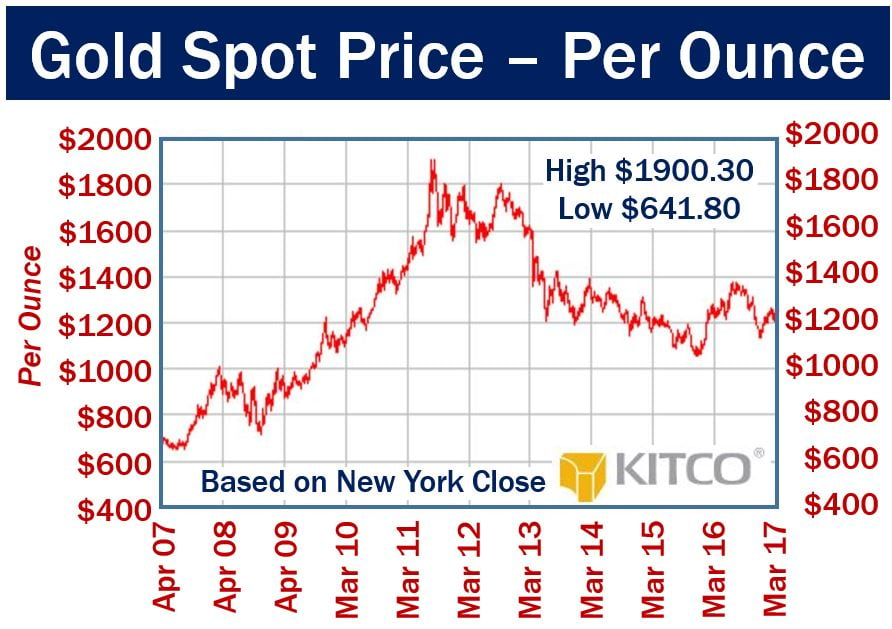

Gold’s spot price peaked at about the same time as silver did, in April 2011. (Image: Adapted from kitco.com)

Gold’s spot price peaked at about the same time as silver did, in April 2011. (Image: Adapted from kitco.com)

Spot price – example

Today, the spot price for gold is $1,250. That is the price at which one ounce of gold can be bought for now. The spot price for one metric ton of wheat today is $161.85.

The futures’ price for one ounce of gold and one metric ton of wheat – to be delivered in 3 months’ time – is $1,248.45 and $170.30 respectively.

There is virtually always a difference between the spot and futures price for any commodity, security or currency, because the market is forever trying to predict prices.

Futures prices may be either higher or lower than commodities’ spot prices – depending on the expected demand and supply for them in the future.

Video – Spot Price

This Investor Trading Academy video explains what the spot price is using easy-to-understand language and simple examples.