There are definite fears across the Eurozone when Europe’s largest economy slows down and experiences its worse economic performance since 2013. The current situation that Germany finds itself in reads simply: Exports are falling while imports are rising, but the reasons for this are removed from German control and there is no straightforward fix.

How the German economic situation reads

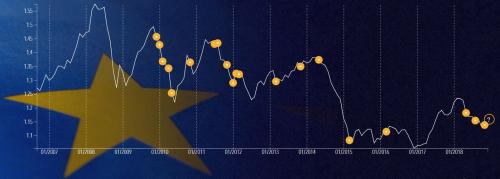

Because Germany exports far more than the next two biggest Eurozone economies of France and Italy, it is pretty susceptible to international trade disputes – notably the US/China trade war that has been escalating since the start of 2018. Since the first quarter of 2018, the EUR to USD value has fallen significantly from a high of $1.25 to $1.14 by the start of January 2019.

This fall in value of the euro has also concerned many business leaders that the Eurozone might be entering into a second debt crisis. As the biggest European economy, what happens to Germany also has a bigger impact on the euro vs dollar value. The tariffs imposed by the Trump administration and the tit for tat tariffs imposed by China on American goods have already had an effect. T and the head of the Federation of German Industries (BDI) German, Dieter Kempf has already warned of the increasing role of the Chinese state-managed economy. China has seen both technology transfer and a bigger reliance on its own internal markets. This has clearly had a contracted effect on German export market reach.

What happened to the German economy in 2013?

In 2013, the German economy shrank by 2%. It felt the full force of reduced exports, which equated to a 6% reduction. This was fuelled by a Russian economic crisis of low oil prices and Western sanctions – Russia imports about 3% of German exports. Meanwhile, China – which represented over 6% of all German exports – slowed down too, rebalancing away from investment and capital goods and started a strategy of internal consumption and technical development combined with a trend toward lower reliance on imports.

Other factors slowing the German economy

But it’s not just the role of the US and China affecting the German economy. Other factors include a disorderly Brexit process which is showing how vulnerable Germany (and the Eurozone) is to the UK’s exit from the EU.

The continuing emissions testing fiasco for the German car industry has also been a huge problem and new, more rigorous emissions testing regulations came into force in the final quarter of 2018, stifling an already badly hit car export industry with higher production costs and increased energy prices.

Any growth predicted at the start of 2018 for the German economy has been hit with the fallout from the US and China trade war (which has also affected the EUR USD forecast) and the increasingly fractious nature of the UK’s withdrawal from the EU. However, it appears that it might be China’s increasing reliance on its own internal markets, as indicated in the slowing of German exports in 2013, that might be the key instigator of the poor German economic performance. China’s increasing self-reliance looks to be gaining traction and has certainly worried German business leaders. No doubt, it will weigh heavy on German growth and economic performance in 2019.

Video – What is International Trade

International trade refers to trade between nations, i.e., countries buying and selling things from/to each other.