There are plenty of good reasons to consider a job in the financial sector. They tend to be very well paid and offer good career prospects as the sector is broad and there are many different types of positions – from investment banking, trading, to insurance. This means that there are plenty of opportunities to find a role that suits your skills, qualifications, experience, and preferences.

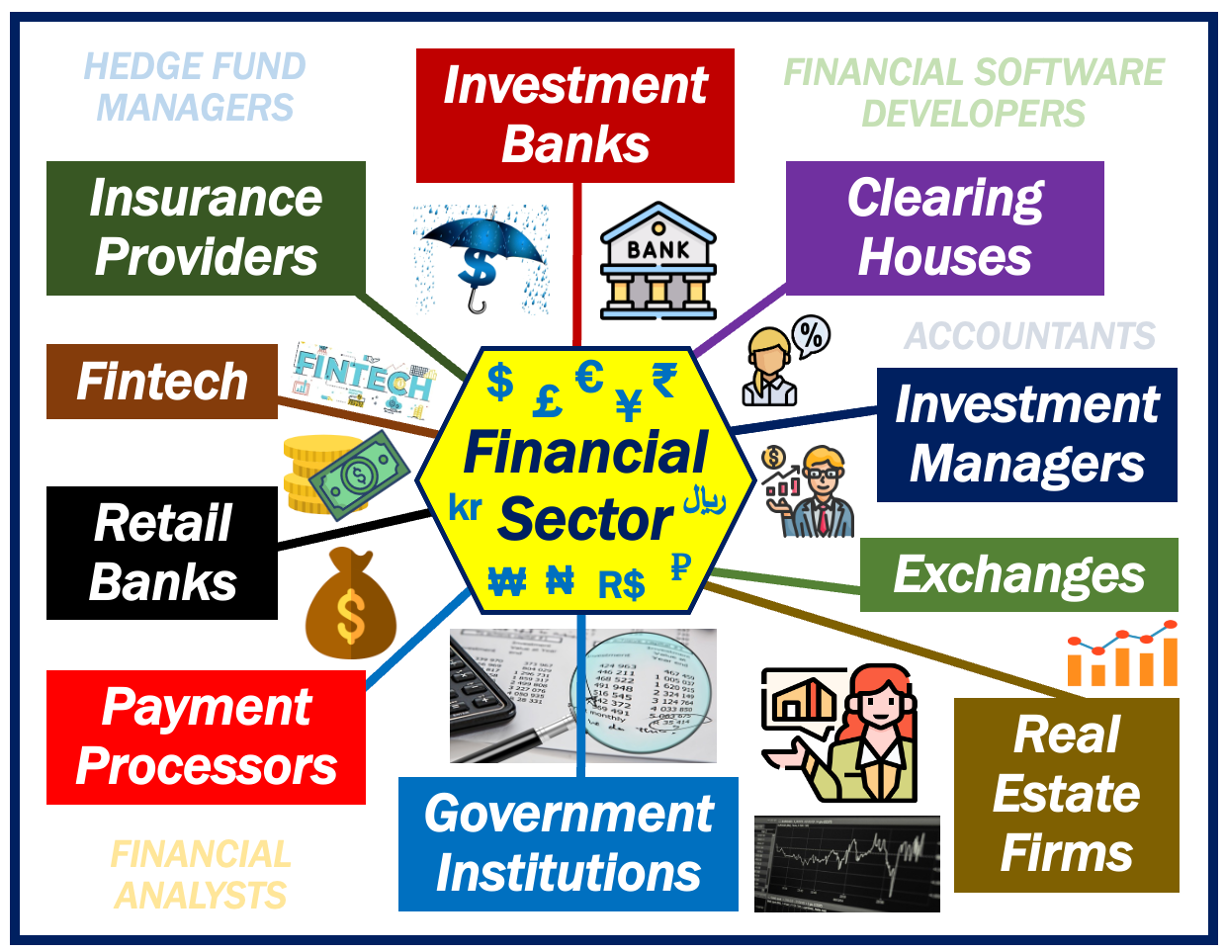

Image created by Market Business News.

The financial sector consists of companies and institutions that provide financial services to retail and corporate customers. It comprises a broad range of industries including insurers, real estate businesses, credit card issuers, payment processing operations, and investment companies. Banks, wealth management firms, and financial advisers also belong to the financial sector.

For a country’s economy to remain stable, it must have a healthy financial sector. It plays a major role in today’s advanced economies.

If you are currently interested in broadening your horizons in the financial sector, read about these high-paying positions.

1. Investment banker

The role of an investment banker is to help companies raise money by issuing and selling securities. Although most investment bankers work for banks, there are increasing numbers of independent enterprises. They assist businesses by developing fresh investment concepts, settling credit agreements, and securing favorable conditions for their goods.

Investment bankers typically have a four-year degree in business or economics. Many investment bankers start their careers as analysts and then move up to associate positions. The most successful investment bankers eventually become partners in their firms.

Average salary: The average salary of an investment banker is $66,784 per year.

2. Hedge fund manager

The role of a hedge fund manager is to protect and grow the assets of their clients. They do this by investing in a variety of assets and strategies, and by hedging against risks.

Hedge fund managers have a deep understanding of the financial markets and an intimate knowledge of the companies and industries in which they invest. They use this knowledge to identify opportunities and make investment decisions that generate returns for their clients.

Hedge fund managers are paid a percentage of the assets they manage. This fee structure provides them with an incentive to grow the assets under their management.

The role of a hedge fund manager is to generate returns for their clients by investing in a variety of assets and strategies. They do this by identifying opportunities and making investment decisions that protect and grow their clients’ assets.

Average salary: The average salary of a hedge fund manager is $83,578 per year.

3. Senior accountant

As a senior accountant, your role is to manage the financial affairs of your company. This includes preparing financial statements, managing budgets, and overseeing auditing and tax compliance.

You will also be responsible for ensuring that financial records are accurate and up to date. In addition, you may be involved in providing advice on financial planning and investment decisions.

Average salary: The average salary of a senior accountant is $73,547 per year.

4. Financial analyst

A financial analyst is someone who provides guidance to businesses and individuals making investment decisions. They use their knowledge of financial markets to analyze past trends and predict future market movements. Financial analysts typically choose finance, economics, or business as majors during their graduation.

The role of a financial analyst is to provide accurate and timely information that will help their clients make informed investment decisions. Financial analysts must be able to understand and interpret complex financial data. They use their skills to identify trends, assess risk, and make recommendations.

Financial analysts play an important role in the financial world. They provide valuable insights that help businesses and individuals make informed investment decisions. If you’re interested in a career in finance, consider becoming a financial analyst.

Average salary: The average salary of a financial analyst is $70,677 per year.

5. Financial software developer

As a financial software developer, you play a crucial role in the development and maintenance of financial software applications. You are responsible for developing and testing code, working with financial data, and ensuring the applications you develop are stable and meet the needs of users.

Your work is essential in helping businesses and individuals make sound financial decisions. With the right software in place, businesses can track their income and expenses, understand their financial position, and make informed decisions about where to allocate their resources. Individuals can use financial software to budget and track their spending, plan for major purchases, and save for retirement.

Given the importance of your work, it is essential that you have a strong understanding of financial concepts and principles. You must be able to work with large amounts of data and be able to spot trends and patterns. You must also be able to develop code that is efficient and reliable.

If you are interested in a career as a financial software developer, you should have a strong background in computer science and experience with developing software applications. You should also be able to demonstrate your analytical and problem-solving skills.

Average salary: The average salary of a financial software developer is $93,817 per year.

Conclusion

The financial sector is one of the most stable and secure industries. There is always a need for financial services, no matter the state of the economy. This stability means that jobs are less likely to be outsourced or automated.

In addition, these positions tend to require a high level of education and skills. Workers must be able to understand and use complex financial instruments and data. You must have excellent analytical and mathematical skills. Top professionals who work in the financial sector are among the highest-paid people in the marketplace.

When preparing your resume or CV (curriculum vitae) and talking to a job interviewer, you will most likely be asked whether you understand the financial sector and why you want to work in it. Make sure you know how to answer those two questions.

Interesting related article: