The world’s biggest interdealer broker ICAP plc posted a -9% decline in revenue on a constant currency basis for the first half of the fiscal year, which fell short of analysts’ expectations. Trading on its alternative currency platform EBS Direct hit a record.

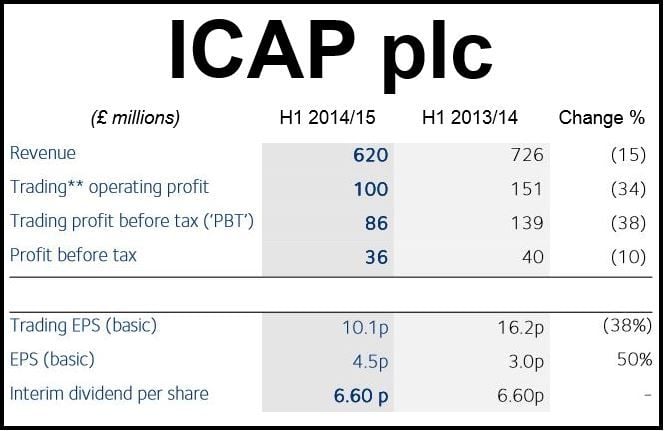

After factoring in currency fluctuations, revenue fell -15% to £620 million compared to £726 million in the first half of last year.

The London-based company’s global broking unit saw revenue decline by -15%. Its post-trade and electronic markets divisions posted a -5% fall and +12% increase respectively.

The electronic dealer broker and provider of post trade risk services announced a -38% decline in pre-tax profit to £86 million.

Since the global financial crisis, new rules have been introduced which have led to banks pulling back from risky trading activities, resulting in revenues for interdealer brokers plunging worldwide.

Years of record-low interest rates have added to their problems, as has market volatility.

Source: ICAP plc.

Michael Spencer, Group Chief Executive Officer, said:

“Our first half results reflect a market environment that has remained relatively fragile; despite this, we are cautiously optimistic that we have started to see some welcome signs of activity and more positive sentiment returning in recent weeks.”

“Having experienced multi-year lows over the past year, FX volatility recovered in September and continued into October with EBS recording its highest trading day in three years on 31 October with traded spot volume of $250 billion. Meanwhile, in October BrokerTec had record single day US Treasury volumes of $471 billion.”

Mr. Spencer added that the company is already seeing some of the benefits of its restructuring program, with the bulk of the savings not becoming evident until the second half of the year.

ICAP has been shifting its focus towards electronic trading and post-trade services, which currently represent 83% of its operating profit, compared to 70% last year.

Its restructuring program should deliver annual savings of £60 million, Mr. Spencer said.

ICAP Shipping is in merger talks with Howe Robinson. The company expects a newly-formed ship-broking company to emerge in Q2 2015.