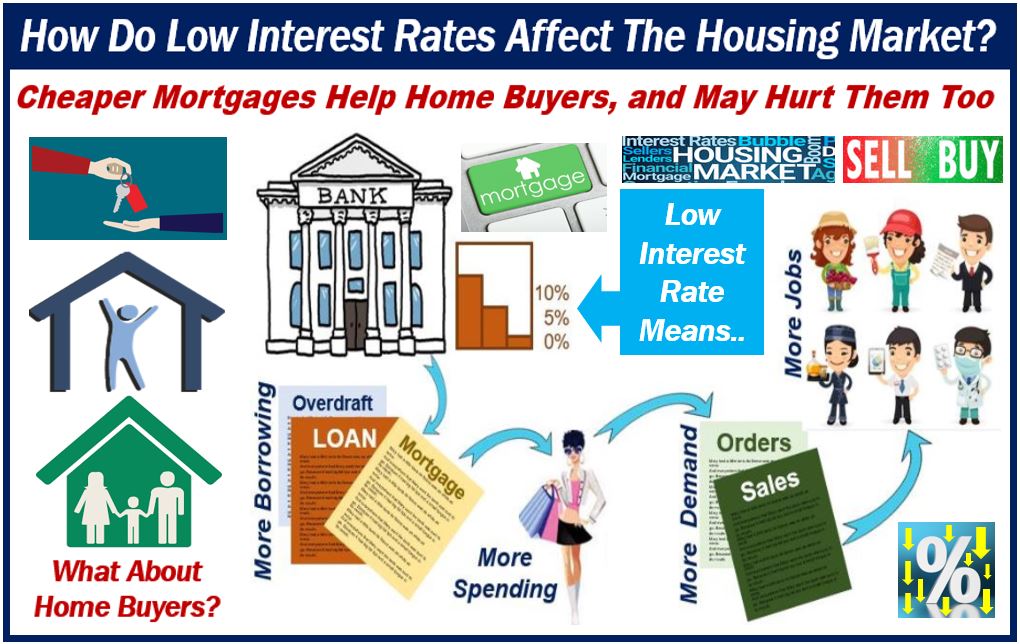

Mortgage rates have a direct impact on the housing market, but what’s not so obvious is exactly how mortgage rates can help or hurt the market. Whether you’re a first time home buyer, or looking to start a real estate business, you might be wondering if low mortgage rates are beneficial in the long run.

Image created by Market Business News.

In this article we’re going to explain how low mortgage rates positively and negatively impact the housing markets, so you can approach the market with a firmer grasp on what lower mortgage rates mean for you, and the market in general.

How mortgage rates are determined

It’s a popular myth that mortgage rates are based on the 10-year Treasury note, but in fact, mortgage rates are based on the bond market. More specifically, mortgage bonds and mortgage-backed securities.

Mortgage-backed securities are really mortgage loans that are packed and bundled together, and then sold in the bond market, as famously explained in the film The Big Short, which chronicled the 2008 mortgage crisis.

The U.S. Federal Reserve does not directly set mortgage rates, but the Fed’s financial policies do have a significant impact on mortgage rates. So when the Federal Reserve sets the federal fund rate, it impacts short-term and variable interest rates.

When the Fed’s interest rates are higher, it becomes more expensive for banks to borrow from other banks, and those extra costs can be passed onto the consumer in the form of higher interest rates on credit, loans, and mortgages.

How buyers benefit from lower mortgage rates

Lower mortgage payments

When mortgage rates are low, consumers will typically enjoy lower monthly payments due to lower interest rates. For example, if you have a $300,000 mortgage loan at an interest rate of 2.50%, you would make monthly payments around $1,215.

If that interest rate was bumped up to 5%, your monthly payments would be $1,556.

By comparing current mortgage rates, you can get a more concrete estimate on what your monthly mortgage payments would be based on current mortgage rates, your down payment, property value, and other little factors.

Money saved in interest costs

Because lower mortgage rates means lower interest rates, you will save a lot of money in interest over time. For example, if you have a 30-year loan term at 2.50% interest rate compared to 5%, then you will obviously pay a bit less in interest over the course of that loan term.

You can afford a bigger house

With lower mortgage rates, you have a bit more purchasing power, and you get more for your money. For example, at current mortgage rates, $1,200 a month could get you approved for a mortgage loan of around $290,000. In 2018, $1,200 per month would’ve gotten you approved for around $235,000.

That $55,000 difference could mean bigger bedrooms, extra bathrooms, or just the satisfaction of knowing you saved $55,000.

How lower mortgage rates can hurt home buyers

With lower mortgage rates, there will be a lot more competition in the housing market. For example, lower mortgage rates can actually lead to higher bidding wars, which can end up increasing home prices.

Lowered mobility to sell

Even if you purchase a home in a low-rate environment, you’ll feel the impact of climbing rates if ever you decide to sell and move residences.

This is because home prices will go up, which leads to higher monthly payments. So selling a house you purchased in a low-rate environment, and then trying to buy a new house in a higher-rate environment, won’t actually net you much of a gain at all.

House inventory is being swept up

The rise in popularity of vacation rentals, like found on Airbnb, has had a detrimental effect on the housing market. In the current low-rate environment, investors are quickly purchasing up single-family homes and turning them into rental properties.

This incentive to purchase homes and rent them out at vacation-prices has had a negative impact on the overall availability in the housing market, as bank-backed investors are turning entire housing subdivisions into rental communities.