Running a successful business often involves adapting to a range of changes, from business growth to unexpected industry shifts.

One way you may need to adapt includes ensuring the various tools and resources you use are sufficient to meet your current needs. You should periodically “audit” your tools to confirm they’re still serving their purposes effectively.

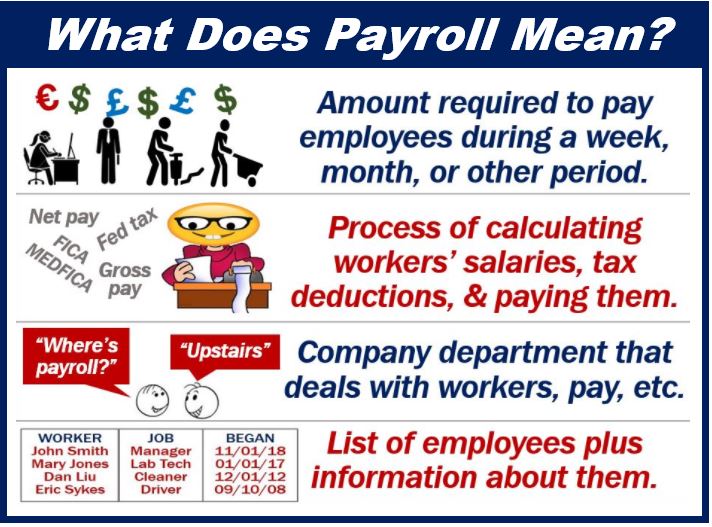

For example, perhaps your current payroll system needs to be upgraded. The following are some warning signs that’s the case. Keep them in mind when reviewing your system. Making improvements by upgrading to a new payroll software solution could be very beneficial in the long run.

You can’t easily find essential records

There are many reasons business owners often have to pull up payroll records. For example, last year, you may have applied for a Paycheck Protection Program loan. These loans were offered to small businesses to ensure they could continue paying employees during the COVID-19 pandemic.

Business owners who used the loans according to certain stipulations may now apply for loan forgiveness. However, in order to qualify, you must be able to prove you used the funds as they were intended. That is, you must show you used a certain percentage of them on payroll expenses.

This requires providing records showing this to be the case. If you want to apply for loan forgiveness, but you’ve had trouble easily and quickly bringing up the records you need, it may be time to switch to a new payroll system that offers more intuitive and accurate reporting features.

Expense management is a headache

When your business was first growing, and you only had a small handful of employees, you may not have had much need for an expense management system. You might have been the one primarily making business purchases.

That may no longer be the case. If your business has reached a certain stage of growth, your employees may now expense client meals, equipment purchases, travel and lodging costs, and more.

Without the right tools, reimbursing them can be a frustrating experience. You want to ensure your payroll system’s expense management features allow you to both automate and track this process as efficiently as possible.

Wage garnishment is also frustrating

While this will hopefully never happen, it’s possible you may one day be required to set aside a portion of an employee’s wages if they are being garnished. Although the employee is technically the one in legal trouble here, you could also find yourself in legal hot water if you fail to garnish their wages appropriately. You’re still the one responsible for ensuring the proper amount is deducted from their paycheck until the debt is entirely paid.

This is another task that may be extremely time-consuming and complicated if your payroll solution doesn’t include wage garnishment management features. Be aware, even if this isn’t a situation you’re currently facing, there are many reasons an employee’s wages may be garnished in the future. Prepare accordingly by choosing a payroll system with the necessary capabilities.

It’s also worth noting that this is merely a general list of warning signs. You have to consider the nature of your business to determine other reasons it might be smart to switch to a new payroll software. Because payroll is such a critical element of virtually every single business with paid employees, the time and money you spend making the switch will pay off in the immediate future.

Interesting related article: “What does Expense mean?“