The Bank of England says that households in the UK should be able to cope with a hike in interest rates.

A survey of over 6,000 households found that the majority were “in a slightly better position to cope with an increase in interest rates than they were a year ago.”

Households across the UK have been able to cut down on debts because of historically low rates – since 2009 the BoE has kept rates at 0.5 percent.

The BoE said in its latest quarterly bulletin: ”Households appear a little better placed to cope with a rise in interest rates than a year ago and survey responses do not imply that a rise in rates would have an unusually large impact on spending,”

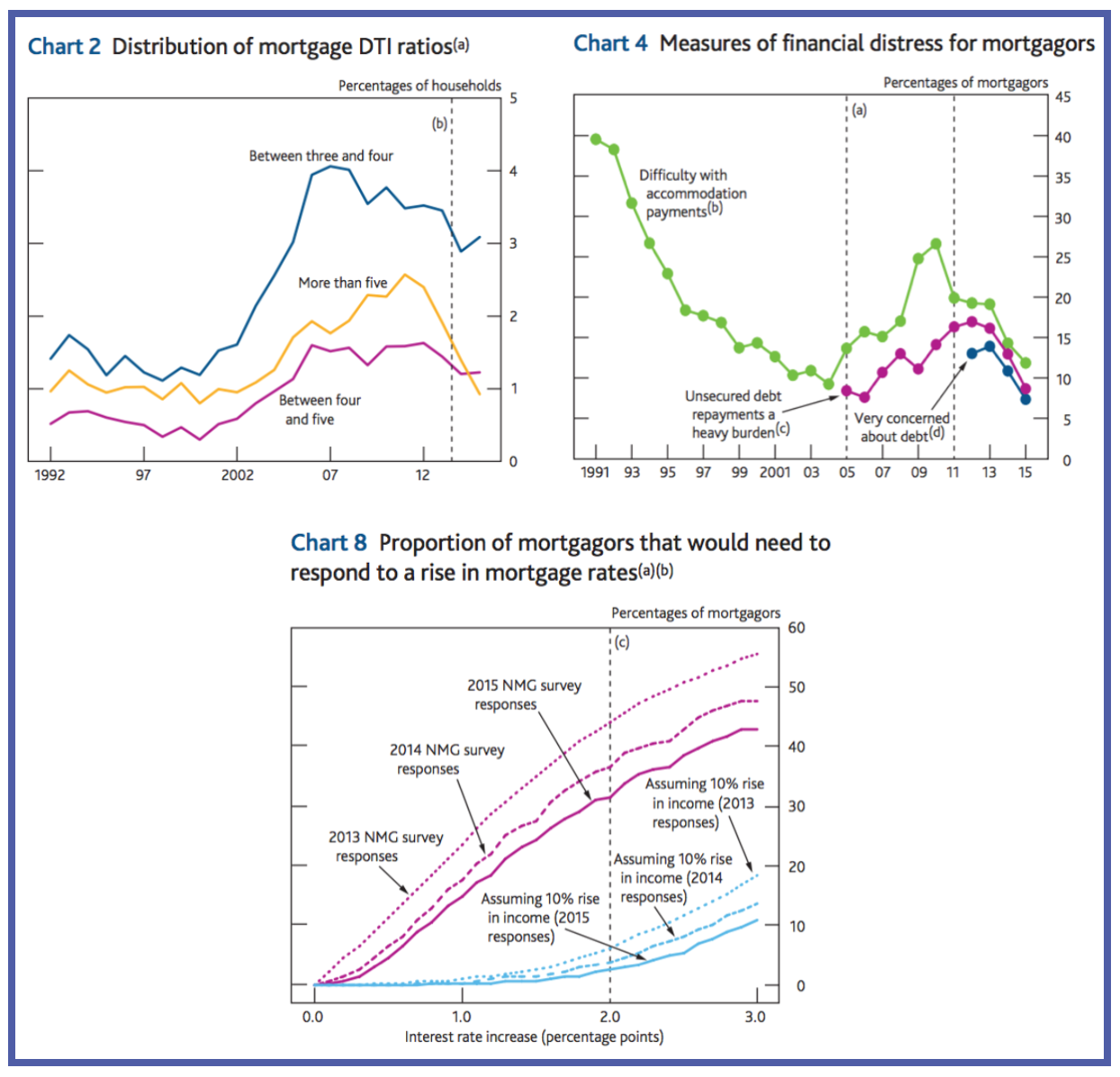

There were fewer mortgagors who reported concerns about their debt or problems paying for their accommodation as well.

Source: Bank of England, “The potential impact of higher interest rates and further fiscal consolidation on

households: evidence from the 2015 NMG Consulting survey”

The results found that if rates increased by 2 percent overnight, with no change in household incomes, “an estimated 31 per cent of mortgagors would need to take some kind of action… down from 37 per cent in 2014 and 44 per cent in 2013.”

It should be noted that there are some households who may be vulnerable to higher interest rates and who expect to be more heavily affected than average by further fiscal consolidation, although the BoE says that group is relatively small.

Two indicators used to assess the sustainability of household balance sheet positions are the debt to income (DTI) ratio and debt-servicing ratio (DSR), which is the proportion of income spent on debt repayments (including both capital and interest payments). A higher DTI and DSR ratio is associated with higher risk of financial distress – especially if incomes were to fall or repayment costs rise.

According to the central bank: “The share of households with a very high mortgage DTI ratio (above five) has fallen back since 2012. That share is now back to levels seen in the 1990s. The proportion of households with a moderately high mortgage DTI ratio (between three and five) has been more stable recently, and is now at similar levels to those seen in the mid-2000s.”

Economists do not expect the base rate to increase to over 2 percent until at least the next decade.