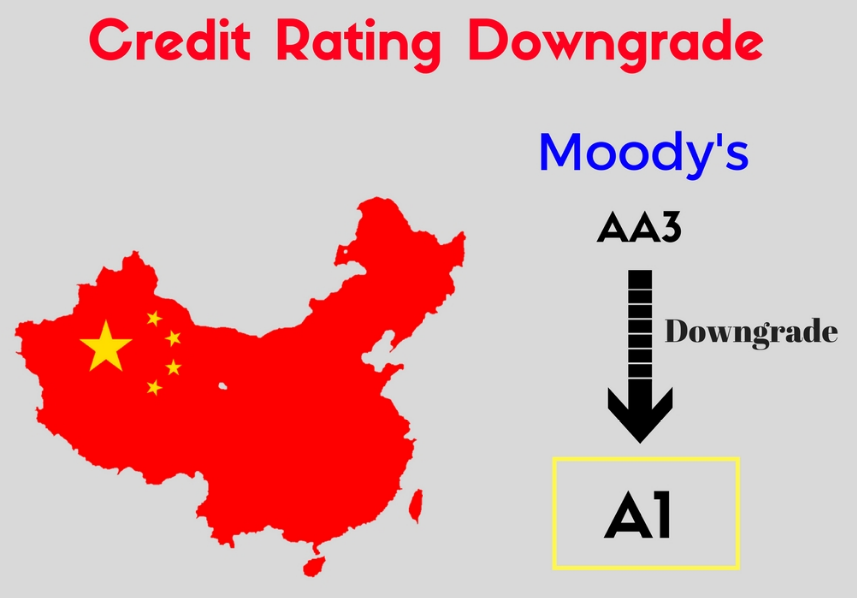

China’s credit rating has been downgraded by Moody’s Investors Service for the first time since November 1989, from Aa3 to A1.

“The downgrade reflects Moody’s expectation that China’s financial strength will erode somewhat over the coming years, with economy-wide debt continuing to rise as potential growth slows,” the ratings agency said in a statement.

Chinese economic growth has slowed significantly over the past years, from double digit GDP growth of 10.6% in 2010 to 6.7% in 2016 – the weakest level of growth since 1990. Moody’s expects growth to decelerate further over the next five years to close to 5%.

The credit rating agency provided three reasons for its GDP outlook:

- A slowdown in capital stock formation as investment accounts for a diminishing share of total expenditure.

- An accelerating fall in the working age population that started in 2014.

- No reversal in the productivity slowdown that has occured over the last few years, despite increased investment in creating a more skilled workforce.

In 2013, Fitch Ratings downgraded China’s debt to A+ (equivalent to Moody’s current rating), while the S&P gives China a slightly higher rating of AA-.

China’s total debt reached 253% of its GDP in 2016, up from 213% in 2013 and 149% in 2008, according to JP Morgan.

The government’s direct debt burden, which is currently at a modest level of less than 40% of GDP, is expected to rise gradually towards 40% of GDP by 2018 and closer to 45% by the end of the decade, in line with the 2016 debt burden for the median of A-rated sovereigns (40.7%).

However, it’s not government debt that’s concerning economists, but rather the amount of debt level of China’s “state-owned enterprises” (SOEs) and debt carried by the country’s local governments. SOE debt in China currently stands at a rate of 115% of GDP.

Moody’s said, “we forecast that economy-wide debt of the government, households and non-financial corporates will continue to rise,”

“Taken together, we expect direct government, indirect and economy-wide debt to continue to rise, signalling an erosion of China’s credit profile which is best reflected now in an A1 rating.”

China’s Finance Ministry responded to the downgrade, stating that Moody’s outlook is based on “inappropriate methodology”.

“Moody’s views that China’s non-financial debt will rise rapidly and the government would continue to maintain growth via stimulus measures are exaggerating difficulties facing the Chinese economy, and underestimating the Chinese government’s ability to deepen supply-side structural reform and appropriately expand aggregate demand,” the ministry said in a statement.

The downgrade will have an impact on the cost of borrowing for China’s government and its SOEs.

Zhu Chaoping, a China economist at UOB Kay Hian Holdings, told Fox Business that the downgrade will likely influence the Chinese exchange rate and weaken the ability for companies in the region to take out more debt or repay existing loans.