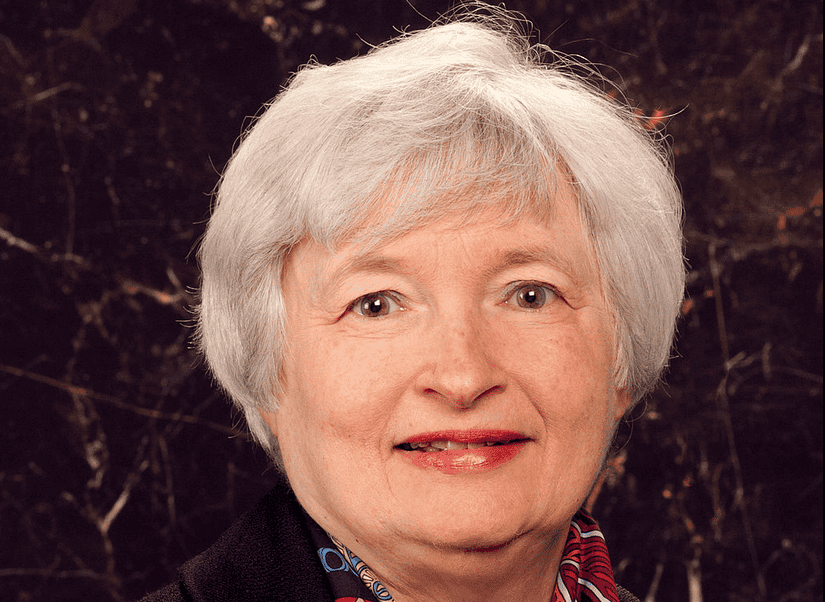

Janet Yellen said that she expects the Federal Reserve to begin raising the key interest rate at some point later this year.

On Friday the Fed Chair told a business group in Rhode Island that she expects the US economy to continue improving, adding that at some point record-low interest rates won’t be necessary.

It’s been six years now since the Federal Reserve cut rates to nearly zero in an effort to boost the economy out of a severe recession.

With the jobless rate falling and steady economic growth the stimulus will no longer be needed, and the Fed can hike rates back up to historic averages.

Janet Yellen said that with the US economy on track, she expects the Fed to begin increasing the key interest rate later this year.

The danger of keeping rates at nearly zero for too long is that it could “overheat” the economy with inflation.

However, the decision on when to hike rates still depends on further economic data.

Once rates do go up they will rise “gradually”, said Yellen.

Consumer prices rise slightly in April

U.S. consumer prices increased for the third straight month in April.

The Labor Department said on Friday that the consumer-price index, a key measure of inflation, rose a seasonally adjusted 0.1% in April from a month earlier.

Low energy costs were offset by more expensive shelter and medical care.

Core prices, excluding volatile food and energy categories, rose 0.3% – the largest increase in two years.

On a year-over-year basis, overall prices dropped 0.2% and core prices rose 1.8%.

Stephen Stanley, chief economist at Amherst Pierpont Securities, told The Wall Street Journal:

“Where does this data leave the Fed? Certainly another step closer to liftoff,”