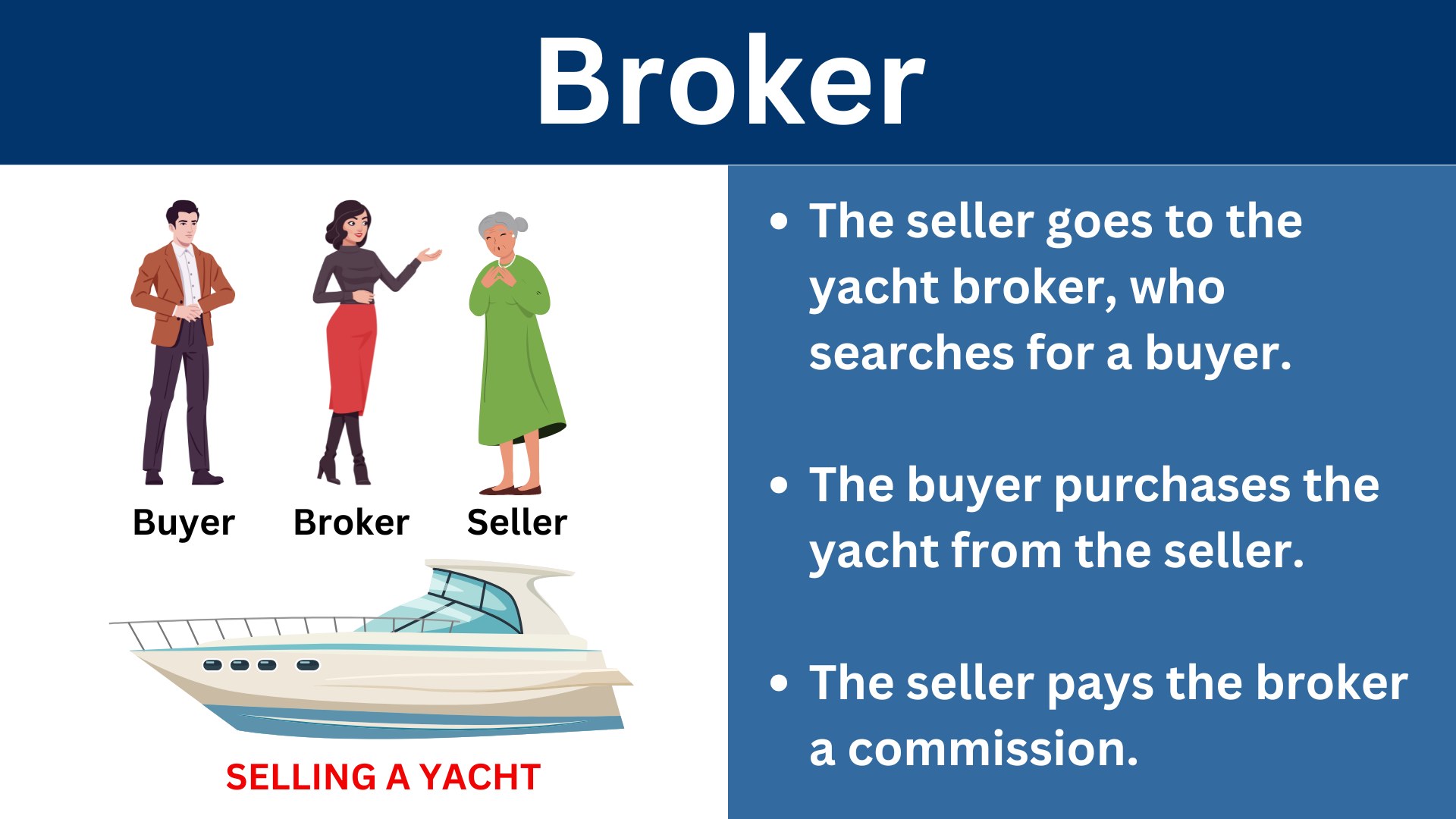

A Broker is a person who buys and sells things on behalf of other people. A broker may also arrange transactions between a purchaser and a vendor. After the parties have completed the deal, one of them pays the broker a commission

When brokers also act as purchasers or sellers, they become the principal party to the deal.

A broker may be a firm. The firm acts as an agent for a customer, who pays it a commission for its services.

Their adaptability to different market conditions and client needs makes them an indispensable part of the global economy.

A widow needed to sell her late husband’s yacht. She contacted a yacht broker, who found a buyer and made sure the transaction went through smoothly. The broker subsequently received a fee – a percentage of the final sale price – for her services.

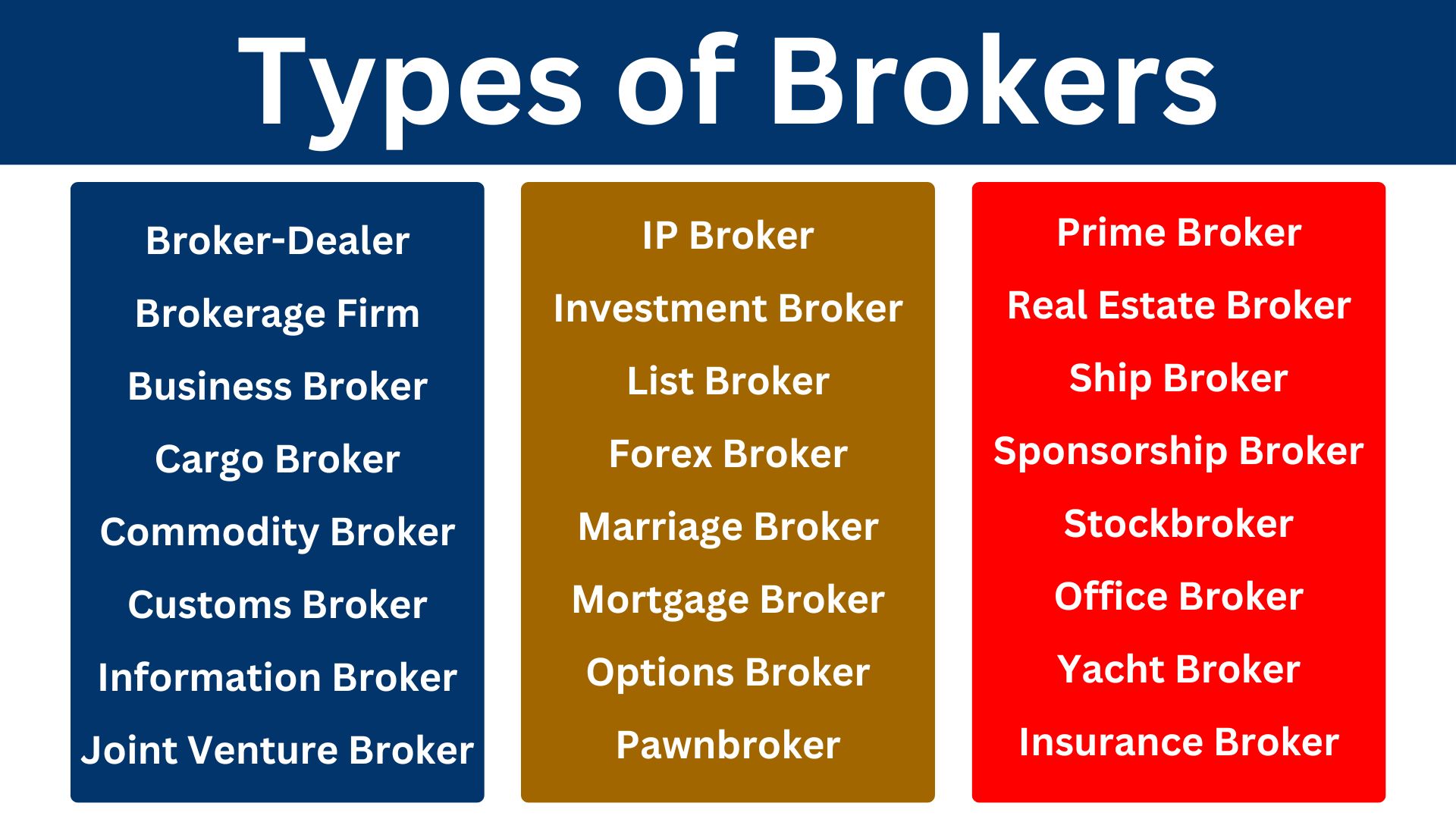

Brokers exist in many industries

Brokers are common in many industries. In most cases, they typically represent the seller. For example, licensed real estate brokers may advertise properties for sale and show them to prospective purchasers. They also determine the properties’ market value and advise their clients regarding offers and other related matters.

Although most brokers work on behalf of sellers, some of them represent the buyer. However, they can never represent both the buyer and seller at the same time. If they did, there would be a conflict of interest.

Brokers are common in the financial world. For example, in finance, they work on behalf of clients trading bonds, stocks, and other financial products.

Brokers not just for rich clients

In the past, only wealthy people used a broker for stock market trading. However, the Internet has changed all that. Today there are thousands of online discount brokers. Online brokers allow investors to trade at considerably lower costs compared to their pre-Internet counterparts.

Online brokers, unlike face-to-face ones, do not provide personalized advice. Even brokers that people telephone offer advice more specific to the needs of the client than those online.

In some sectors, such as the stock market or real estate, a broker must have a license. To get a license, you must pass several exams. In others sectors, however, there are no requirements.

In fact, virtually every citizen in the advanced economies can afford to invest in the stock market today. This is thanks to the Internet.

Why use a broker?

The main advantage in using brokers is that they know their market well. In other words, they are experts. Brokers also have relationships with prospective accounts. They know who to talk to, what to do, and above all, how to do it well.

A broker also has the resources and tools to reach the widest possible base of buyers. They screen these potential purchasers for revenue that would support the potential acquisition.

Before deciding whether to hire a broker, you should do some research. You should check what the requirements are in your country or market for somebody to use the title. In real estate, for example, there are strict requirements in most regions of the world for using the term ‘broker.’

In other industries, however, such as selling aircraft, people use the title much more loosely.

A commercial finance broker

According to the NACFB, a commercial finance broker is somebody who channels funds from lenders to commercial businesses. Put simply; they find lenders for companies. NACFB stands for the National Association of Commercial Finance Brokers.

A competent commercial finance broker will know the details of several alternative lenders. Their knowledge is not limited to just the well-known ones. Furthermore, they know what types of enterprises each lender focuses on.

This type of broker works on behalf of companies that are looking to borrow money. They want to borrow money from specialized lenders. Through their knowledge and expertize, the broker will match a borrower’s requirements with the most suitable lender operating in the market.

Some types of brokers

Business brokers

Business brokers help buyers and sellers of private companies in the trading process. We also call them intermediaries or business transfer brokers.

They help buyers and sellers of private companies in the buying and selling process.

Cargo brokers

Cargo brokers, shipping agents, or port agents are responsible for handling shipments and cargo. They work on behalf of their clients at ports and harbors.

Not only do these professionals work domestically but they also work internationally.

Commodity brokers

Commodity brokers execute orders to buy-sell commodity contracts on behalf of clients. In other words, if you tell the broker to buy, they will buy on your behalf. They do what you tell them to do.

Information brokers

Information brokers or data brokers gather information. For example, they may have extensive information about individual people. They then sell this data to companies. Companies subsequently use the information to target advertising and marketing towards specific groups.

Insurance brokers

Insurance brokers or insurance agents sell, solicit, or negotiate insurance for compensation.

Intellectual property brokers

Intellectual property brokers mediate between buyers and sellers of intellectual property. They may also manage the many steps in the intellectual property process.

For example, they may managethe purchase, license, sale, or marketing of intellectual property assets such as trademarks, patents, or inventions.

Intellectual property refers to patents, inventions, trademarks, slogans, etc. Put simply; they are things that the human mind creates. Examples include designs, symbols, images, names, and literary and artistic works.

Investment brokers

Investment brokers bring together purchasers and sellers of investments. In most countries, they need to have a license to act on behalf of buyers-sellers of stock.

Mortgage brokers

Mortgage brokers act as intermediaries. They broker mortgage loans on behalf of people or businesses.

Pawnbrokers

Pawnbrokers offer loans to people who offer items of personal property as collateral. They typically accept jewelry, computers, video game systems, and other possessions as collateral.

In fact, most of them will also buy something from you if you do not want to borrow money.

Ship brokers

Ship brokers are specialist intermediaries or negotiators between shipowners and charterers who use ships to transport cargo. They also facilitate business between buyers and sellers of vessels.

Stockbrokers

Stockbrokers are regulated professionals, usually working with a broker-dealer or brokerage firm. These dealers and firms buy and sell stocks and other financial securities.

They represent both retail and institutional clients either through a stock exchange or over the counter.

In the USA, to be a stockbroker you must have a license. To get a license, you need to pass several demanding exams. You may have to pass Series 7 and either the Series 66 or Series 63 exams.

Additionally, maintaining this licensure requires ongoing professional education to ensure brokers stay abreast of evolving regulations and market conditions.