Defensive shares, defensive stocks, or non-cyclical stocks are the shares of companies with stable profits. In other words, the country’s overall economic performance does not affect their profits as much as in other companies.

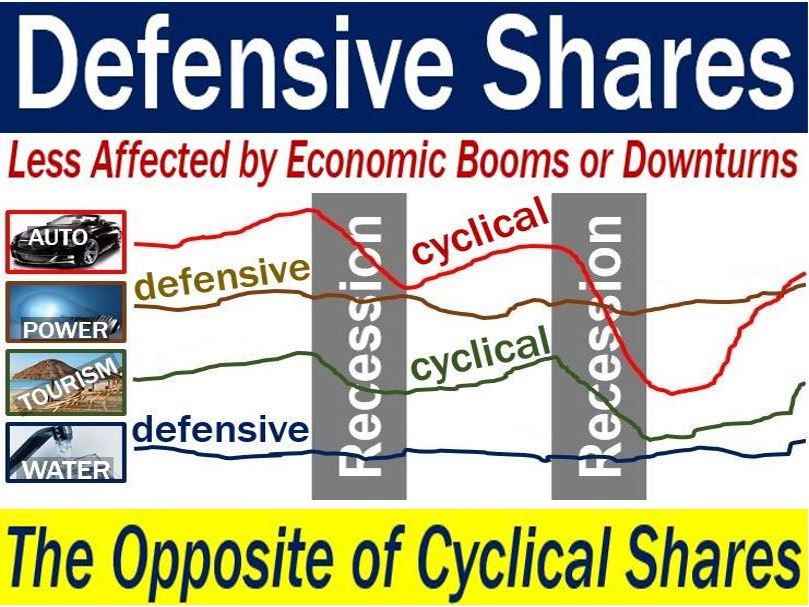

Defensive shares are the opposite of cyclical shares. Cyclical shares go up and down according to how well or badly the economy is doing.

A nation’s economic cycle affects the shares of utility companies less than, for example, automobile manufacturers. Utility companies sell electricity, butane gas, and water.

Car companies thrive during an economic boom and suffer during recessions. However, we all continue purchasing electricity, butane gas, and water regardless of how well or badly the economy is doing.

Utility sales fluctuate less because we all need what they sell. In fact, we need utilities all the time. That is why utility companies have defensive shares.

Defensive shares are more stable than cyclical shares. During a recession, they perform better than the market. However, they perform worse than the market when the economy is expanding.

Investors will increase their portfolios’ proportion of defensive stocks if they believe the economy is about to slow down. Conversely, when they foresee a rise in economic activity, they will slant towards cyclical stocks.

Defensive shares – examples

Healthcare

Demand for medications is constant; it does not rise during an economic boom or decline in a recession. Companies that make medications have defensive shares.

The shares of manufacturers of medical devices, insurance firms, and testing laboratories are also defensive.

Non-Durable Goods

Durable goods are products that households buy and consume quickly. For example, detergent, toothpaste, and soap are non-durable goods.

Consumers buy these items regardless of how well or badly the national economy is doing.

Utilities

Suppliers of water, heating oil, butane gas, and electricity have defensive shares.

We used to include cable TV and telephone companies in this list. However, thanks to greater competition, those are no longer ‘captive’ markets. A captive market is one in which there is a lack of choice for consumers.

Food and Drink

Examples include producers of foods, beverages, and fast-food restaurants. In fact, even sales of beverages containing alcohol are relatively immune to economic cycles.

Tobacco

One would expect cigarette makers to see sales fall during a recession. However, nicotine addicts see cigarettes as essential items and are ‘loyal customers.’

Even when regular smokers’ financial situations deteriorate, they always find a way to get money for tobacco.

Defensive shares – pros and cons

Purchasing defensive stocks provides the investor with a conservative portfolio. These shares give us above-average returns during economic downturns.

Defensive stocks hold their own during recessions because demand for these businesses’ goods is fairly steady. Even when people have to tighten their belts, demand will not change much.

However, during an economic rebound, these companies perform less impressively than cyclical businesses.

Equity and growth funds

Most equity income funds have a high proportion of defensive stocks. Growth funds, on the other hand, focus more on cyclical shares.

An investment portfolio should consist of the two types of shares. They both have their potential merits.

Their relative balance depends mainly on your market view and your risk tolerance. Their balance also depends on your requirement for dividends.

We can reduce a portfolio’s overall volatility by including defensive shares in the investment mix.