What is earmark? Definition and examples

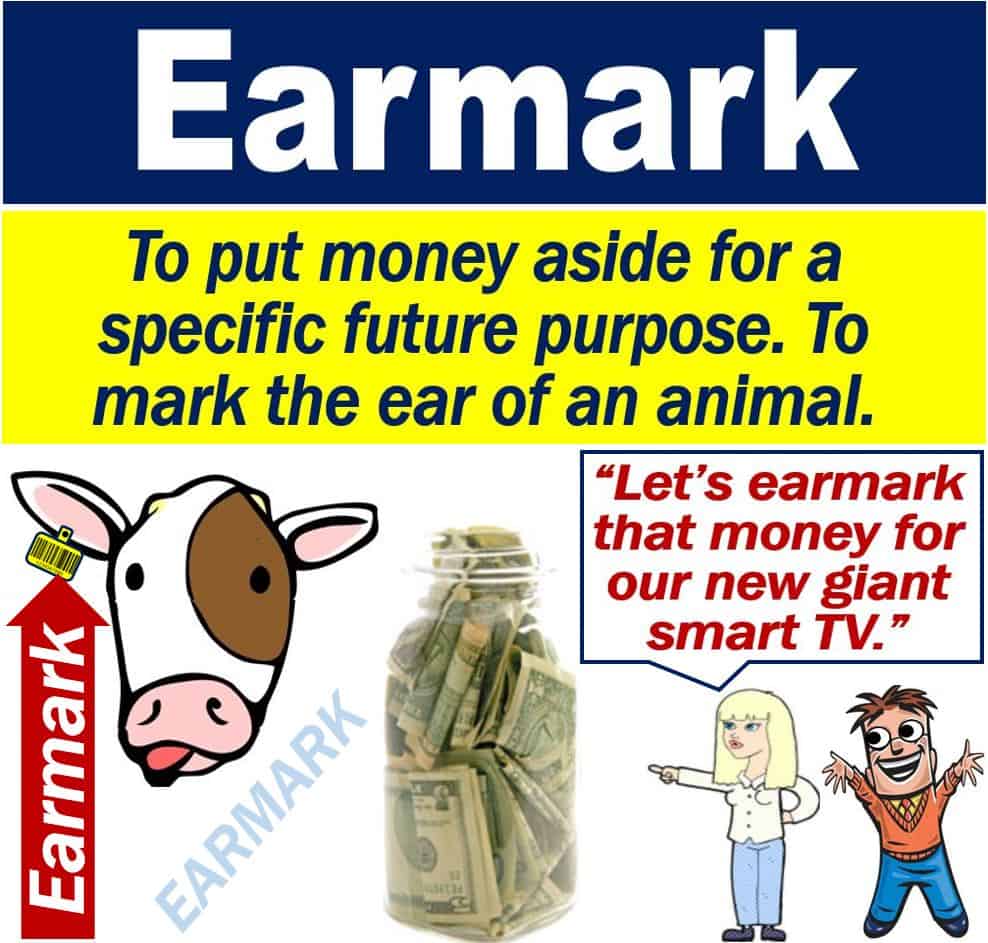

To earmark means to designate resources or funds for a specific purpose. It means to set something aside for a particular future purpose. As a noun, the word means an identifying feature or characteristic. For example, if I say “It has all the earmarks of suburbia,” it means “all the features of suburbia.” In the United States, it is a Congressional directive, i.e., authoritative instruction, to spend money on a project.

In livestock farming, to earmark means to mark the ear of an animal. Farmers do that as a sign of identity or ownership. In this context, it is also a noun. In other words, an earmark may mean a mark on an animal’s ear indicating identity or ownership.

The Cambridge Dictionary has the following definitions of the term:

“1. (Verb) to keep or intend something for a particular purpose. 2. (Noun) in the US, a legal request that is added to a law to make sure that an amount of money from the US Congress’s budget is spent on a particular project.”

“3. (Noun) a characteristic or feature that is typical of a person or thing.”

Etymology of earmark

Etymology is the study of the history of words including their origins. It is also a study of the evolution of the meanings of words.

As a noun, the word first emerged in the English language in the mid-fifteenth century. At the time, it meant a mark or cut in the ear of cattle or sheep. It served as a sign of ownership.

In the 1570s, earmark acquired the figurative meaning of “stamp of ownership.”

The word began to mean “to identify by a mark on an animal’s ear,” i.e., as a verb, in the 1590s.

It was not until 1868 that it also meant “to set aside money for a special purpose.”

Earmarking doctrine law

The earmarking doctrine exists in bankruptcy law. Certain borrowed funds are excluded from a bankrupt entity’s assets. However, the lender must have lent the money to the debtor up to ninety days before the bankruptcy filing. Also, the purpose of that money must have been to pay a specific creditor. A debtor is the party that is in debt; they owe money.

Bankruptcy defines a person or company that cannot pay back debts.

Earmarking makes sure that the money doesn’t go to other creditors who have preference in the proceedings of the bankruptcy.

Put simply; in this context, lenders ‘earmark’ the money so that it goes to a specific creditor.

Regarding this doctrine in bankruptcy law, USLegal.com says:

“The doctrine gets the name probably because the loan has been earmarked, i.e., specifically designated, by the debtor to pay a specific creditor.”