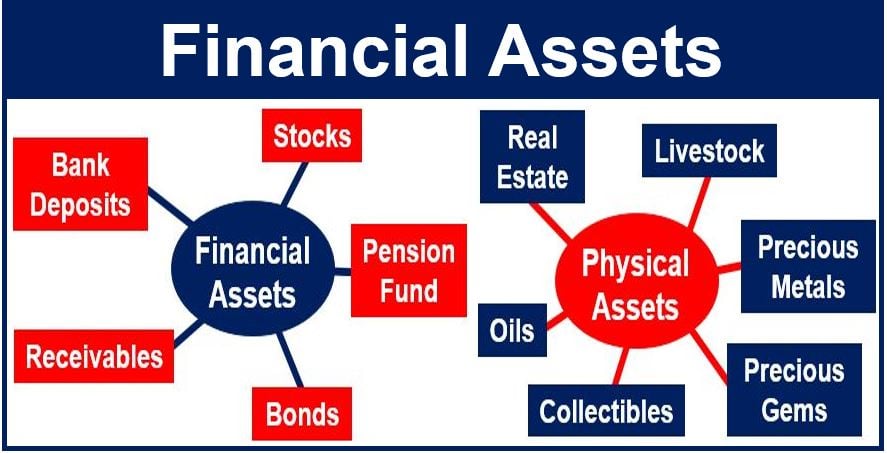

Financial Assets are intangible assets such as bank deposits, bonds, and stocks, whose values are derived from a contractual claim of what they represent. Unlike property or commodities, they are not physical (apart from the documents’ paper).

Financial assets are more liquid than tangible assets, i.e. they can be turned into cash more rapidly.

While land or some other tangible asset has physical value, a financial document does not until it is converted into cash.

Types of financial assets

-

Certificate of deposit (CD)

This is a common type of financial asset. With a CD, the investor agrees to keep a set amount of money deposited, while the bank commits to pay a guaranteed rate of interest.

-

Bonds

These popular assets are sold by companies and governments. They are debt securities in which the company or government promises to repay the principal along with interest at a specified maturity date.

-

Shares

Shares, also known as stocks, are financial assets with no agreed ending date. When an investor buys stocks, he/she becomes part owner of a company and shares in its profits and losses. Stocks can be kept for as long as you like, and may be sold to other investors.

Financial assets are valued according to how much cash they can be converted to. The value of people’s financial assets can change significantly, especially if much of their wealth is in the form of stocks, whose prices fluctuate hourly.

With the majority of financial assets with a maturity date in the contract, cashing out too early can cost the investor financial penalties.

Certain financial assets like treasury bills are considered near-cash due to their high liquidity and short maturities.

Derivatives such as options and futures represent financial assets that derive their value from an underlying asset, offering both risk management and speculative opportunities.

Compound phrases with “assets”

There are many compound phrases containing the term “asset.” Let’s have a look at some of them:

-

Fixed Asset

A long-term tangible piece of property that a firm owns and uses in its operations to generate income.

Example: “The company’s balance sheet listed buildings and machinery as part of its fixed assets.”

-

Current Asset

An asset on the company’s balance sheet that is expected to be sold or used within a year.

Example: “Inventory is considered a current asset because it can be converted into cash within the fiscal year.”

-

Digital Asset

An electronic resource that has value or the potential to generate revenue.

Example: “The firm invested heavily in digital assets, such as proprietary software and online content.”

-

Intangible Asset

An asset that is not physical in nature, such as intellectual property, brands, or goodwill.

Example: “Patents are a key intangible asset for many technology companies.”

-

Capital Asset

A significant piece of property such as equipment, buildings, or land, which is essential to business operations.

Example: “The new manufacturing plant is classified as a capital asset on the company’s books.”

-

Liquid Asset

An asset that can be quickly converted into cash with minimal impact on its value.

Example: “Cash on hand and marketable securities are considered liquid assets due to their immediate accessibility for transactions.”

Video – What are Financial Assets?

This video presentation, from our sister channel on YouTube – Marketing Business Network, explains what the meaning of ‘Financial Assetss’ is using simple and easy-to-understand language and examples.