What is Preferred Stock?

Preferred stock (also known as preferred shares) is a type of stock that has a higher claim on earnings and assets compared to common stock.

It is essentially a financial instrument that has the features of fixed dividends and potential appreciation.

Holders of these types of stocks are paid a specific dividend before common stock holders are paid their dividends.

For example, in the event that a company goes bankrupt, preferred shareholders are paid off before common stockholders.

According to nasdaq.com, preferred stock refers to:

“A security that shows ownership in a corporation and gives the holder a claim, prior to the claim of common stockholders, on earnings and also generally on assets in the event of liquidation. Most preferred stock pays a fixed dividend that is paid prior to the common stock dividend, stated in a dollar amount or as a percentage of par value.”

Holders of preferred stock receive a fixed dividend that does not fluctuate. However, they might not be paid dividends if the company is financially unable to pay.

Preferred stocks are rated by major credit-rating companies. They are normally rated lower than bonds, because they do not have the same level of guarantee.

Preferred stocks are a class of shares that have a combination of features that common stocks do not have, including:

- preference in dividends,

- preference in assets,

- convertibility to common stock,

- callability, and

- non-voting.

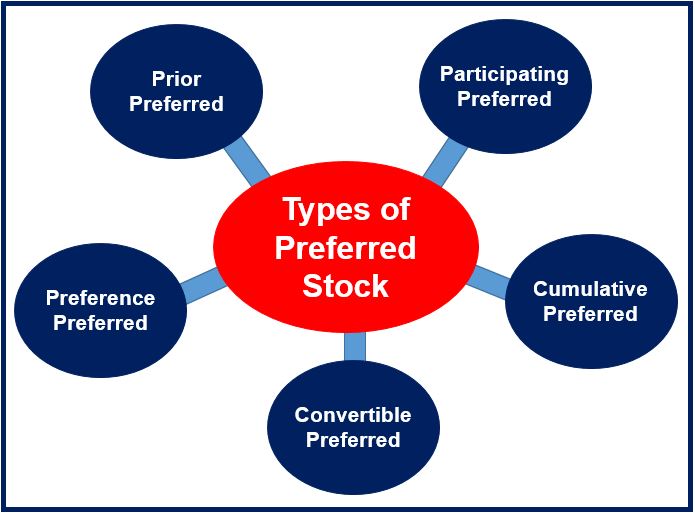

Different kinds of preferred stock

There are a number of different types of preferred stock, such as:

- Prior preferred – some companies have different classes of preferred stock, with one particular issue that has highest priority. If the business only has enough money to pay dividends on one of the preferred issues, it makes the payments to those with the prior preferred stock.

- Preference preferred – these issues receive preference over all other classes of stock except for prior preferred.

- Convertible preferred – these stocks can be changed for common-stock shares. The holder has to pay to make the conversion.

- Cumulative preferred – if the dividends cannot be paid, what is due will accumulate for future payment. In other words, these stock holders will eventually get missed payments (in years when the company is not doing well) paid later on.

- Participating preferred – holders can receive extra dividends if the company achieves specific financial goals.

Video – Common and Preferred Stock