What is the secondary market? Definition and meaning

The Secondary Market, also known as the Aftermarket, is the market where previously issued financial instruments, such as bonds and stocks are bought and sold. It is where investors sell to other investors.

The buying and selling of existing home loans, which are usually bundled together and traded as mortgage-backed securities, occur in the secondary mortgage market.

The term ‘secondary market’ may also mean a market for any assets or goods that are not new. It may also refer to an alternative market (usage) for an existing product or asset. For example, corn is mainly sold for human or animal consumption, but it also has a secondary market – ethanol production.

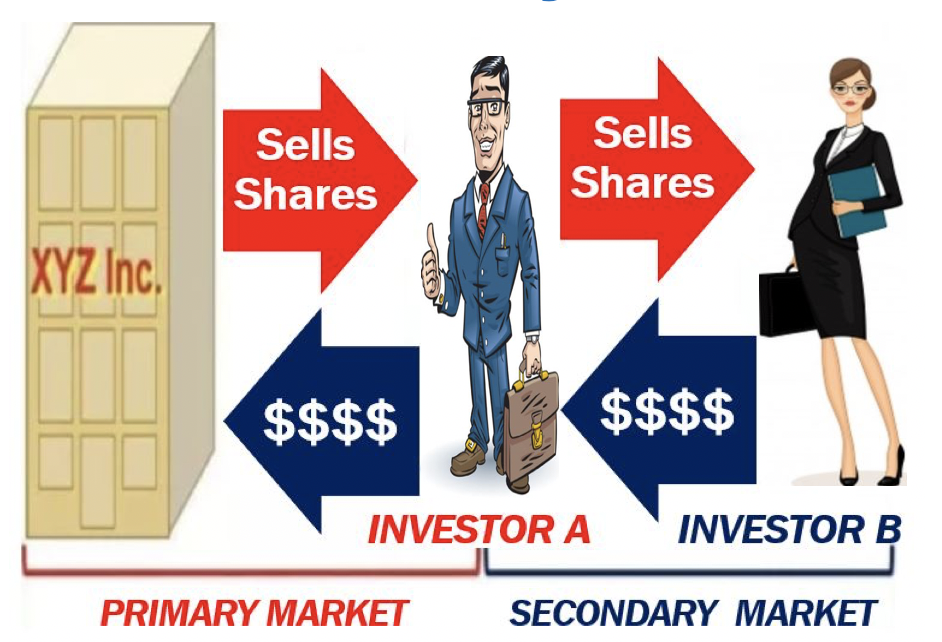

The primary market and secondary market

In the world of finance, there are two main markets in the capital market: the primary and secondary markets.

The primary market is where new securities or financial instruments are sold – investors buy these securities directly from the issuers, such as a company selling shares for the first time in an initial public offering, or a government selling bonds.

After the security has been sold, investors may want to sell them on to others. This is done in the secondary market.

Examples of highly-organized secondary markets are the major stock exchanges, such as the London Stock Exchange, the New York Stock Exchange, and Nasdaq. Investors come to stock exchanges to sell stocks they own or to purchase shares that are not new.

Most bonds and structured products are traded over the counter or via a broker-dealer.

In the primary market, the price of a security such as a share is set beforehand, while in the secondary market it is determined by markets forces (supply and demand).

The secondary market’s dynamic pricing environment benefits both buyers and sellers by providing real-time price adjustments based on the latest market trends and news.

Most capital market activity occurs in the secondary market.

The tech secondary market

The tech secondary market, also known as the IT aftermarket, is where tech resellers and purchasers buy and sell IT equipment outside the channel endorsed by manufacturers.

It is where refurbished tech equipment is sold at a fraction of what they cost in the shops.

In the tech secondary market, resellers also deal in tech service and support, as well as the installation and removal of purchased goods.

According to nasdaq.com, the secondary market is:

“The market in which securities are traded after they are initially offered in the primary market. Most trading occurs in the secondary market. The New York Stock Exchange, as well as all other stock exchanges and the bond markets, are secondary markets. Seasoned securities are traded in the secondary market.”

Using the term in context

Below are some sentences showing you how we use the terms “secondary market” and “primary market” in context:

Secondary Market:

- “A robust secondary market is crucial for the trading of ETFs, allowing investors to transact with ease, without the need to directly engage with the fund’s underlying assets.”

- “Art collectors often turn to the secondary market to acquire pieces with established provenance, bypassing the initial sale events hosted by galleries or the artists themselves.”

- “In the secondary market, the option to trade corporate bonds has provided pension funds with a strategy to reallocate their portfolios in response to changing economic forecasts.”

- “The secondary market for residential properties has seen an uptick in activity, as buyers seek to capitalize on the potential for value appreciation in mature neighborhoods.”

Primary Market:

- “Startups aiming for rapid expansion frequently approach the primary market to conduct a funding round, thereby bypassing traditional lending institutions.”

- “The primary market for government securities witnessed heightened activity this quarter, signaling strong investor confidence in the country’s economic management.”

- “Agricultural producers are increasingly exploring the primary market for green bonds as a means to secure investment for sustainable farming practices.”

- “In the primary market, art enthusiasts can directly support emerging artists by purchasing their works during initial gallery showings, helping to establish their market presence.”

Two Educational Videos

These two interesting video presentations, from our sister YouTube channel – Marketing Business Network, explain what the ‘Secondary Market’ and ‘Primary Market’ are using simple, straightforward, and easy-to-understand language and examples.

-

What is the Secondary Market?

-

What is the Primary Market?