Treasury bills, also known as T-bills, are short term maturity promissory notes issued by a national government – their maturity is usually three months, but may range from just a few days to up to twelve months.

Treasury bills are primary instruments for raising funds and regulating the money supply through open-market operations.

In the United States, treasury bills are issued through the country’s central bank. Their yield is the difference between their purchase price and redemption value (par value or face value) – they typically pay no explicit interest.

Players in the financial markets closely watch treasury bill yields, which impact the yields on corporate and municipal bonds, as well as bank interest rates.

Institutional investors like treasury bills because they are as close as one can get to being a risk-free investment – they are guaranteed by the federal government.

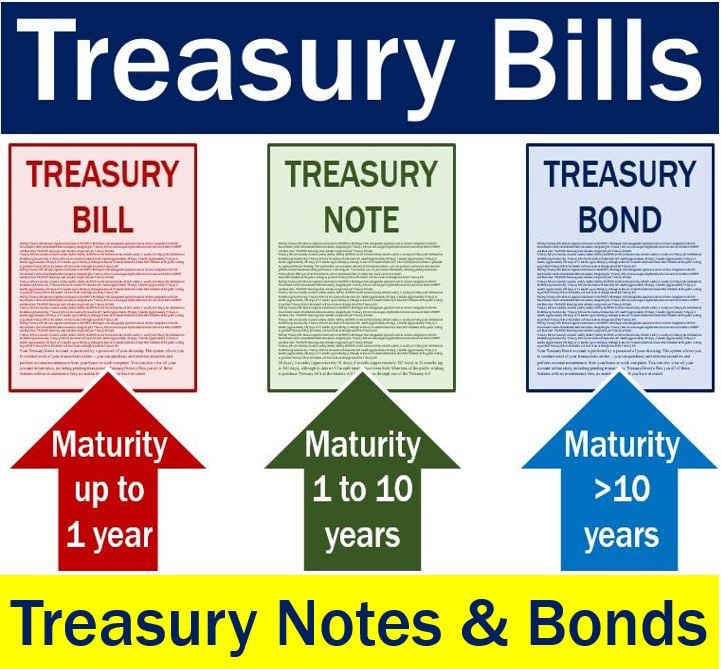

Treasury bills are short term promissory notes guaranteed by the national government, while treasury notes and treasury bonds are medium- and long-term ones – respectively.

Treasury bills are short term promissory notes guaranteed by the national government, while treasury notes and treasury bonds are medium- and long-term ones – respectively.

“Treasury bills are the shortest-term Treasury securities, those that mature within a year (from the time they are issued). The Treasury issues three- and six-month bills weekly and a one-year bill (the so-called year-bill) once a month.”

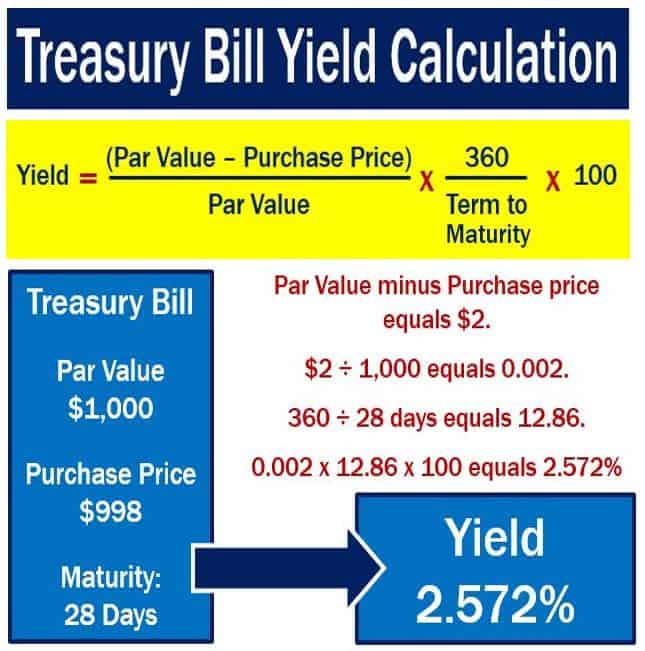

“Treasury bills are discount instruments. Rather than making interest payments, they are issued at a discount to face value and mature at face value. The interest rate is a function of the purchase price, the face value and the time remaining till maturity.”

Treasury bills from TreasuryDirect.gov

TreasuryDirect.gov says that treasury bills are sold in terms ranging from just a few days to fifty-two weeks. They are typically sold at a discount from the par value.

For example, a $1,000 treasury bill might be purchased for $990. When it matures, the holder of that T-bill is paid $1,000.

The difference between how much the buyer paid for the treasury bill and its face value is the interest he or she earned.

Although US treasury bills do not pay interest officially, purchasers buy them for less than they sell them for – so there is a ‘yield’ – it is the difference between the purchase price and the par value.

Although US treasury bills do not pay interest officially, purchasers buy them for less than they sell them for – so there is a ‘yield’ – it is the difference between the purchase price and the par value.

TreasuryDirect.gov adds:

“It is possible for a bill auction to result in a price equal to par, which means that Treasury will issue and redeem the securities at par value.”

US treasury bills can be purchased direct from TreasuryDirect.gov, or through a broker or bank. You can hold a T-bill until it matures or sell it before its maturity date.

Bidding for treasury bills

In the United States, people can bid for treasury bills in two ways:

– Non-Competitive Bid: the buyer agrees to accept the discount rate that was determined at auction. With this type of bid, the holder is guaranteed to receive the T-bill he or she wants, and in the full amount they want.

Investors may use TreasuryDirect.gov, a bank, or a broker to place a non-competitive bid.

– Competitive Bid: the investor specifies the discount rate that he or she is willing to accept. Their bid may be: 1. Accepted in the full amount they want if the rate they specify is less than the discount rate that was set at the auction. 2. Accepted in less than the full amount they want, if their bid equals the high discount rate. 3. Rejected, if the rate they specify is greater than the discount rate that was set at the auction.

The investor must use a bank or broker to place a competitive bid.

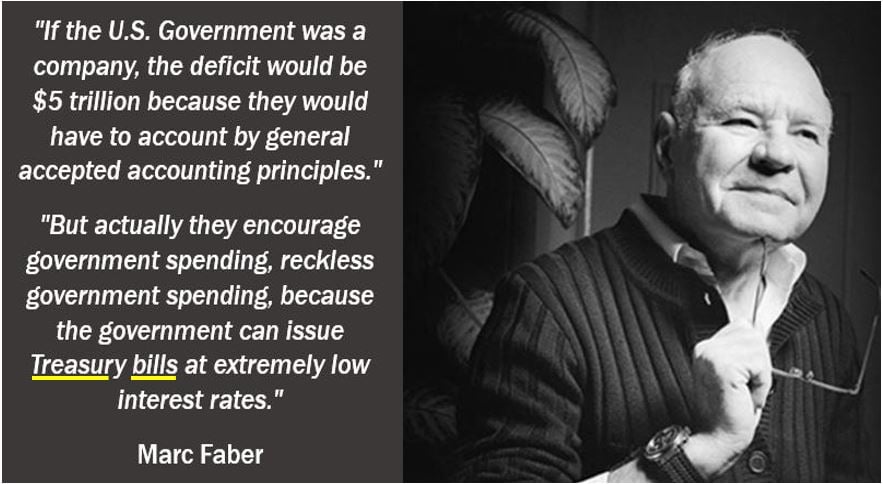

Marc Faber is a Swiss investor who is based in Thailand. He publishes the ‘Gloom Boom & Doom Report’ newsletter. He is also director of Marc Faber Ltd., which is a fund manager and investment adviser. Dr. Faber specializes in investment funds that focus on emerging and frontier markets. (Image: adapted from twitter.com/gloomboomdoom)

Marc Faber is a Swiss investor who is based in Thailand. He publishes the ‘Gloom Boom & Doom Report’ newsletter. He is also director of Marc Faber Ltd., which is a fund manager and investment adviser. Dr. Faber specializes in investment funds that focus on emerging and frontier markets. (Image: adapted from twitter.com/gloomboomdoom)

Features of US treasury bills

TreasuryDirect.gov lists the following T-bill features on its website:

– They are sold at a discount. All discount rates are determined at auction.

– They pay ‘interest’ only at maturity. The interest equals the bill’s face value minus its purchase price.

– Treasury bills are sold in increments of one-hundred dollars. The cheapest T-bill is $100.

– They are auctioned every week, except for 52-week and cash-management bills. There is no regular schedule for cash management bills, while 52-week bills are auctioned once every four weeks.

– Cash management bills, which usually mature within a few days, are issued in variable terms.

– Today, all T-bills are issued in electronic form.

– Treasury bills may be held until they mature, or they can be sold before their maturity date.

– A bidder is allowed to purchase up to $5 million in bills in a single auction by non-competitive bidding, or by up to thirty-five percent of the initial offering amount by competitive bidding.

Sterling treasury bills

According to the United Kingdom Debt Management Office, treasury bills are issued routinely at weekly tenders (auctions), held by the Debt Management Office (DMO) on Fridays – the last business day of each week – for settlement on the following working (business) day.

Sterling treasury bills may be issued with maturities of 12 months, 3 months and 1 month “although to date no 12-month tenders have been held.”

Members of the public who wish to buy treasury bills at tenders will have to do so through a treasury bill Primary Participant, and buy a minimum of £500,000 of bills.

On its website, the DMO writes:

“Sterling Treasury bills form an important constituent in the DMO’s Exchequer cash management operations and an intrinsic component in the UK Government’s stock of marketable debt instruments, alongside gilts.”

“Treasury bills are zero-coupon eligible debt securities and can be held in CREST and Euroclear. The DMO financing remit includes a target end year Treasury bill total.”

Treasury bills in Canada

Canadian treasury bills are similar to US ones – they are also fully guaranteed by the federal government. However, Canadian T-bills offer highly attractive rates of interest.

Treasury bills issued by Canada’s central bank are available in either US or Canadian dollars. According to Finance Maps of the World (regarding Canadian treasury bills):

“The smallest amount that may be invested is about five thousand for a period of three months to one year. An investor might also put in twenty five thousand for a period of one or two months. The Canadian government covers each and every aspect of these bills and as such they are risk-free.”