Accounting Ratios, or Financial Ratios, are comparisons made between one set of figures from a company’s financial statement with another.

We use accounting ratios to determine whether a business can pay its debt and how profitable it is.

Additionally, accounting ratios are used to predict whether a company is likely to go bankrupt soon. Overall, the aim when studying these ratios is to analyze trends.

Accounting ratios are indicators of a commercial entity’s performance and financial situation. We calculate the majority of ratios from data that the firm’s financial statements provide.

Financial ratio sources could be the balance sheet, income statement, or statement of cash flows. The statement of changes in equity is also a source. The data comes from either within the company’s financial statements or its accounting statements. There are many different types of accounting ratios. They tell us how healthy/unhealthy a company is.

There are many different types of accounting ratios. They tell us how healthy/unhealthy a company is.

Apart from determining whether a firm can meet its financial obligations, they tell us how profitable it is. Furthermore, we are better able to predict whether it will thrive or sink in the near future.

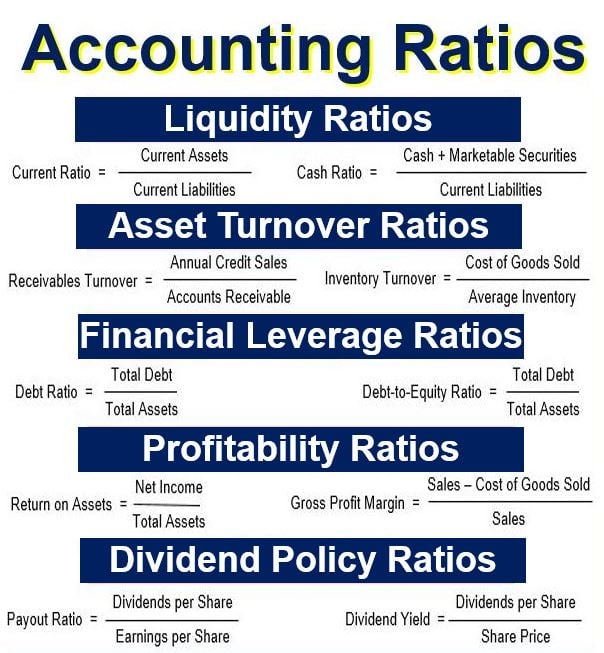

Most common accounting ratios

There are many types of accounting ratios, depending on the information they contain. Here is a list of the ratios we use most frequently, their meanings, and how they can be used in a sentence:

- Absolute Liquid Ratio

The relationship between absolute liquid, or super quick current assets, and liabilities.

Example: “The company’s high Absolute Liquid Ratio indicates strong financial health, with ample liquid assets to cover liabilities.”

- Activity Ratios

Measure a company’s ability to convert different accounts within its balance sheets into cash or sales.

Example: “The improvement in the firm’s Activity Ratios reflects its increased efficiency in managing receivables and inventory.”

- Asset Turnover Ratios

Measure the efficiency of a commercial entity’s use of its assets in generating sales revenue.

Example: “With a high Asset Turnover Ratio, the company efficiently uses its assets to generate substantial sales.”

- Current Cash Debt Coverage Ratio

Measures the relationship between net cash from operating activities and the average current liabilities of the firm.

Example: “The company’s strong Current Cash Debt Coverage Ratio shows it can easily meet short-term obligations with its operational cash flow.”

- Current Ratio or Working Capital Ratio

Measures a business’s ability to pay short- and long-term obligations.

Example: “The firm’s healthy Current Ratio indicates its capability to pay off short-term liabilities without financial strain.”

- Debt Service Coverage Ratio (DSCR)

The ratio of liquid cash available for debt servicing to interest, principal, and lease payments, measuring a firm’s ability to service its current debts.

Example: “The company’s DSCR above 1 suggests it has sufficient income to cover its debt obligations comfortably.”

- Dividend Policy Ratios

The most common are Dividend Payout Ratio, Dividend Yield, and Dividend Cover. The Dividend Payout Ratio tells us how well earnings support dividend payouts.

Example: “The company’s high Dividend Payout Ratio indicates that a significant portion of its earnings is being distributed as dividends.”

- Financial Leverage Ratios

Measure the overall debt load of a commercial enterprise and compare it with assets or equity.

Example: “A low Financial Leverage Ratio suggests the company is not overly reliant on debt to finance its operations.”

- Liquidity Ratios

Indicate a firm’s cash levels and its ability to turn assets into cash to pay off debts and current obligations.

Example: “Given the company’s strong Liquidity Ratios, it appears well-positioned to meet its short-term financial commitments.”

- Profitability Ratios

Measures that indicate how well a company is performing, specifically its ability to generate profit.

Example: “The company’s increasing Profitability Ratios demonstrate its growing ability to generate earnings effectively.”

- Quick Ratio or Acid Test Ratio

Measures a firm’s liquidity and ability to meet its financial obligations, viewed as a sign of financial strength or weakness.

Example: “The company’s Quick Ratio is above the industry average, signaling strong short-term financial stability.”

Expressing ratios

We can express ratios as numbers or percentage values. We quote some ratios, such as earnings yield, as percentages. These ratios are the ones that are always less than one.

We typically quote ratios that are more than one in decimal numbers (1.0, 1.1, 1.2, etc.). An example is the P/E ratio.

You can take any ratio’s reciprocal. In other words, if that ratio is above one, the reciprocal will be below one, and vice versa. Sometimes the reciprocal may be easier to understand.

Why do we use accounting ratios?

We use accounting ratios:

- to make comparisons between different accounting periods of the same company,

- when we compare one company with the average within its industry,

- when making a comparison between different companies, as well as

- to compare one industry with another.

A ratio is only useful if we benchmark it against something else, like another company or past performance.