The UK FTSE 100 dropped on Tuesday amid concerns of slow global economic growth and over-supply in the commodity markets.

The UK FTSE 100 dropped on Tuesday amid concerns of slow global economic growth and over-supply in the commodity markets.

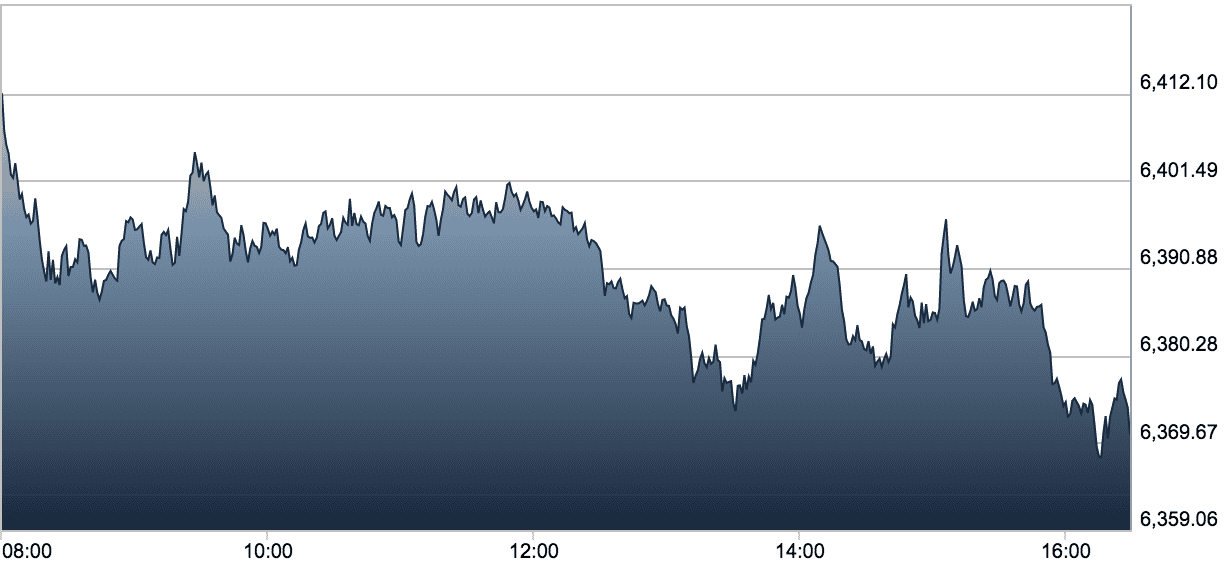

The index dropped 0.8 percent, or 51.75 points, closing at 6,365.27.

The markets weren’t that active on Tuesday because of the upcoming Federal Reserve meeting in which the US central bank is expected to keep interest rates unchanged.

Brenda Kelly, head analyst at London Capital Markets, told Reuters: “There does seem to be a certain amount of pause for breath ahead of the meeting this week,”

She added: ”I think markets are … waiting for that confirmation that we’ll have loose monetary policy for longer.”

The mining index dropped 3.1 percent, with Glencore, Rio Tinto, Anglo American, BHP Billiton, and Antofagasta all posting losses of at least 2.2 percent.

FTSE 100 – October 27th

Chris Beauchamp, at spreadbetter IG Index, noted: “Equity markets are in retreat once more, as nervous investors continue to trim the gains made at the end of last week.

“In London, Anglo American and Antofagasta led the market lower, as caution on miners persists while the Chinese government meets to set new objectives for economic growth.”

Concerns of an oversupply in the commodity markets drove the oil and gas sector index down 1.7 percent to the lowest level in six weeks.

Robert Parkes, equity strategist, HSBC Global Research, told Reuters: “Resources are under pressure today. There is continued uncertainty regarding the outlook for global growth and there is also some caution ahead of the Fed meeting,”

BP shares fell 1.1 percent, despite its third quarter results beating forecasts. The oil giant posted underlying profits of $1.8 billion, down from $3 billion in the same period last year.

Shire shares gained 6.9 percent after the drug company posted positive results for its dry-eye disease drug Lifitegrast.

The sterling fell 0.26 percent against the US dollar at $1.5310 and dropped 0.16 percent against the euro at €1.3868.