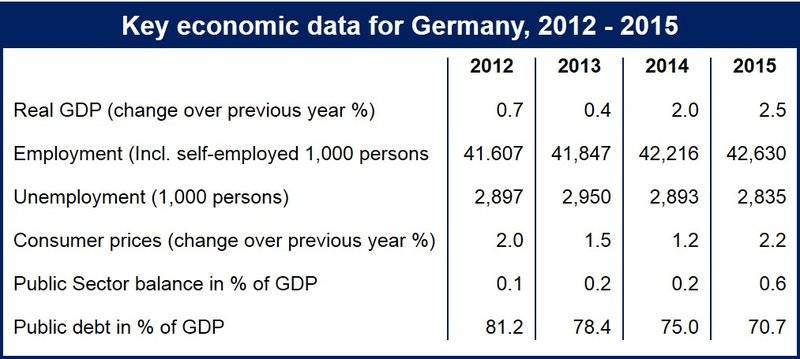

In 2014, Germany’s gross domestic product (GDP) is forecast to expand by 2% and then by 2.5% in 2015, well above its 1.25% potential growth rate. As capacity utilization is pushed further up, economist are wondering “Is the German economy overheating or set to overheat?”

Production capacities in 2015 will be approaching the territory of overheating, says the Kiel Institute, Kiel, Germany.

The Deutsche Bundesbank, Germany’s central bank, forecasts 1.9% GDP growth for 2014 and 1.8% in 2016. According to Germany’s statistical agency Destatis, GDP expanded by 0.8% in the first quarter of 2014 compared to Q4 2013.

Stimulating monetary environment

Last week, the European Central Bank (ECB) reduced its benchmark interest rate to 0.15%, a record low, while the interest rate on the deposit facility went below zero to (minus) -0.10%. It is the first time ever a major central bank has pushed one of its main rates into negative territory.

The ECB says it will reinforce its hugely permissive monetary stance for at least the next couple of years.

While these measures may help the peripheral Eurozone countries, they are far below the suitable level for the German economy. The risk of a monetary-triggered boom in the German economy has increased significantly.

Strong investment spending

German fixed investment spending has finally recovered and is gathering pace. Below are some projections made by Kiel economists:

- Fixed investment spending growth 2014: +5.2%

- Fixed investment spending growth 2015: +6.2%

- Investment in machinery & equipment spending growth 2014: +7.6%

- Investment in machinery & equipment spending growth 2015: +10.7%

- Housing construction growth 2014: +5.1%

- Housing construction growth 2015: +4.3%

Fixed investment spending is forecast to reach pre-crisis levels by the end of 2015, while housing construction will come close to the construction boom levels recorded after German unification.

International trade, strong pull-effect on imports

International trade refers to all the imports and exports of goods and services between nations. As the German economic rebound gains pace, imports are expected to rise. For 2014, analysts predict a +6.8% increase in imports, and then by +8.8% in 2015.

Exports are also expected to rise, but at a slower rate, by +5.3% in 2014 and +7.6% in 2015, “leaving the production growth to be fully absorbed by domestic uses.”

Progressive growth in net property income flows and improved terms of trade indicate that the country’s current account balance will carry on growing in absolute terms, but will remain fairly stable in relation to GDP at last year’s level of 7.6%.

Moderate unemployment decline, strong job creation

Employment is expected to grow by 370,000 in 2014 and by 414,000 in 2015, enabled by greater participation of female and elderly workers, and higher immigration.

Unemployment, on the other hand, will fall moderately, from 6.7% in 2014 to 6.5% in 2015.

By the end of 2015, the number of hours worked will be close to a 25-year high, “which marks an all-time high of productive labor input after the fall of the Berlin wall.”

(Source: Kiel Institute)

Higher government revenue

As the number of people with jobs plus total hours worked rise, social security contributions are forecast to grow by +4.1% in 2014 and +5.3% in 2015, while tax revenues will see more moderate increases of +2.7% in 2014 and +4.6% in 2015.

The Kiel Institute predicts that the overall fiscal surplus in relation to GDP will be 0.2% in 2014 and 0.6% in 2015, “despite expenditure programs.”

The Kiel Institute wrote:

“Also, the government budgets are far from reflecting fiscal soundness: record low interest rates, erosion of the public capital stock as well as temporary demographic effects heavily distort the picture. Much more political ambitions are necessary to cushion the risks involved with the overheating of the economy and the foreseeable challenges for potential output growth in the near future.”