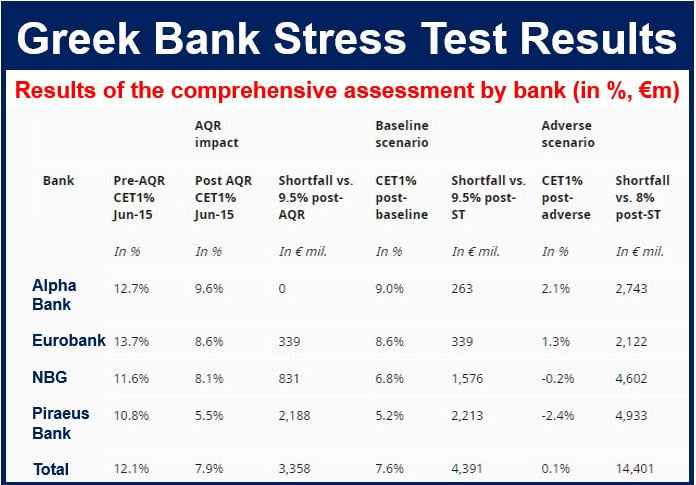

As the European Central Bank (ECB) announced the results of stress tests for large Greek banks, aimed at rehabilitating the financial institutions, it informed that they need to raise over €14.4 billion ($15.85 billion, ₤10.26 billion) of extra capital to cover a gaping black hole of unpaid loans.

This amount refers to the following banks: Alpha Bank, Eurobank, National Bank of Greece and Piraeus Bank.

A very high number of Greeks either can’t or won’t repay their debts after a dispute regarding reforms between international lenders and the far-left government that pushed the country to the brink of exiting the Eurozone.

Of the big four, Piraeus Bank fared the worst. (Source: ECB)

Of the big four, Piraeus Bank fared the worst. (Source: ECB)

Controls on cash withdrawals have considerably dampened Greece’s economy. There are now an additional €7 billions’ worth of loans at risk of non-payment – a total of €107 billion.

The ECB wrote in its website today:

“The four banks will have to submit capital plans to ECB Banking Supervision explaining how they intend to cover their shortfalls by 6 November. This will start a recapitalisation process under the economic adjustment programme that must conclude before the end of the year.”

“Covering the shortfalls by raising capital will result in the creation of prudential buffers at the four Greek banks, which will improve the resilience of their balance sheets and their capacity to withstand potential adverse macroeconomic shocks.”

The total amount is approximately half of all the credit given by Greece’s four largest banks, the ECB says. Piraeus Bank, which scored worse in the stress tests, appears to have 57% of all its loans at risk of non-payment.

Investors may be pleased with today’s news

Hedge funds and other investors may be encouraged to buy shares, given that the declared capital hole is less than the €25 billion destined to help banks in Greece’s bailout.

The more investments Greece can attract, the less it will need from the Eurozone’s rescue scheme, the European Stability Mechanism.

Greek banks are currently kept going by central bank money. However, there is a rush to finalize their recapitalization.

If the recapitalization is not completed by the end of 2015, new EU regulations mean large depositors may lose money in their accounts.

On Saturday, Euclid Tsakalotos, Greece’s Finance Minister, said he believed his country’s banks would be fully recapitalized by the end of 2015.

The ECB said:

“The bank recapitalisation process is an integral part of the efforts by Greece and its partners to restore confidence in the banking sector, so that capital controls can be gradually removed and affordable lending to the economy can resume.”

Overall, most economists say today’s result are encouraging. They mark a step in the right direction towards restoring confidence in both Greek banks and its economy. However, much still needs to go right for the country.

Parliament to vote on reforms

Greek lawmakers will vote on Sunday on a government-sponsored legislation regarding reforms in the banking sector in anticipation of the recapitalization.

Included in the reforms is a requirement that a bank’s executive board must include individuals with at least ten-years’ experience abroad, including three years in the banking sector. These individuals must not have previously held any senior government posts.

The executive board of the country’s four largest banks meet on Saturday to discuss the stress test results.

Video – Unpaid loans black hole in Greek banks