US March inflation remained well below the Federal Reserve’s target of 2%. The Consumer Price Index increased 0.2% in March, higher than February’s 0.1%, according to the Bureau of Labor Statistics, part of the US Department of Labor.

The Consumer Price Index is a measurement that shows the average price increases or declines in services and goods bought by Americans. According to a Reuters poll of economists, a 0.1% US March inflation rise had been forecast.

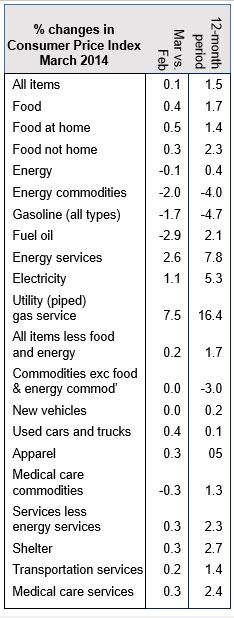

A 0.4% increase in food prices was offset by a 1.7% fall in the price of gasoline. The costs of eggs, meat and fish, which rose by 1.2%, were the main drivers of food prices. Extreme weather patterns, including the recent droughts in parts of the US and Brazil, have pushed up the price of beef to record highs. This was reflected in the Bureau of Labor Statistics’ food index. In February, food prices had also risen by 0.4%. Shelter rose, with rental housing increasing at a higher rate (0.3%).

The prices of airline fares, used cars and trucks, apparel and medical care also rose in March, while the costs of household furnishings and recreation fell.

In an interview with the Wall Street Journal, Barclays economist Dean Maki said “The report showed a solid and broad-based rise in prices on the month, and we view it as consistent with our view that core inflation will be strengthening this year.”

US March inflation year-on-year 1.5%

Year-on-year, prices have increased by 1.5%, compared to a year-on-year rise of 1.1% in February.

The prices of all items, excluding energy and food, rose 1.7% over a twelve month period to March, while the energy index advanced by just 0.4%.

With inflation higher in March than in February, analysts suggest that the country’s deflationary trend may have finally run its course.

Even though US March inflation figures should calm the nerves of some Federal Reserve (Fed) officials who had expressed concern about the consequences of a prolonged period of very low price rises, cost pressures are still weak enough for interest rates to remain near zero for some time to come.

The index for all items, excluding energy and food, also increased by 0.2% in March.

Bloomberg quoted Thomas Costerg, an economist at Standard Chartered Plc, New York, who said “The overall picture is that inflation has stopped falling and is on a gradual uptrend. To some extent, today’s numbers relieve fears about the U.S. slipping into deflation.” Costerg had accurately predicted the US March inflation rate.

Low inflation in the advanced economies

Moderate inflation suggests healthy demand, which encourages businesses to hire more workers and invest. Weak inflation or deflation (falling prices), however, discourage consumers and businesses from spending. If people expect prices to possibly fall further, they postpone their spending.

The European Union and Japan are facing persistently low inflation amid subdued global economic growth. Japan has been struggling for several years in an environment of on-and-off deflation. After registering falling industrial production in February, analysts predict that the Bank of Japan will inject more stimulus into the economy.

The Eurozone’s inflation rate is moving further and further away from the ECB’s (European Central Bank’s) target of 2% per year. There is growing concern that Europe could slide into deflation.

ECB President, Mario Draghi announced on Monday that if the euro continues to strengthen he and his team will consider looser monetary policy. A higher euro, which has been rising over the last 12 months, would push the Eurozone’s already low inflation rate even further down.