There are plans to shift the main UK inflation measure from the CPI (consumer prices index) to the CPIH which is like the CPI but includes estimates of the cost of home ownership.

The Office for National Statistics (ONS) says the CPIH will become its preferred measure of inflation from March 2017.

The ONS says it has taken a number of steps to increase confidence in CPIH in its push to make it the main UK inflation measure. Image: pixabay

The ONS says it has taken a number of steps to increase confidence in CPIH in its push to make it the main UK inflation measure. Image: pixabay

The CPIH does not take into account house prices or mortgage payments, but uses estimates of the rental value of owner-occupied properties, plus council tax.

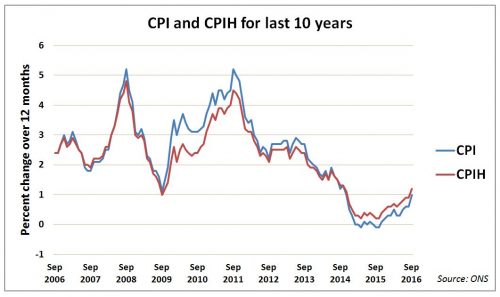

Had it been used for the most recent data (for September), the headline inflation measure would have shifted from 1 percent (using CPI) to 1.2 percent (using CPIH).

However, it is only in the last couple of years that CPIH has been higher than CPI, before that, there was a period of around 5 years when it was lower, reflecting the fact household expenses were rising faster than rents and council tax.

Not officially ‘a national statistic’

CPIH lost its official “national statistic” status in 2014 because of criticisms of how it calculated the rental value portion of the home ownership cost – which attempts to answer the question “how much would I have to pay in rent to live in a home like mine?” for an owner occupier.

The ONS is hopeful of resolving this in its push to make the CPIH the main UK inflation measure, as John Pullinger, the national statistician and chief executive of the ONS, says in a recent statement:

“Following the publication on 3 March of the UK Statistics Authority Assessment Report on CPIH, a great deal of work has gone into addressing the requirements set out in the assessment. We have already taken a number of steps to increase confidence in CPIH and over the coming weeks we are looking to engage further with users.”

In the last couple of years, CPIH has been higher than CPI.

In the last couple of years, CPIH has been higher than CPI.

Treasury view

However, in what the Financial Times describes as a “blow to the ONS’s hopes,” the Treasury has not announced any intention to ask the Bank of England to use CPIH as its inflation target instead of the current 2 percent CPI inflation target.

Currently, the government uses CPI to uprate benefits (that is the ones not affected by the current freeze), as a reference for raising tax thresholds, and to help revise the state pension each year.

A Treasury spokesperson,” told BBC News the government has no plans to change the way upratings were done.

Pay negotiations

Employers also look at inflation when considering the annual pay review. These are thought to be fairly evenly divided between those that use RPI (retail price index) and those that use CPI.

RPI includes housing costs such as mortgage interest payments and council tax. It is a long-standing measure of UK inflation that has been used for the indexation of pensions, rents, and index-linked gilts , among other things. Gilts are British government bonds.

RPI no longer has “national statistic” status because the way it is calculated does not meet international standards, although the ONS continues to report it.

Recent research suggests that only about 2 percent of private sector firms use the CPIH when considering the annual pay settlement.

XpertHR who carried out the research, told Personnel Today that pay awards negotiated with unions generally continue to use RPI, which typically results in a higher inflation figure than CPIH.