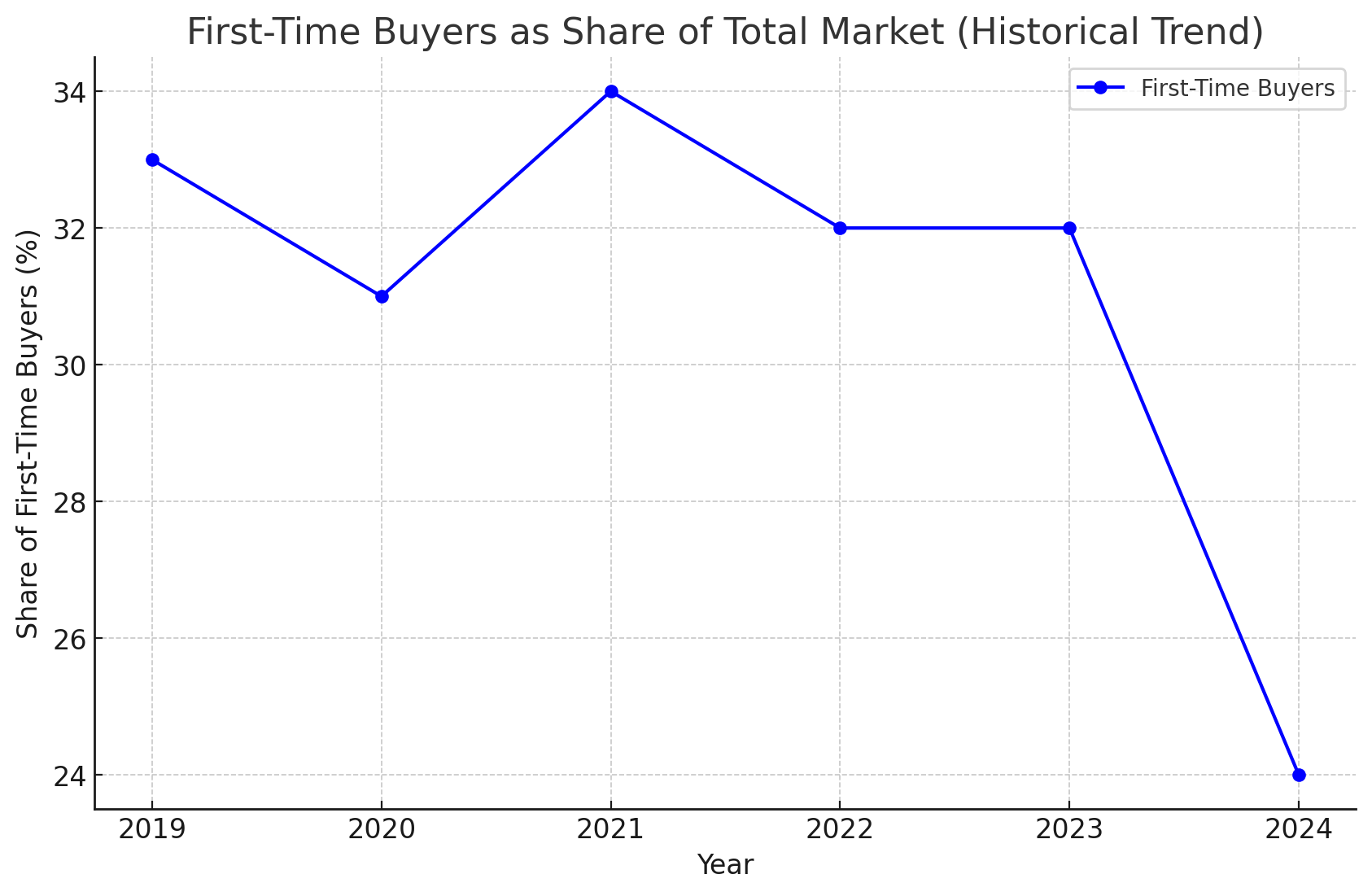

- Low Numbers for First-Time Buyers: First-time home buyers now make up only 24% of the market. This is a big drop from 32% last year and the lowest since 1981.

- Older Buyers and Sellers: The average age of first-time buyers has increased to 38 years old, while repeat buyers are typically 61. The average age of sellers has also reached a new high of 63.

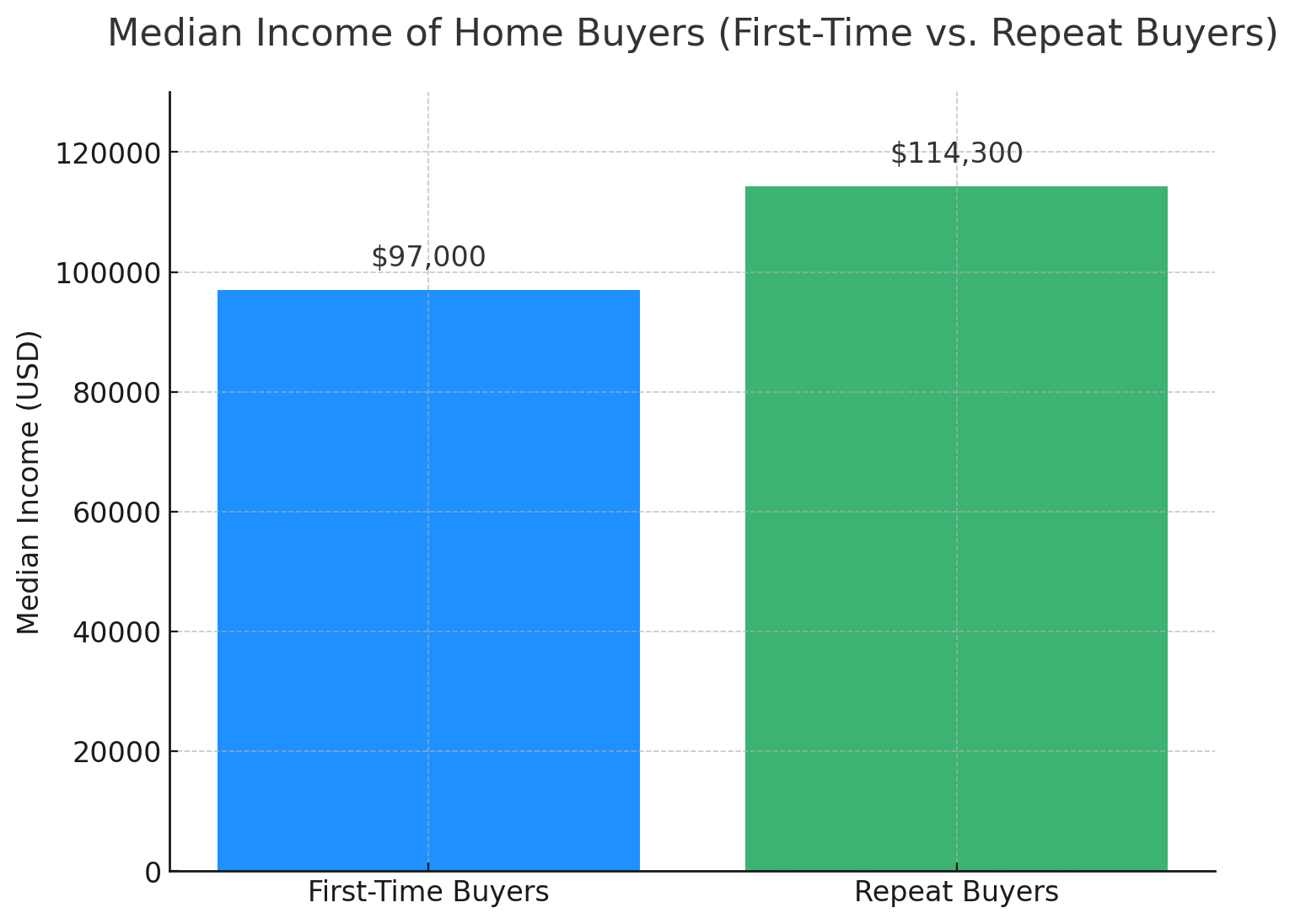

- Income Gap in Home Buying: The median income for first-time buyers is $97,000, compared to $114,300 for repeat buyers.

A recent National Association of Realtors (NAR) report shows that only 24% of home buyers are first-time buyers, down from 32% last year and the lowest level since 1981.

Mortgage rates have averaged around 7% this past year and home prices have kept rising. This means first-time buyers need to earn a lot more than buyers did a few years ago.

In fact, according to the report, the average income for new buyers now stands at $97,000, up $26,000 compared to two years ago. Higher prices and rates mean that a lot of people have to wait longer to buy a home or rent for longer than they planned.

There is an advantage for repeat buyers in the housing market. They are usually older and have built up equity over time, letting them more easily make large down payments or buy homes outright. In 2024, a record 26% of all home purchases were cash deals.

More people are buying homes later in life.

First-time buyers are now, on average, 38 years old, up from 35 last year. The median age for all home buyers is 56, while repeat buyers average 61.

Becuase of high housing prices, a lot of families are choosing to live together to save money. This year, 17% of buyers bought homes for multiple generations, the highest number ever recorded. This option helps young adults who are struggling with rent and seniors who need care.

Many home buyers start their search online. About 43% explore property listings to see what is available. But the majority of buyers, 86%, opted to work with a real estate agent.

Sellers are older and still getting asking prices.

This year, sellers are older, with an average age of 63. Many sellers, 23%, moved to be closer to family. Others needed to downsize or find bigger homes, or they didn’t like changes in their neighborhoods. Homes are also staying on the market longer this year, averaging three weeks, compared to two weeks last year. However, sellers are still often getting their asking prices.

Difficult market for younger or first-time buyers.

Recent changes have made the housing market tougher for younger or first-time buyers but easier for current homeowners. This situation is different from just a few years ago. Buyers may need to save more money or look for help from family. Sellers find themselves in a good position because demand for homes is still high, but their reasons for selling are changing.