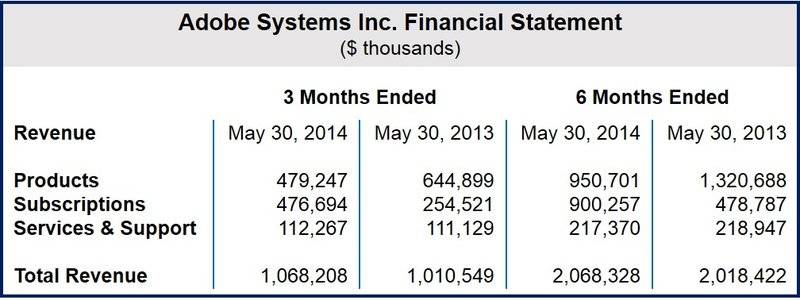

Adobe shares were up 6% to a record $71.60 after the news of its second quarter earnings of $1.07 billion, a rise of 16%, was published. Adjusted earnings increased to $0.37 per share. Revenue and adjusted earnings were higher than analysts had forecast.

Adobe Systems Inc., which makes Photoshop, Dreamweaver and Illustrator design software, has been shifting its business model from packaged software to subscription cloud services. Microsoft is also transitioning from selling software on a multi-year cycle to a recurring basis.

Shantanu Narayen, Adobe’s president and chief executive officer, said:

“Adobe’s first-half upside was driven by accelerated adoption of Creative Cloud and Adobe Marketing Cloud. We’re excited about our upcoming product pipeline and expect a strong second half of the year.”

Adobe’s executive vice president and chief financial officer, Mark Garrett, said:

“Our earnings performance in Q2 reflects the financial leverage we have in our model. With Adobe’s Creative Cloud transformation behind us, our focus moving forward is to drive strong revenue and earnings growth with our market-leading cloud offerings.”

Cloud service subscriptions up

Adobe’s subscription cloud services are doing well:

- There are now 2,308,000 paid up Creative Cloud subscriptions, 464,000 more than in the previous quarter. Creative Cloud is a combination of cloud storage and applications for creative types. In the US it sells for between $19.99 and $74.99 per month.

- Its Creative annualized recurring revenue increased to $1.2 billion.

- Its total Digital Media annualized recurring revenue rose to $1.38 billion.

- 53% of the company’s Q2 revenue was from recurring sources such as Adobe Marketing Cloud and Creative Cloud.

- Its Marketing Cloud revenue for the quarter increased by 23% to $283 million.

The company, which is based in San Jose, California, forecasts its Adobe Marketing Cloud will achieve revenue growth of 20+% and bookings growth of 30% this year.

Adobe has been trying to get its customers to buy software subscriptions based in the cloud, helping to ease falling income by replacing one-off purchases of programs. Even though the changeover has resulted in falling sales in several divisions, Mr. Narayen says he is willing to sit it out to boost demand for Adobe applications.

(Source: Adobe Systems Inc.)

In an interview with Bloomberg, Mark Moerdler, an analyst at Sanford C. Bernstein & Co., said “They are moving quite well to cloud subscriptions.” The rate of customers changing over is ahead of the 4 million target by the end of 2015 set by Adobe. “The numbers moving over are significant,” Moerdler added.

Mr. Narayen says Adobe is about to launch a new version of Creative Cloud that will have new features that consumers and hobbyists will like.