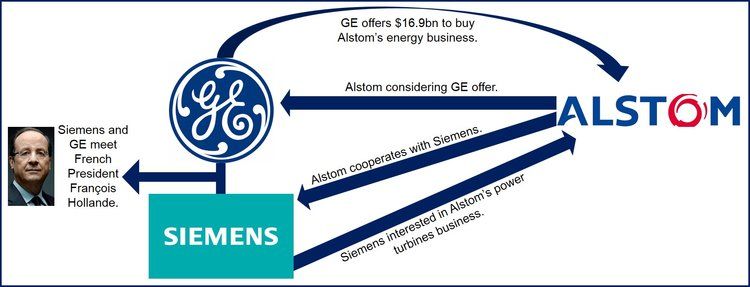

While Alstom considers General Electric’s bid worth $16.9 billion for its energy division, the French multinational emphasized it would welcome a rival offer from Siemens, which has expressed interest in its power turbines business.

In a joint press release, GE and Alstom wrote “GE has submitted a binding offer to acquire the Thermal, Renewables (“Power”) and Grid businesses of Alstom (ALO.PA) consisting of $13.5 billion (€9.9 billion) enterprise value and $3.4 billion (€2.5 billion) of net cash, totaling $16.9 billion (€12.35 billion).”

Update June 22, 2014: The Board of Directors of Alstom has unanimously approved General Electric’s bid. If supported by Alstom’s workers representatives, regulators and shareholders, the transaction is likely to be completed next year. The French government, which will buy a 20% shareholding in Alstom, said the GE offer has its full support.

Update June 20th, 2014: Siemens along with Mitsubishi have increased the cash component of their Alstom bid by €1.2 billion to €8.2 billion ($11.2 billion), just one day after General Electric revised its bid.

Siemens may make an offer

German company Siemens says it would be interested in making an offer for the French company if it could interview the management for four weeks and had access to Alstom’s data room, i.e. the company’s books, in order to carry out a suitable due diligence.

Siemens wrote “A letter in this regard was submitted this afternoon to the French company. No further comments will be made at this time.”

Alstom says it received a declaration of interest from Siemens and its Board has reviewed it “regarding an alternative transaction.” The company adds that Siemens will have fair access to the data it needs to make, should it decide to do so, a binding offer.

Alstom says it will decide by the end of May.

Both potential buyers met French President

French President François Hollande has met delegations of both companies regarding their potential bids. Arnaud Montebourg, France’s Economy Minister had stressed earlier this week that the French government wanted to make sure any takeover was in the best interests of the country.

GE’s CEO, Jeff Immelt, said regarding his meeting with the French President “(we had a) productive two-way dialogue.”

Alstom says that if the GE bid is approved and completed, it would focus on its Transport activities, including the production of high-speed trains. “Alstom would use the sale proceeds to strengthen its Transport business and give it the means of an ambitious development, pay down its debt and return cash to its shareholders,” the company wrote.

Alstom announced today:

“The Board of Directors of Alstom, acknowledging unanimously the strategic and industrial merits of this offer and having noted the publicly announced undertakings by GE, has decided to set up a committee of independent directors, led by Jean-Martin Folz, to review before the end of May the proposed transaction, taking into consideration all stakeholders interests including the French State. Patrick Kron and the committee will liaise with the representatives of the French State to consider their views.”

“Should the Board conclude positively, the information and consultation of Alstom employees’ representative bodies will be conducted before entering into a definitive agreement.”

Alstom added that it would make a decision by the end of May.

Chairman and CEO of Alstom Patrick Kron said:

“The combination of the very complementary Energy businesses of Alstom and GE would create a more competitive entity to better service customer needs. Alstom’s employees would join a well-known, major global player, with the means to invest in people and technology to support worldwide energy customers over the long term. The proposed transaction would allow Alstom to develop its Transport business as a standalone company, with a strong balance sheet to capitalize on opportunities in the dynamic rail transport market.”

Alstom and GE a good match

According to Alstom, along with GE the two companies have complementary offerings in Power and in Grid:

- Thermal Power – the two companies have complementary offerings in gas and steam turbine technology. “Alstom will add balance of plant and turnkey capabilities to enhance the combined entity’s power offerings.”

- Wind Power – while GE is focused on onshore wind, Alstom is small in that area, but has a competitive offering in offshore wind.

- Hydro Power – GE is not present while Alstom is a global player.

- Service – the French company’s comprehensive product portfolio complements GE’s global presence perfectly.

- Grid – “Alstom and GE are complementary in the products and solutions they offer and in their geographic focus.”