The online retail giant Amazon is going to start paying more tax in the UK following accusations that it avoided tax in its third largest market by funneling cash abroad.

The company previously registered all of its UK revenues to the tax haven of Luxembourg.

Amazon paid minimal rates in the UK, claiming that it had no permanent residence, even though it owned a number of warehouses across the country.

MPs called the structure ‘immoral’ and the European Commission ruled that the Luxembourg deal was ‘illegal’.

However, that has all changed, as Amazon set up a London branch.

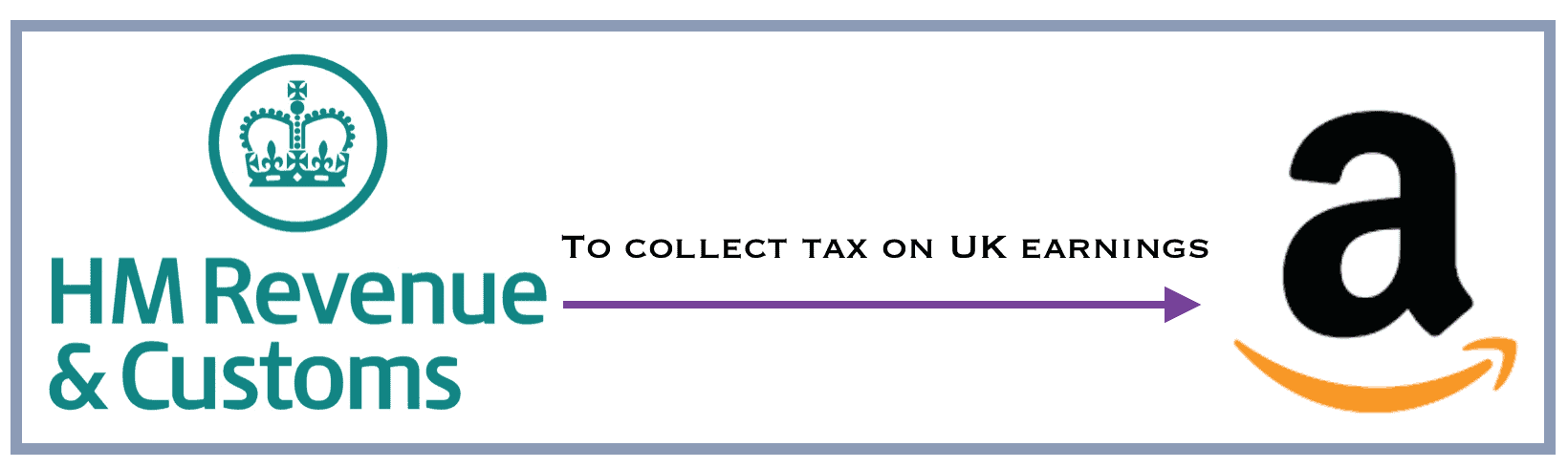

Since May 1, the branch been responsible for booking sales from UK customers, allowing HM Revenues and Customs to collect the correct tax on profits associated with sales in Britain.

Amazon said:

“As of May 1, Amazon EU Sarl is recording retail sales made to customers in the UK through the UK branch. Previously, these retail sales were recorded in Luxembourg.”

However, the company noted that corporate tax is based on profits and not revenues:

“E-commerce is a low-margin business and highly competitive, and Amazon continues to invest heavily around the world, which means our profits are low.”

A spokesman for the company said:

“We regularly review our business structure to ensure that we are able to best serve our customers and to pursue future growth opportunities. Christopher North remains the country manager and head of Amazon in the UK.”

In 2013 Amazon posted sales of £4.3 billion in the UK and only paid £4.2 million in tax.

Video – E-Commerce

Amazon is an e-commerce giant.