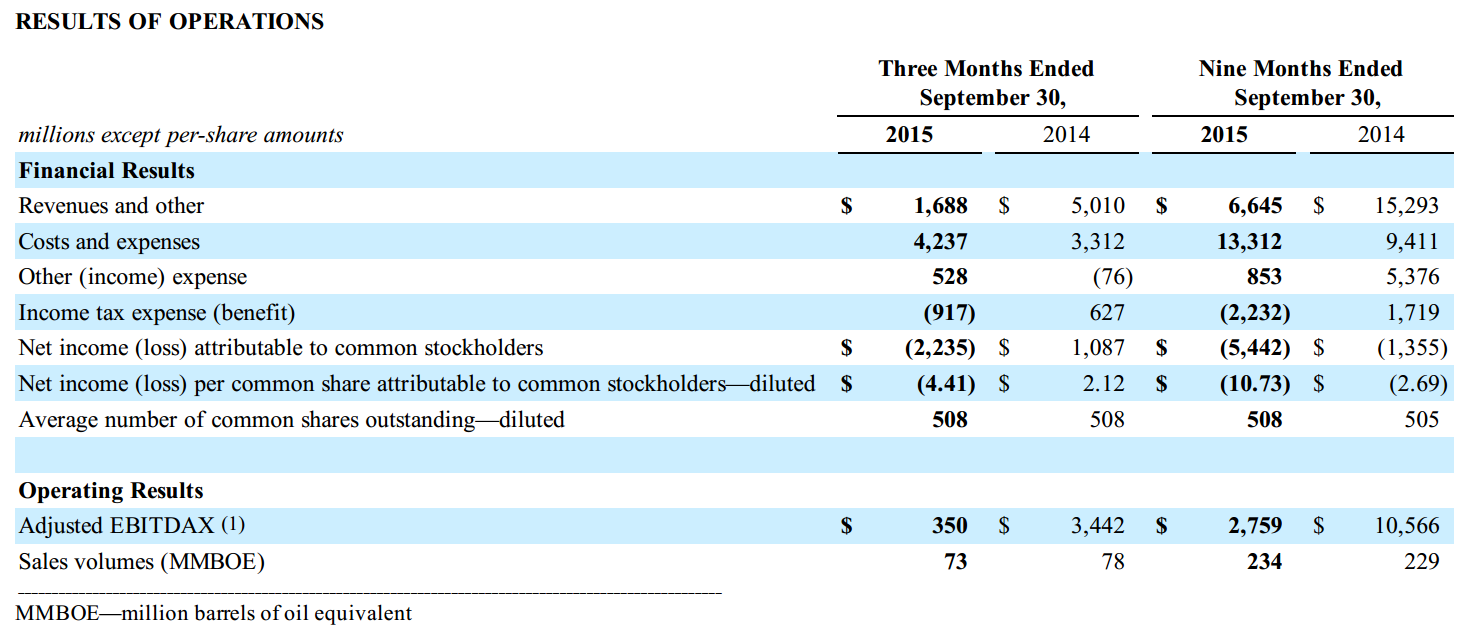

Anadarko, one of the world’s largest oil and gas exploration and production companies, reported a loss of $2.2 billion (or $4.41 per share) in the third quarter.

Anadarko, one of the world’s largest oil and gas exploration and production companies, reported a loss of $2.2 billion (or $4.41 per share) in the third quarter.

Analysts expected Anadarko to post a big loss given the steep decline in oil prices over the last 15 months.

The company’s sales volumes averaged 787 thousand barrels of oil equivalent per day (MBOE/d), down 7% from the same period last year.

Sales of oil and NGLs dropped 2%, or 10 thousand barrels per day, from the third quarter last year.

Total revenue dropped to $1.688 billion in the third quarter from $5,010 in the year ago period.

Net cash flow from operating activities in the quarter was $1.127 billion. Operating activities are all the things people do in a company that generate revenue.

Q3 Financial Results:

“We remain committed to building and preserving value in this challenging environment,” said Anadarko Chairman, President and CEO Al Walker.

“During the third quarter, we continued our focus on maintaining long-term flexibility, while enhancing short-cycle returns by delivering higher-margin sales volumes for lower costs.

“Our employees have continued to do outstanding work optimizing our performance by moderating our base decline, safely improving efficiencies and rig productivity, and achieving greater cost savings. These efforts and achievements have us well positioned to create differentiating value today and to accelerate activity when the market begins to reward growth again.”