Apple has been ordered by the European Commission to pay up to €13bn (£11bn) in back taxes. The comission found the tech giant guilty of receiving illegal state aid through its Irish tax scheme.

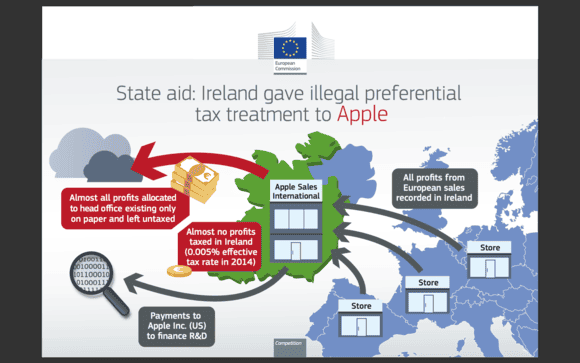

Apple has two subsidiaries in Ireland: Apple Sales International and Apple Operations Europe.

According to the investigation, Apple has been paying far less in taxes than other companies in the region. The standard rate in Ireland is 12.5%, but Apple had effectively only paid 1% tax on its European profits in 2003 and approximately 0.005% in 2014.

Competition Commissioner Margrethe Vestager said: “Member states cannot give tax benefits to selected companies – this is illegal under EU state aid rules.”

“Tax rulings granted by Ireland have artificially reduced Apple’s tax burden for over two decades, in breach of the EU state aid rules. Apple now has to repay the benefits,” Vestager told a news conference.

“I would have a feeling if my effective tax rate were 0.05 percent, falling to 0.005 percent. I would feel that maybe I should have another look at my tax bill,” she said.

The US Treasury believes that the EU has been unfairly targeting US firmws operating in Europe.

The Treasury said: “We believe that retroactive tax assessments by the Commission are unfair, contrary to well-established legal principles, and call into question the tax rules of individual member states.”

A senior Democrat senator, Charles Schumer, called the move a “cheap money grab”.

“This is a cheap money grab by the European Commission, targeting US businesses and the US tax base,” Schumer said.

“By forcing their member states to retroactively impose taxes on US companies, the EU is unfairly undermining our ability to compete economically in Europe while grabbing tax revenues that should go toward investment here in the United States,” he added.

Meanwhile, Irish Finance Minister Michael Noonan, who profoundly disagrees with the commission’s move, said that he will appeal the decision to ensure that Ireland remains an attract location for foreign investment.

“There is no economic basis for this decision. It’s bizarre and it’s an exercise in politics by the Competition Commission,” Noonan said.

“They don’t have responsibility for taxes and they are opening a back door through state aid to influence tax policy in European countries when the European treaties say tax policy is a matter for sovereign governments,” he added.

Tim Cook calls the move a devastating blow to the soveriegnty

Apple CEO Tim Cook said in an open letter to customers in Europe:

“The European Commission has launched an effort to rewrite Apple’s history in Europe, ignore Ireland’s tax laws and upend the international tax system in the process. The opinion issued on August 30th alleges that Ireland gave Apple a special deal on our taxes. This claim has no basis in fact or in law. We never asked for, nor did we receive, any special deals. We now find ourselves in the unusual position of being ordered to retroactively pay additional taxes to a government that says we don’t owe them any more than we’ve already paid.

“The Commission’s move is unprecedented and it has serious, wide-reaching implications. It is effectively proposing to replace Irish tax laws with a view of what the Commission thinks the law should have been. This would strike a devastating blow to the sovereignty of EU member states over their own tax matters, and to the principle of certainty of law in Europe. Ireland has said they plan to appeal the Commission’s ruling and Apple will do the same. We are confident that the Commission’s order will be reversed.

“At its root, the Commission’s case is not about how much Apple pays in taxes. It is about which government collects the money.

“Taxes for multinational companies are complex, yet a fundamental principle is recognized around the world: A company’s profits should be taxed in the country where the value is created. Apple, Ireland and the United States all agree on this principle.”

Cook added that he is “confident that the Commission’s order will be reversed.”